- Japan

- /

- Electric Utilities

- /

- TSE:9503

Kansai Electric (TSE:9503) Is Up 5.5% After Upgrading Earnings and Dividend Outlook for FY2026—What's Changed

Reviewed by Sasha Jovanovic

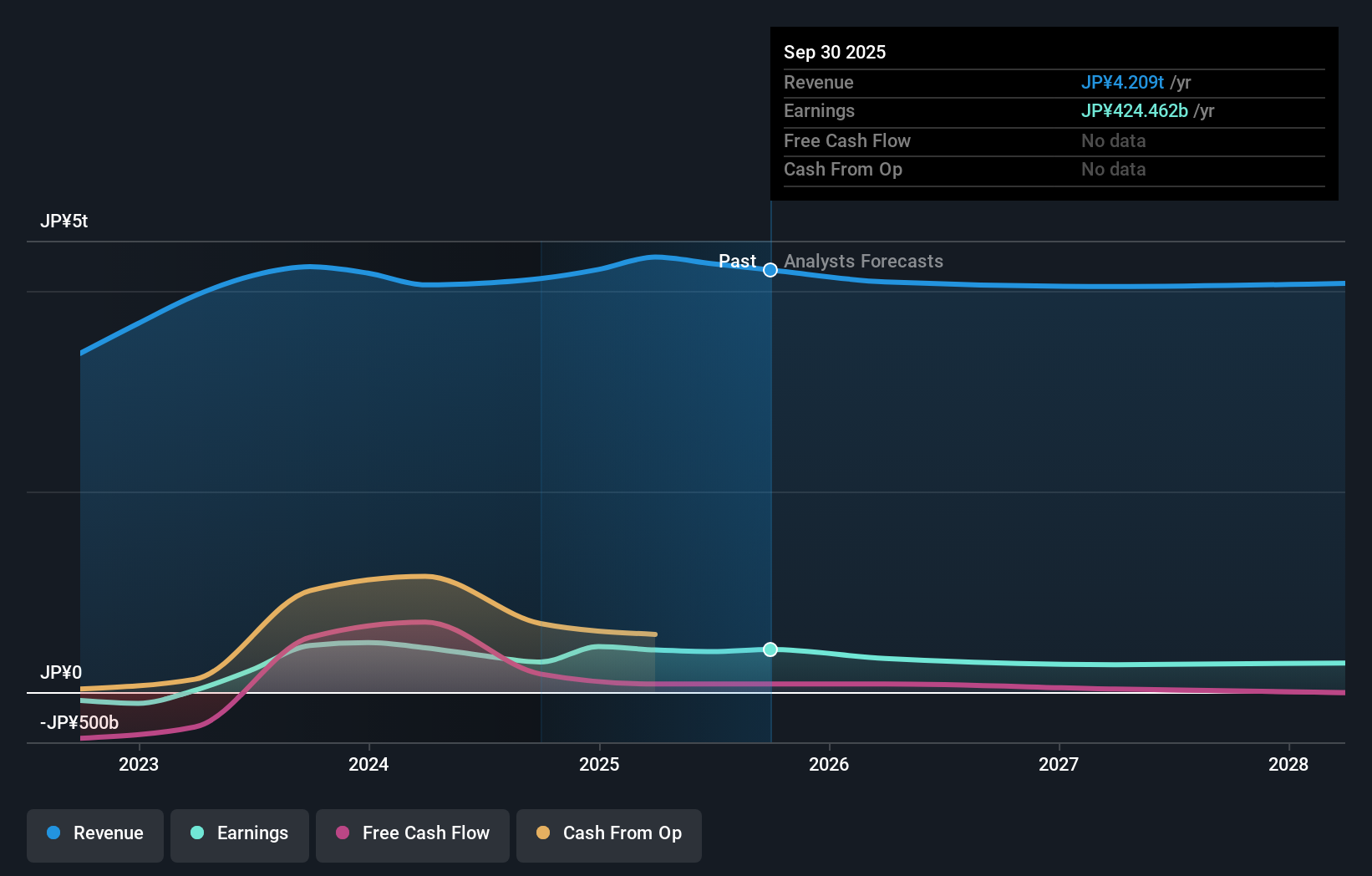

- On October 30, 2025, Kansai Electric Power Company revised its full-year consolidated earnings and dividend guidance for the fiscal year ending March 31, 2026, projecting net sales of ¥4.05 trillion and an increase in annual dividends to ¥45.00 per share.

- This upward revision reflects stronger electricity demand in the Kansai region, with higher expected profits from both energy sales and transmission segments, and a reduction in supply and demand adjustment costs.

- We'll explore how the improved earnings and dividend outlook, driven by robust energy demand, shapes Kansai Electric Power's investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is Kansai Electric Power Company's Investment Narrative?

To be a shareholder in Kansai Electric Power Company right now, it makes sense to believe in a sustained, resilient demand for electricity in the Kansai region and the company’s ability to turn that demand into growing profits and rising dividends. The recent guidance revision is a material event that could shift the near-term outlook, raising operating profit expectations considerably and signaling a willingness to return more capital to shareholders. With profit forecasts boosted and annual dividends jumping from ¥30.00 to ¥45.00 per share, short-term catalysts now focus on the company’s momentum in capturing higher sales volumes and controlling costs. However, risks like declining long-term profit forecasts and questions about dividend sustainability due to cash flow coverage remain, even as the news flow paints a stronger short-term picture. Investors may want to weigh these shifting priorities. Yet, beneath this momentum, dividend sustainability could still present a challenge for shareholders.

Kansai Electric Power Company's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 2 other fair value estimates on Kansai Electric Power Company - why the stock might be worth less than half the current price!

Build Your Own Kansai Electric Power Company Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kansai Electric Power Company research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Kansai Electric Power Company research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kansai Electric Power Company's overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kansai Electric Power Company might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9503

Kansai Electric Power Company

Engages in electricity, gas and heat supply, and telecommunication and gas supply in Japan.

Solid track record with slight risk.

Market Insights

Community Narratives