- Japan

- /

- Electric Utilities

- /

- TSE:9503

Kansai Electric Power (TSE:9503): How Has the Upgraded Outlook and Higher Dividend Shifted Its Valuation?

Reviewed by Simply Wall St

Kansai Electric Power Company (TSE:9503) just updated its outlook for the fiscal year ending March 2026, announcing higher earnings expectations along with a planned boost to its annual dividend. The company is seeing stronger profits across its key segments.

See our latest analysis for Kansai Electric Power Company.

Momentum has surged for Kansai Electric Power Company, with the latest share price up over 37% year-to-date as investors respond to upgraded profit expectations and a dividend increase. Still, the company’s 1-year total shareholder return is down just over 2%. This highlights how this year’s price climb follows a more turbulent period. Its three- and five-year total returns are especially strong. Recent upward revisions to earnings guidance, stronger segment results, and a bigger dividend have clearly sparked renewed optimism from the market.

If you're weighing similar stories of profit growth and shifting sentiment, now is a perfect moment to broaden your watchlist and discover fast growing stocks with high insider ownership

With shares climbing over 37% this year and now trading above analyst price targets, is Kansai Electric Power Company a hidden bargain, or has the market already priced in all the recent growth and optimism?

Price-to-Earnings of 6.3: Is it justified?

Kansai Electric Power Company is currently trading at a price-to-earnings (P/E) ratio of 6.3, while its last close was ¥2,389.5 per share. This puts its shares at a premium compared to the average of its closest peers.

The price-to-earnings ratio shows how much investors are willing to pay for each yen of earnings. It is widely used to benchmark valuation in the utilities sector, especially for mature, stable companies like Kansai Electric Power Company. A higher P/E compared to the peer group can indicate expectations of higher growth or better profitability, but it may also signal overvaluation if such prospects are not evident.

Currently, the company’s 6.3x P/E ratio is above the peer group average of 4.5x. This suggests the stock is priced more aggressively than similar companies in Japan’s electric utilities industry. However, when compared with the estimated fair P/E ratio for Kansai Electric Power Company (8.9x), the current valuation appears less stretched and could move closer to that fair level if fundamentals remain robust.

Explore the SWS fair ratio for Kansai Electric Power Company

Result: Price-to-Earnings of 6.3 (OVERVALUED)

However, persistent declines in annual revenue and net income growth could challenge the sustainability of Kansai Electric Power Company’s strong recent momentum.

Find out about the key risks to this Kansai Electric Power Company narrative.

Another View: What Does the SWS DCF Model Say?

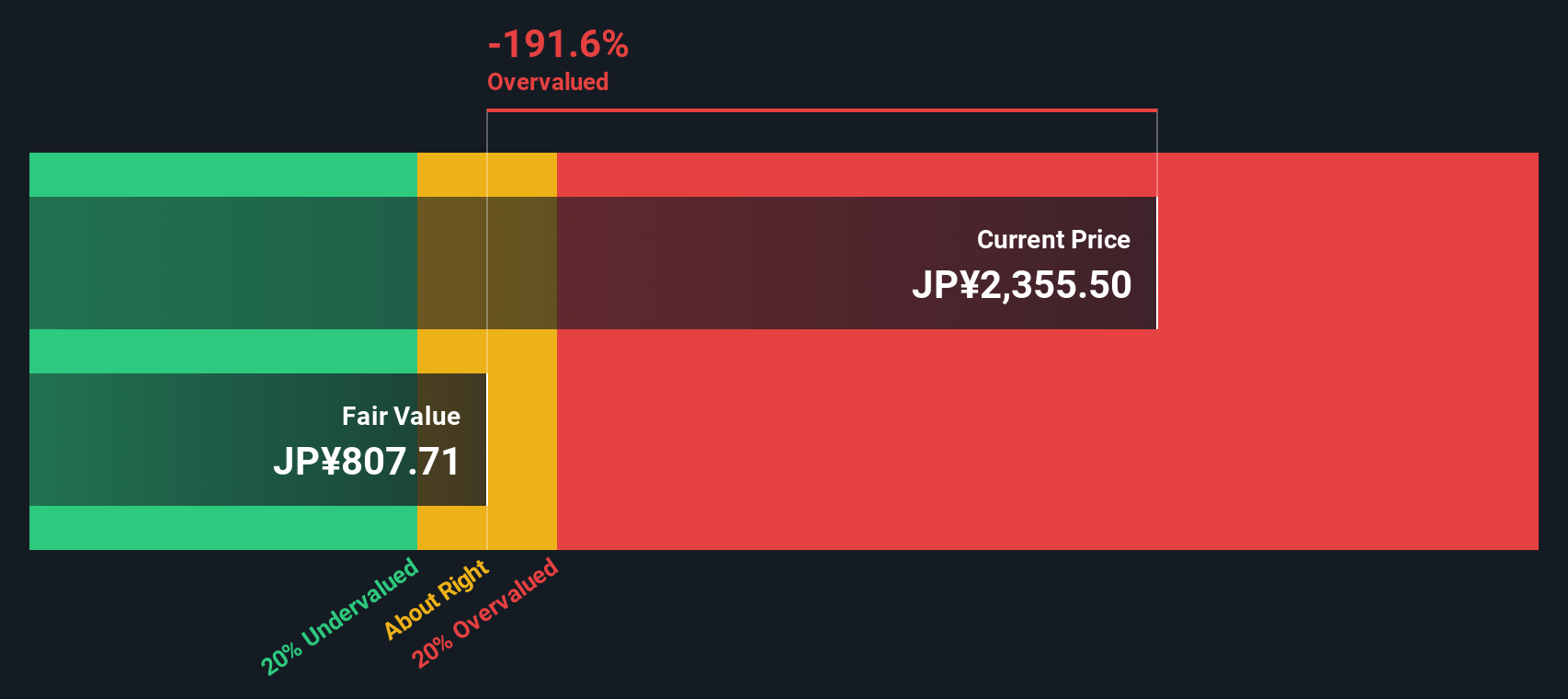

Looking at Kansai Electric Power Company’s valuation from a different angle, our DCF model estimates fair value closer to ¥814.45 per share, which is much lower than the current market price of ¥2,389.5. This suggests the stock is trading well above its calculated intrinsic value and could indicate downside risk. Is the market being too optimistic, or is there more to the company’s story?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Kansai Electric Power Company for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 849 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Kansai Electric Power Company Narrative

If you think your view of Kansai Electric Power Company’s value is different, or want to explore the numbers first-hand, you can build your own narrative in just a few minutes. Do it your way

A great starting point for your Kansai Electric Power Company research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Why stop now? The Simply Wall Street Screener uncovers unique stocks with strong financials, innovation, and growth potential you might not spot elsewhere. Give yourself an edge and never let a great idea slip away.

- Start building lasting wealth with steady income and check out these 17 dividend stocks with yields > 3%, which offers yields above 3%.

- Harness the future of medicine by exploring these 32 healthcare AI stocks and discover companies driving healthcare innovation with advanced artificial intelligence.

- Ride the next wave of blockchain transformation by tapping into these 82 cryptocurrency and blockchain stocks for opportunities in cryptocurrency and distributed ledger technologies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kansai Electric Power Company might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9503

Kansai Electric Power Company

Engages in electricity, gas and heat supply, and telecommunication and gas supply in Japan.

Solid track record with slight risk.

Market Insights

Community Narratives