- Japan

- /

- Gas Utilities

- /

- TSE:8174

Nippon Gas (TSE:8174): Assessing Valuation After Major Share Buyback Announcement

Reviewed by Simply Wall St

Nippon Gas (TSE:8174) just revealed a share buyback plan, with the company aiming to repurchase up to 4 million shares by March 2026. The move is designed to optimize its capital-to-asset ratio and reduce shareholder’s equity.

See our latest analysis for Nippon Gas.

Nippon Gas shares have been on a tear, jumping 3.1% after the buyback news and now boasting a 36.6% share price return year-to-date. Following the Board’s repurchase approval, momentum has clearly picked up. The stock’s long-term track record is strong, with a 48.6% total shareholder return over the past year and 106% over five years.

If this kind of momentum has you thinking about what else is possible, now is a prime time to broaden your search and discover fast growing stocks with high insider ownership

With the stock surging and a major buyback on the table, the key question for investors is whether Nippon Gas is still undervalued or if the market has already factored in its potential for future growth.

Price-to-Earnings of 24x: Is it justified?

Nippon Gas is currently trading at a price-to-earnings ratio of 24x, which stands out compared to peers and suggests the market is pricing in strong forward expectations. With a last close of ¥2,948.5, the stock appears expensive by both industry and regional standards.

The price-to-earnings ratio measures how much investors are paying for each yen of Nippon Gas's earnings. In the gas utilities sector, this metric helps gauge whether the market believes future profit growth will justify current valuations.

Despite the company’s history of robust earnings growth, the current multiple is more than double the Asian gas utilities industry average of 13.7x and significantly above the peer average of 11.7x. When compared to the estimated fair price-to-earnings ratio of 8.7x, this premium is even more pronounced and may act as a ceiling for upside if earnings do not keep pace with lofty expectations.

Explore the SWS fair ratio for Nippon Gas

Result: Price-to-Earnings of 24x (OVERVALUED)

However, slower-than-expected earnings growth or unfavorable regulatory changes could quickly challenge Nippon Gas's premium valuation and disrupt its current momentum.

Find out about the key risks to this Nippon Gas narrative.

Another View: Discounted Cash Flow Analysis

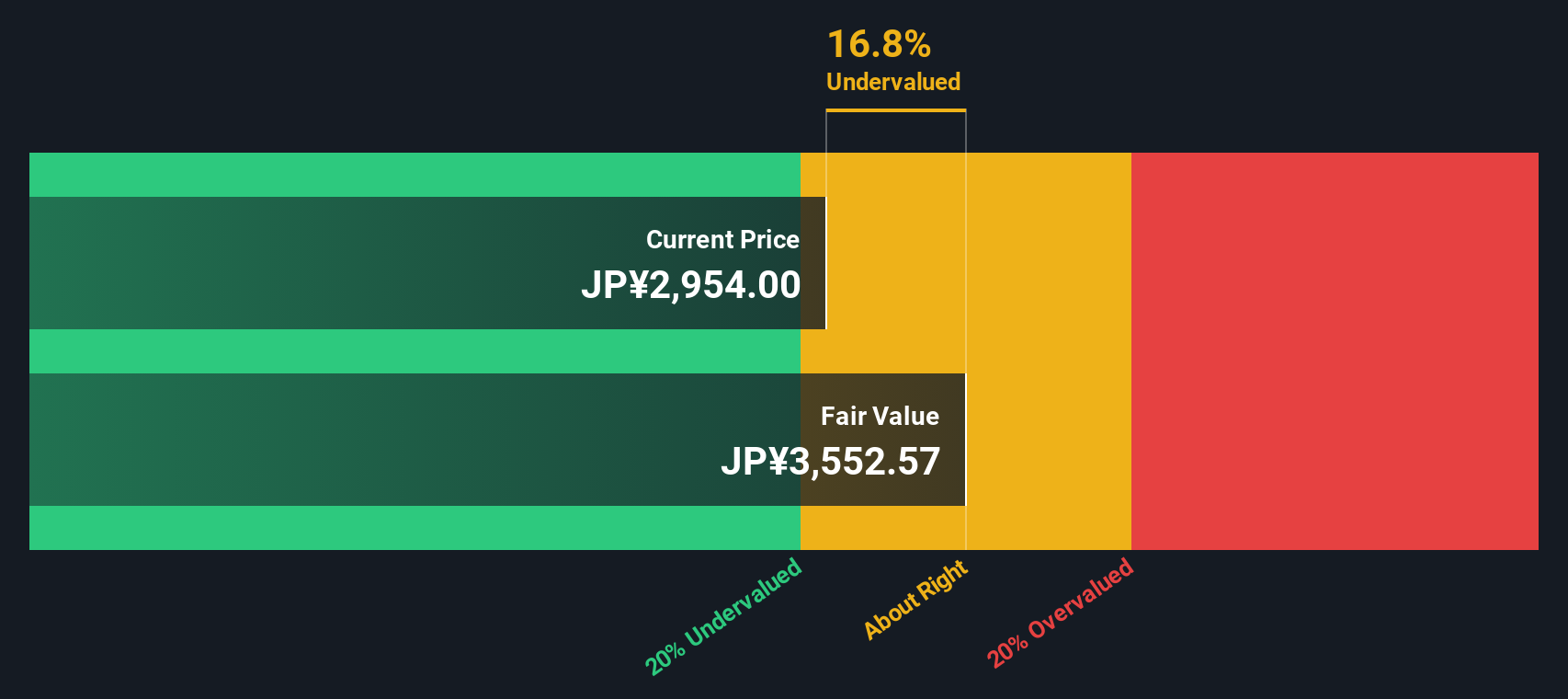

While the company's price-to-earnings ratio raises overvaluation concerns, our DCF model offers a different perspective. Based on projected cash flows, Nippon Gas appears to be trading around 17% below its estimated fair value. Could this indicate the stock is undervalued despite its high earnings multiple?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Nippon Gas for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 837 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Nippon Gas Narrative

If you see the numbers differently or want to dig into the data yourself, building your own take is quick and straightforward. Do it your way.

A great starting point for your Nippon Gas research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

The smartest investors always keep their radar up for new opportunities. Seize your edge by browsing these curated lists and get ahead before others catch on.

- Uncover tomorrow’s blue chips by reviewing these 3579 penny stocks with strong financials, which feature resilient financials and fast-rising momentum.

- Capitalize on technological breakthroughs by researching these 26 AI penny stocks, as they are reshaping the digital landscape and powering the AI revolution.

- Secure steady income by checking out these 24 dividend stocks with yields > 3%, which offer robust yields and stable returns for long-term growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nippon Gas might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8174

Nippon Gas

Engages in the supply and sale of LP gas and natural gas in Japan.

Outstanding track record with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives