As global markets experience broad-based gains and U.S. indexes approach record highs, investors are navigating a landscape marked by strong labor market data and geopolitical uncertainties. In this dynamic environment, dividend stocks can offer a compelling investment option, providing potential income stability amid fluctuating economic conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.98% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.53% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.56% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.67% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.38% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.49% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.43% | ★★★★★★ |

| James Latham (AIM:LTHM) | 6.10% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.85% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.90% | ★★★★★★ |

Click here to see the full list of 1960 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Jacobson Pharma (SEHK:2633)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Jacobson Pharma Corporation Limited, with a market cap of HK$1.59 billion, operates through its subsidiaries to develop, produce, market, and sell generic drugs and branded healthcare products in Hong Kong, Mainland China, Macau, Singapore, and internationally.

Operations: Jacobson Pharma's revenue primarily comes from its generic drugs segment, which generated HK$1.56 billion.

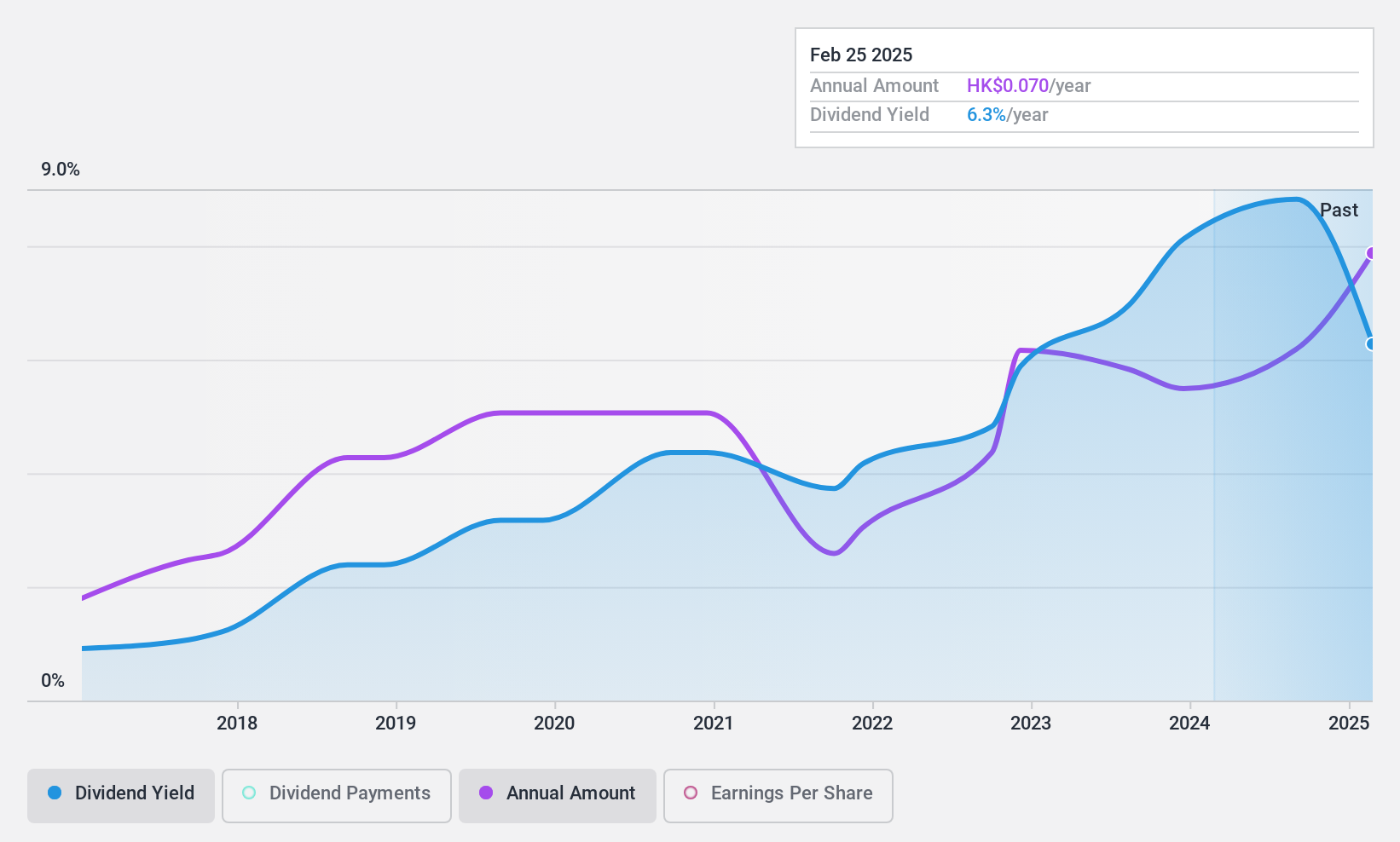

Dividend Yield: 8.4%

Jacobson Pharma's dividend payments have increased, with a recent interim dividend hike of 40% to HK$0.035 per share, though the company has only an 8-year history of dividends marked by volatility. The dividend yield is among the top in Hong Kong at 8.43%, supported by a cash payout ratio of 39.2% and an earnings payout ratio of 50.2%. However, shareholder dilution over the past year and an unstable track record may concern some investors.

- Dive into the specifics of Jacobson Pharma here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that Jacobson Pharma is trading behind its estimated value.

ENN Energy Holdings (SEHK:2688)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ENN Energy Holdings Limited is an investment holding company involved in the investment, construction, operation, and management of gas pipeline infrastructure in the People’s Republic of China with a market cap of HK$57.21 billion.

Operations: ENN Energy Holdings generates revenue from several key segments, including Retail Gas Sales Business (CN¥67.73 billion), Wholesale of Gas (CN¥40.99 billion), Integrated Energy Business (CN¥15.95 billion), Value Added Business (CN¥7.74 billion), and Construction and Installation (CN¥5.58 billion).

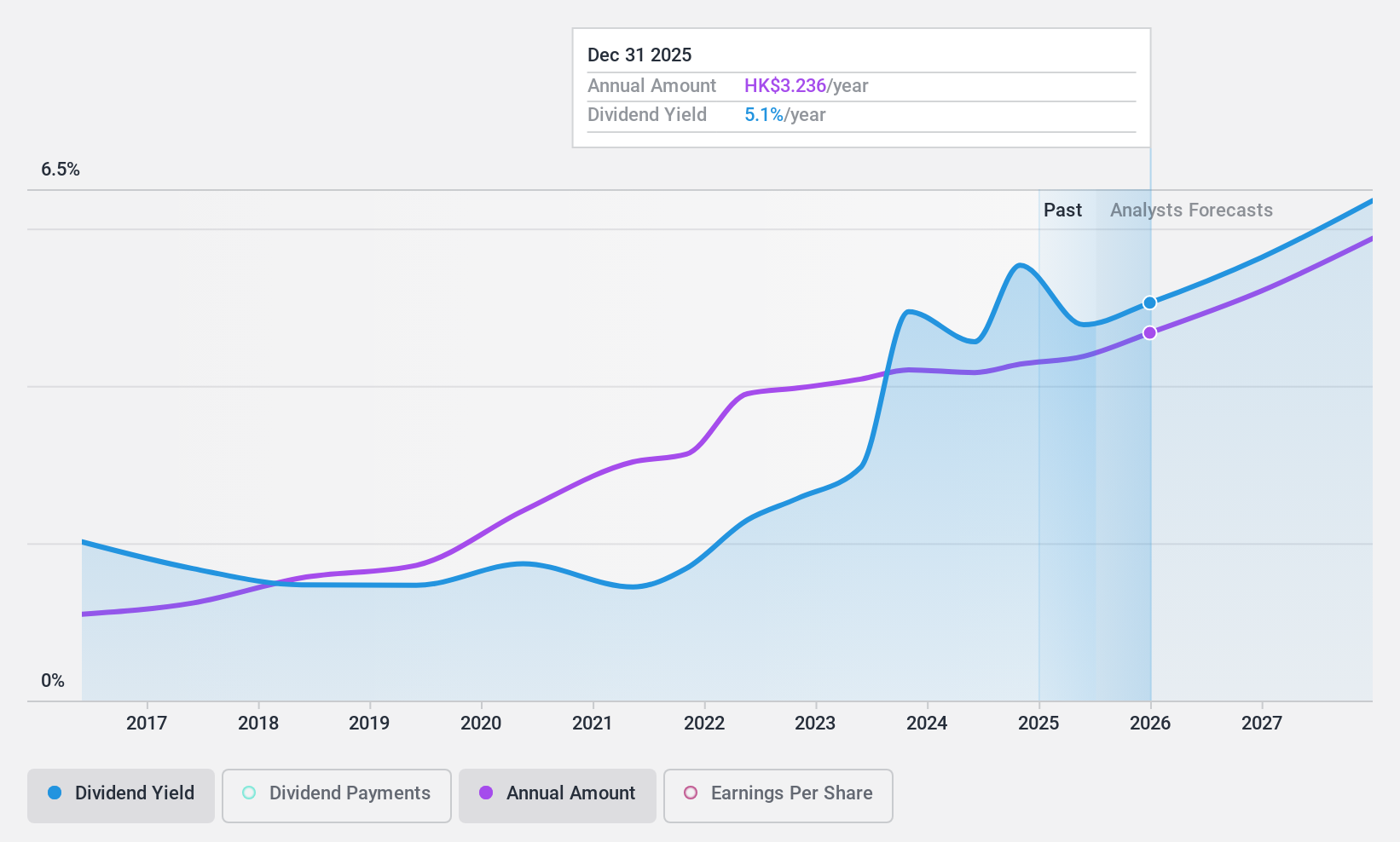

Dividend Yield: 5.3%

ENN Energy Holdings' dividend yield of 5.35% is below the top quartile in Hong Kong, and its dividends are not covered by free cash flows due to a high cash payout ratio of 114.2%. Despite this, the dividend has been stable and growing over the past decade with a low earnings payout ratio of 49.9%. Recent operating results show increased energy sales volumes but a decline in newly-developed residential households, which may impact future growth prospects.

- Click here and access our complete dividend analysis report to understand the dynamics of ENN Energy Holdings.

- The valuation report we've compiled suggests that ENN Energy Holdings' current price could be quite moderate.

Japan Airlines (TSE:9201)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Japan Airlines Co., Ltd. operates scheduled and non-scheduled air transport services across Japan, Asia, Oceania, North America, the United Kingdom, and Europe with a market cap of ¥1.07 trillion.

Operations: Japan Airlines Co., Ltd. generates revenue through its air transport services, which include both scheduled and non-scheduled flights across various regions such as Japan, Asia, Oceania, North America, the United Kingdom, and Europe.

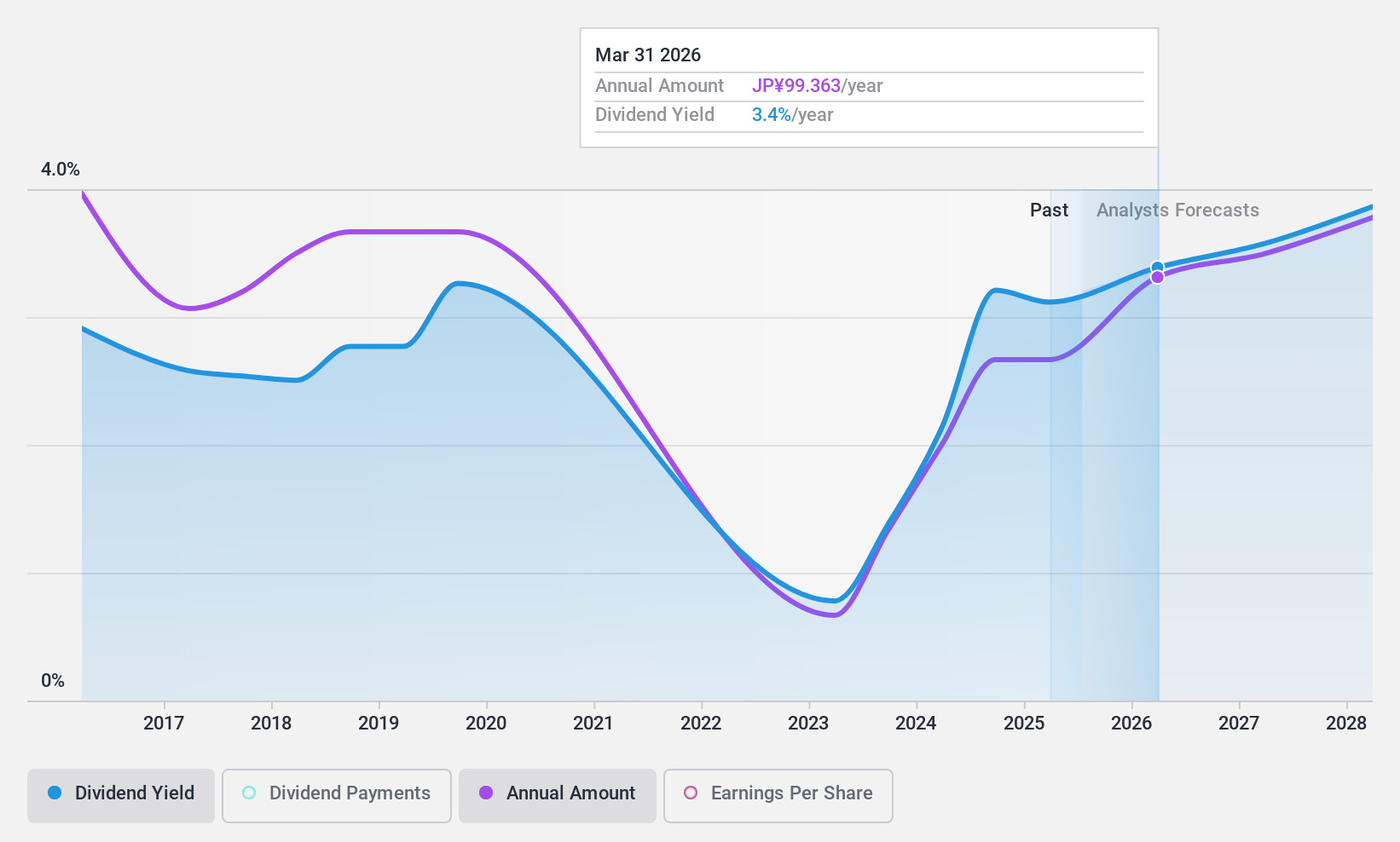

Dividend Yield: 3.2%

Japan Airlines' dividend yield of 3.24% is lower than the top 25% of payers in Japan. The payout ratio of 60% indicates earnings cover dividends, while a higher cash payout ratio of 85.4% suggests limited coverage by free cash flows. Although dividends have grown over the past decade, they remain volatile and unreliable. Recently, Japan Airlines increased its dividend to ¥40 per share from ¥30, reflecting a positive shift despite past instability.

- Take a closer look at Japan Airlines' potential here in our dividend report.

- According our valuation report, there's an indication that Japan Airlines' share price might be on the cheaper side.

Make It Happen

- Unlock more gems! Our Top Dividend Stocks screener has unearthed 1957 more companies for you to explore.Click here to unveil our expertly curated list of 1960 Top Dividend Stocks.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2633

Jacobson Pharma

Through its subsidiaries, engages in the research, development, production, sale, and distribution of medicine and drugs in Hong Kong, Mainland China, Macau, Singapore, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives