- Japan

- /

- Marine and Shipping

- /

- TSE:9101

Does Nippon Yusen’s (TSE:9101) New Dividend Plan Reflect a Shift in Capital Allocation Priorities?

Reviewed by Sasha Jovanovic

- On November 6, 2025, Nippon Yusen Kabushiki Kaisha announced revised consolidated earnings guidance for the fiscal year ending March 31, 2026, alongside updated dividend policies including a lower ordinary dividend of ¥85.00 per share and a commemorative dividend of ¥25.00 per share.

- This combination of a regular dividend decrease and the introduction of a one-off commemorative dividend highlights the company’s intention to balance shareholder returns amid changing earnings expectations.

- We’ll examine how the lower regular dividend guidance impacts Nippon Yusen’s investment narrative and prospects for earnings stability.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Nippon Yusen Kabushiki Kaisha Investment Narrative Recap

As a Nippon Yusen Kabushiki Kaisha shareholder, you need to believe in the ongoing relevance and resilience of global shipping and logistics, while accepting the cyclical nature of earnings and uncertainties in freight rates. The recent reduction in regular dividend guidance, despite a one-off commemorative payout, may signal a cautious near-term stance, but does not materially alter the company’s most important short-term catalyst, how successfully NYK manages expected declines in Liner business freight rates, nor does it reduce the significant risk posed by volatile market conditions and evolving global trade dynamics.

Most relevant to these developments is NYK's revised consolidated earnings guidance for the fiscal year ending March 31, 2026, now forecasting revenues of ¥2,350,000 million and a profit attributable to owners of ¥210,000 million (¥495.07 per share). This update frames the company’s outlook amid an industry environment where pressures on freight and profitability remain central to the investment narrative.

In contrast, investors should also remain alert to the unpredictable impact of geopolitical disruptions on shipping operations and revenue, as...

Read the full narrative on Nippon Yusen Kabushiki Kaisha (it's free!)

Nippon Yusen Kabushiki Kaisha is forecast to reach ¥2,409.5 billion in revenue and ¥218.4 billion in earnings by 2028. This outlook assumes an annual revenue decline of 1.7% and a decrease in earnings of ¥201.2 billion from the current ¥419.6 billion.

Uncover how Nippon Yusen Kabushiki Kaisha's forecasts yield a ¥5380 fair value, a 7% upside to its current price.

Exploring Other Perspectives

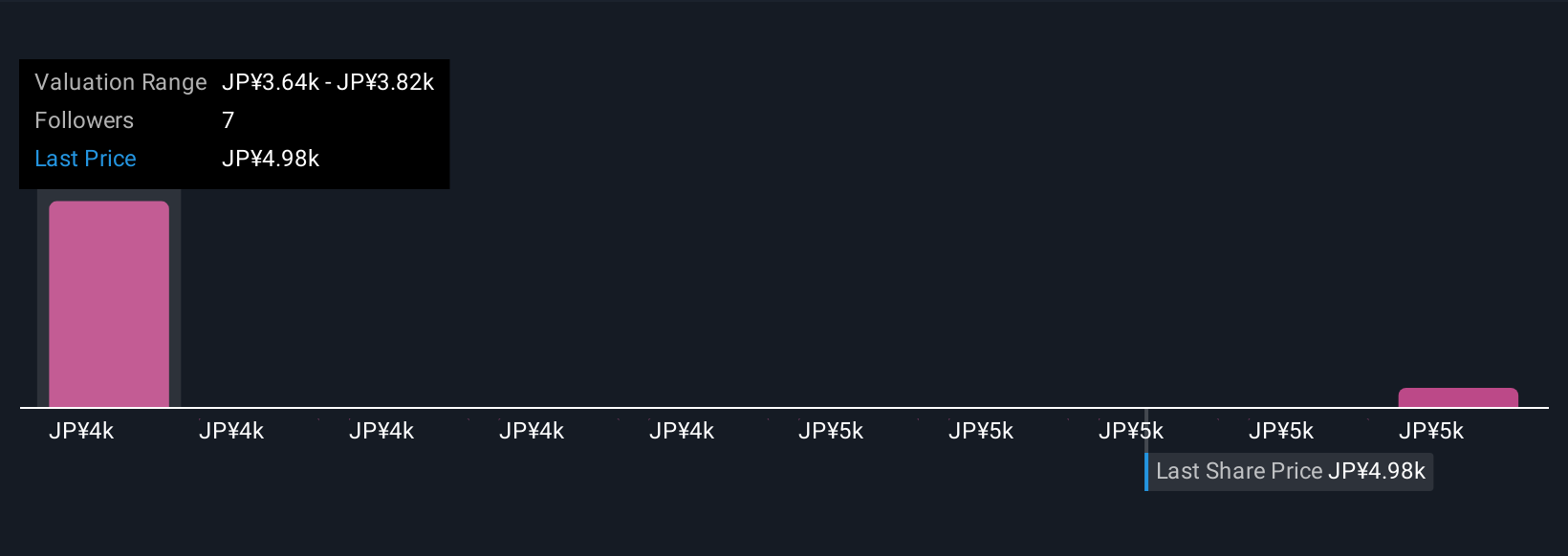

The Simply Wall St Community’s fair value estimates for NYK range from ¥3,674 to ¥5,380 across two perspectives, showing wide variation in expectations. While these private investor views differ markedly, shifting freight rates and earnings guidance could weigh heavily on how market participants assess the stock going forward.

Explore 2 other fair value estimates on Nippon Yusen Kabushiki Kaisha - why the stock might be worth as much as 7% more than the current price!

Build Your Own Nippon Yusen Kabushiki Kaisha Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nippon Yusen Kabushiki Kaisha research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Nippon Yusen Kabushiki Kaisha research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nippon Yusen Kabushiki Kaisha's overall financial health at a glance.

Seeking Other Investments?

Our top stock finds are flying under the radar-for now. Get in early:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nippon Yusen Kabushiki Kaisha might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9101

Nippon Yusen Kabushiki Kaisha

Provides logistics services in Japan, North America, Asia, and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives