Sankyu (TSE:9065) Is Up 9.3% After Upgraded Guidance, Dividend Hike and Buyback Plan - Has the Bull Case Changed?

Reviewed by Sasha Jovanovic

- On October 31, 2025, Sankyu Inc.’s Board of Directors approved both a raised full-year earnings guidance and an interim dividend of ¥118 per share, with the dividend record date set for September 30, 2025 and payment effective December 8, 2025.

- These developments, coupled with a planned share buyback, highlight the company’s emphasis on increased shareholder returns and a strengthened financial outlook.

- Let’s explore how Sankyu’s upgraded earnings guidance shapes the company’s broader investment narrative going forward.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Sankyu's Investment Narrative?

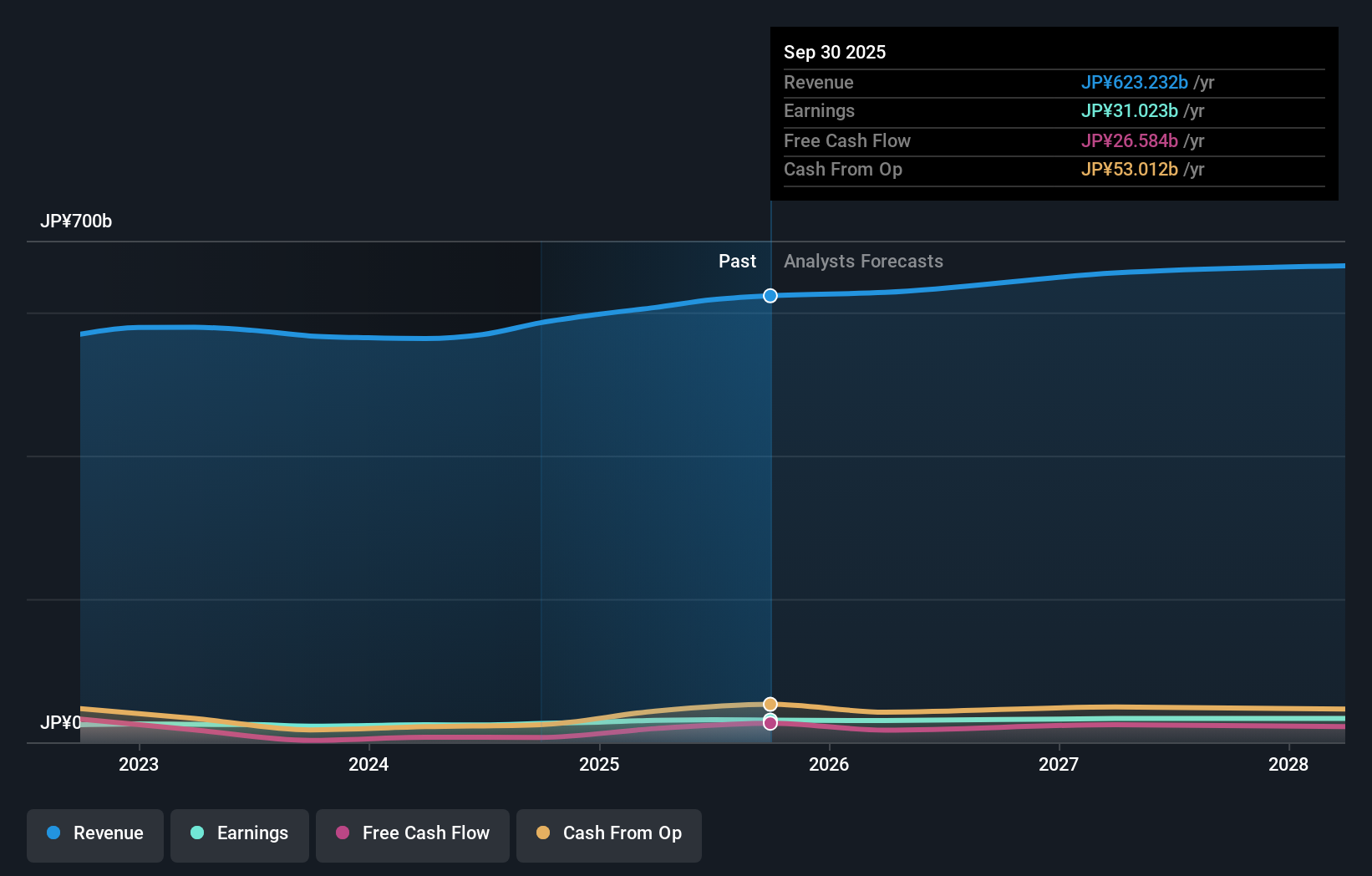

For me, the big-picture case for holding Sankyu comes down to believing in its ability to maintain consistent profit growth while running a disciplined capital return program. The company's recent decision to boost earnings guidance, lift the interim dividend, and accelerate share buybacks emphasizes a clear shift toward rewarding shareholders, which may boost near-term sentiment and serve as a catalyst for continued support. This is a meaningful change, previous analysis pegged Sankyu as steady but unspectacular, with solid quality earnings and reliable, though not industry-leading, growth. Now, with profit guidance coming in above expectations and tangible cash returns on offer, short-term risks like lagging revenue growth versus the broader market take on less weight, while attention turns more to whether these performance upgrades are repeatable. Still, board turnover and the pace of new director appointments remain areas investors should keep on their radar.

By contrast, not all investors may have noticed just how many new directors have joined the board.

Exploring Other Perspectives

Explore another fair value estimate on Sankyu - why the stock might be worth just ¥8182!

Build Your Own Sankyu Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sankyu research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Sankyu research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sankyu's overall financial health at a glance.

Curious About Other Options?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 38 companies in the world exploring or producing it. Find the list for free.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9065

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives