- Japan

- /

- Transportation

- /

- TSE:9044

Nankai Electric Railway (TSE:9044): Valuation in Focus After Dividend Hike and Upgraded Earnings Guidance

Reviewed by Simply Wall St

Nankai Electric Railway (TSE:9044) just announced a higher interim dividend and revised its full-year earnings guidance upward. These moves signal growing confidence in business performance and enhanced shareholder returns.

See our latest analysis for Nankai Electric Railway.

After unveiling a bigger dividend and a more optimistic full-year outlook, Nankai Electric Railway's momentum has picked up. The 15.63% year-to-date share price return hints that investor sentiment is warming. Over the past year, total shareholder return stands at a strong 15.5%, signaling both short- and longer-term potential as management’s confidence translates into action.

If these moves have you wondering where else value and momentum are building, it might be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

But with a higher dividend and improved outlook now public, the question for investors is clear: is Nankai Electric Railway still undervalued, or has the market already accounted for its next phase of growth?

Price-to-Earnings of 13x: Is it justified?

Nankai Electric Railway currently trades at a price-to-earnings ratio of 13x, putting it above the average for both peers and the wider JP Transportation sector. The last closing price was ¥2,848.

The price-to-earnings (P/E) ratio compares a company's share price to its earnings per share and is widely used to value established, profit-generating businesses. A higher P/E can imply expectations for stronger future growth, but it can also indicate market over-optimism if growth does not follow through.

In this case, Nankai Electric Railway’s 13x P/E is not just a premium to the industry average of 12.5x; it is also slightly above the calculated fair ratio of 12.7x. This means the stock is priced optimistically relative to its sector, and the market could adjust closer to the fair ratio if future growth disappoints.

Explore the SWS fair ratio for Nankai Electric Railway

Result: Price-to-Earnings of 13x (OVERVALUED)

However, slowing revenue and modest profit growth could temper expectations. This makes it crucial for investors to watch for sustained operational improvements ahead.

Find out about the key risks to this Nankai Electric Railway narrative.

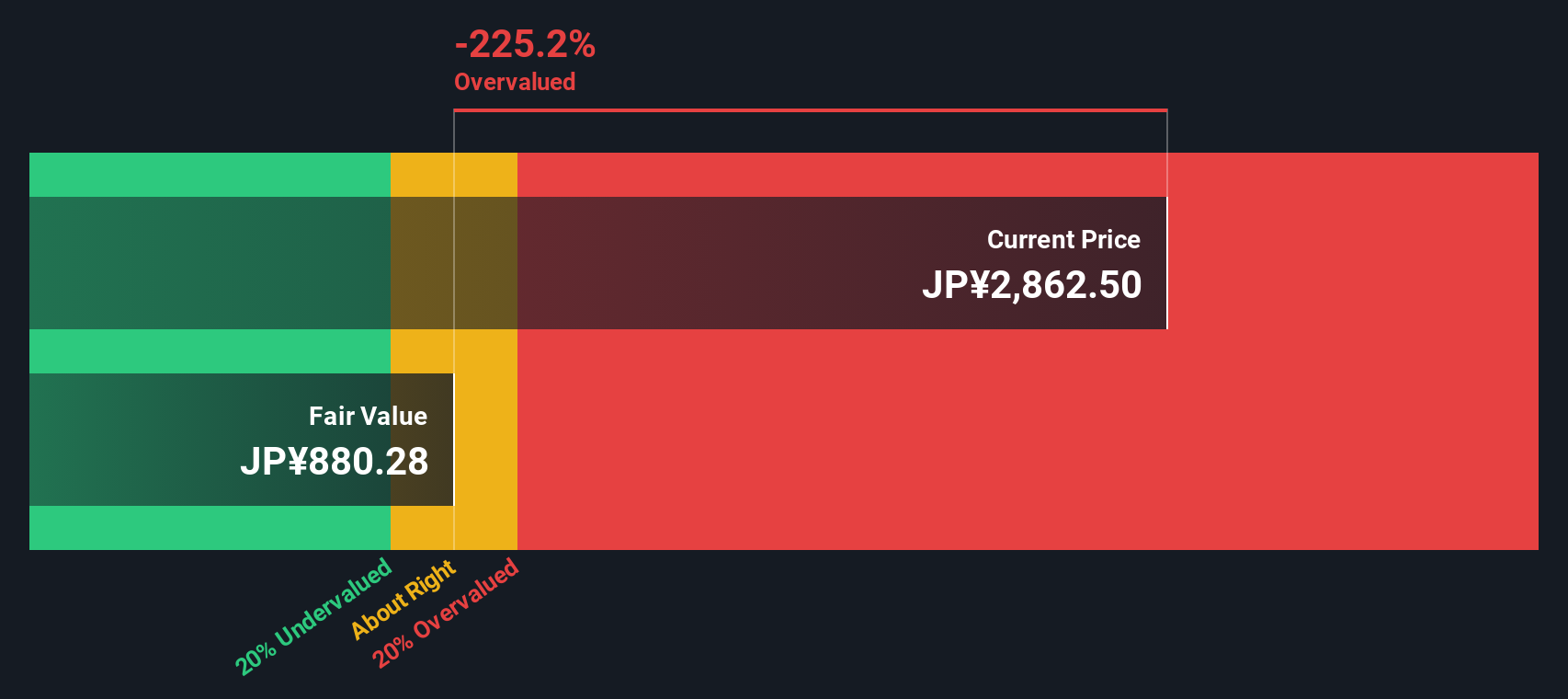

Another View: Discounted Cash Flow Challenges the Premium

While the market values Nankai Electric Railway above its peers based on earnings, our DCF model presents a more cautious perspective. According to this approach, the stock’s intrinsic value appears to be much lower than today’s price. This could mean investors are paying too much. Does this signal an opportunity, or a warning to examine the fundamentals more closely?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Nankai Electric Railway for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 848 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Nankai Electric Railway Narrative

If you want to dig deeper or reach your own conclusions, it only takes a few minutes to explore the numbers directly and shape your own story. Do it your way

A great starting point for your Nankai Electric Railway research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready to uncover your next investment winner?

The real edge comes from acting now, not later. Get ahead by finding stocks set to benefit from today’s powerful market trends on Simply Wall Street.

- Boost your portfolio with stable cash-generators delivering impressive yields as you tap into these 17 dividend stocks with yields > 3%.

- Ride the AI wave and seize early opportunities by reviewing these 25 AI penny stocks before the rest of the market.

- Step into the future of computing by exploring these 28 quantum computing stocks and discover companies powering breakthroughs in technology and innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nankai Electric Railway might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9044

Questionable track record with imperfect balance sheet.

Market Insights

Community Narratives