- Japan

- /

- Real Estate

- /

- TSE:8871

Discovering Undiscovered Gems In Japan This August 2024

Reviewed by Simply Wall St

In a turbulent week for global markets, Japan's stock indices saw significant declines, with the Nikkei 225 Index dropping 4.7% and the broader TOPIX Index down 6.0%. Amid this backdrop, investors are increasingly looking toward value stocks and small-cap companies as potential opportunities. Identifying promising stocks in such a market involves finding companies with strong fundamentals, growth potential, and resilience to economic fluctuations. Here are three undiscovered gems in Japan that could offer compelling investment opportunities this August 2024.

Top 10 Undiscovered Gems With Strong Fundamentals In Japan

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ryoyu Systems | NA | 1.08% | 8.08% | ★★★★★★ |

| Totech | 16.84% | 4.67% | 9.18% | ★★★★★★ |

| ITOCHU-SHOKUHIN | NA | -0.08% | 12.04% | ★★★★★★ |

| Ad-Sol Nissin | NA | 1.94% | 6.44% | ★★★★★★ |

| Imuraya Group | 17.62% | 1.55% | 27.83% | ★★★★★★ |

| AJIS | 0.69% | 0.07% | -12.44% | ★★★★★☆ |

| Marusan Securities | 5.33% | 1.01% | 10.00% | ★★★★★☆ |

| Kappa Create | 73.80% | -1.08% | -8.46% | ★★★★★☆ |

| Toyo Kanetsu K.K | 45.07% | 2.00% | 11.94% | ★★★★☆☆ |

| FDK | 89.57% | -0.88% | 25.34% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Mirai IndustryLtd (TSE:7931)

Simply Wall St Value Rating: ★★★★★★

Overview: Mirai Industry Co., Ltd., along with its subsidiaries, manufactures and sells electrical and pipe materials as well as wiring devices in Japan, with a market cap of ¥54.42 billion.

Operations: Mirai Industry Co., Ltd. generates revenue primarily through the sale of electrical and pipe materials, as well as wiring devices in Japan. The company has a market cap of ¥54.42 billion and operates with a diverse product portfolio within these segments.

Mirai Industry Ltd. has shown remarkable resilience, with earnings growth of 59.5% over the past year, outpacing the Electrical industry’s 20.2%. Its debt-to-equity ratio has improved significantly from 2.5 to 0.8 over five years, indicating prudent financial management. The company's Price-To-Earnings ratio stands at 10.5x, below the JP market average of 11.5x, suggesting it may be undervalued despite forecasts predicting a slight annual earnings decline of 1.7% for the next three years.

- Unlock comprehensive insights into our analysis of Mirai IndustryLtd stock in this health report.

Understand Mirai IndustryLtd's track record by examining our Past report.

GOLDCRESTLtd (TSE:8871)

Simply Wall St Value Rating: ★★★★★☆

Overview: GOLDCREST Ltd. (TSE:8871) focuses on the planning, development, and sale of new condominiums in Japan and has a market cap of ¥91.93 billion.

Operations: GOLDCREST Ltd. generates revenue primarily through the planning, development, and sale of new condominiums in Japan. The company has a market capitalization of ¥91.93 billion.

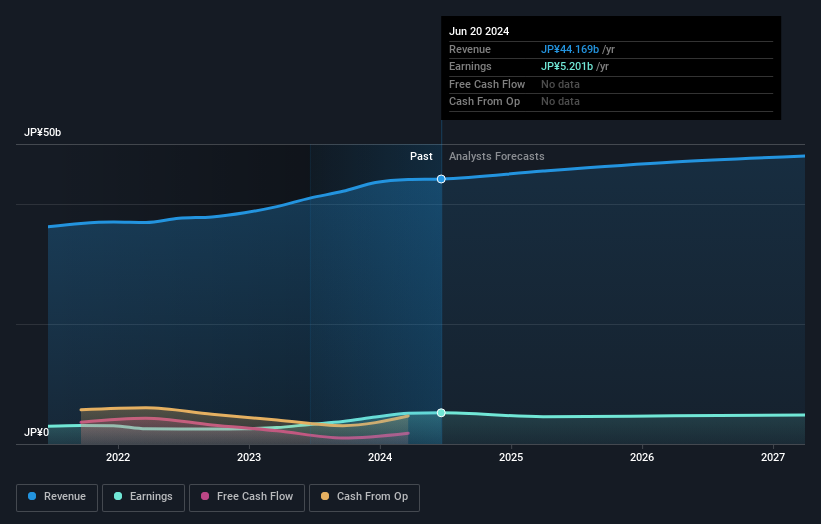

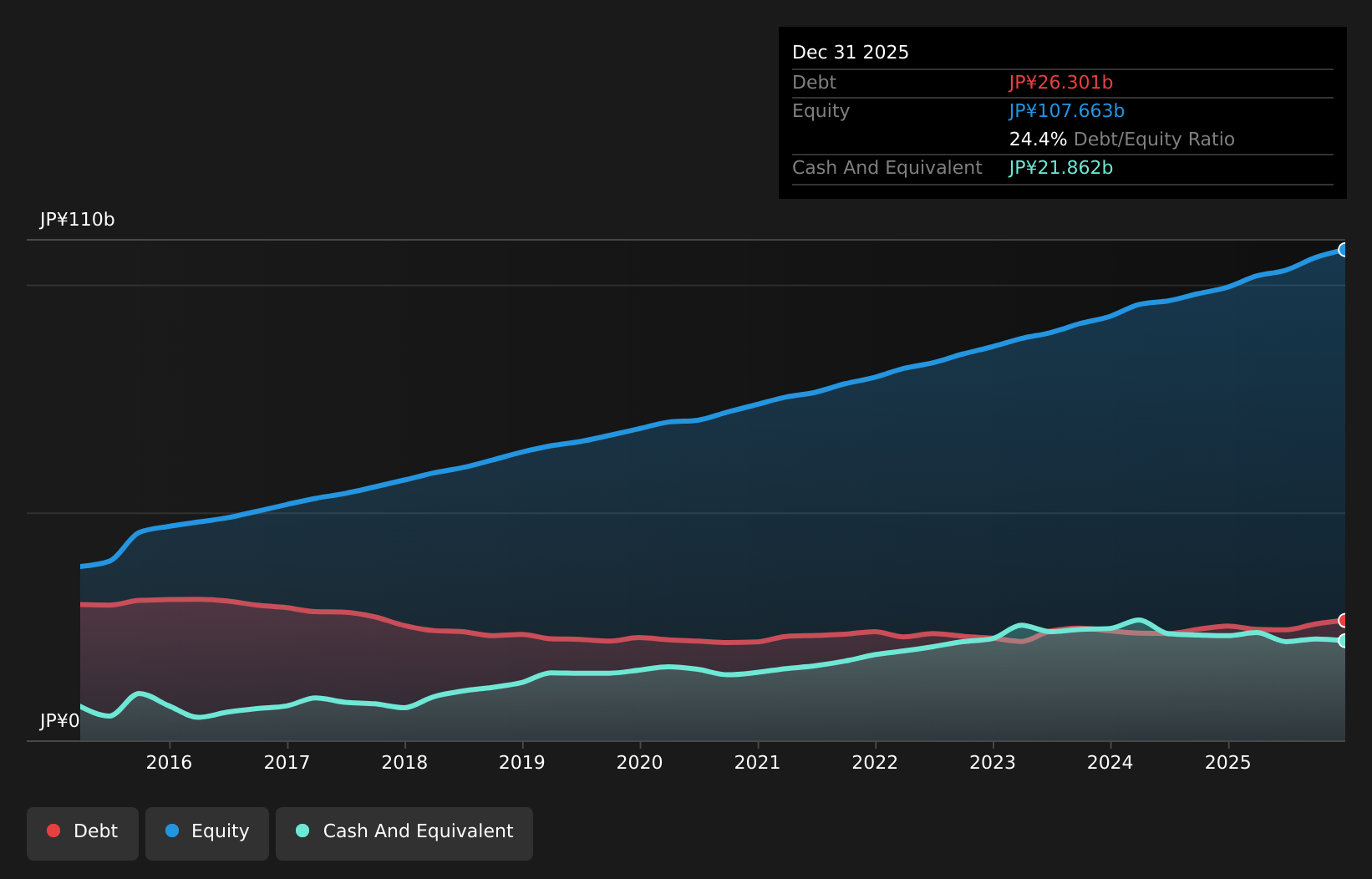

GOLDCREST Ltd. has shown impressive performance with earnings growing by 304% over the past year, significantly outpacing the Real Estate industry's 14%. The company boasts high-quality past earnings and is profitable, ensuring a secure cash runway. Its debt level is appropriate, with more cash than total debt, and interest payments are well covered by EBIT at 25.8x coverage. Additionally, GOLDCREST's debt-to-equity ratio has improved from 39.6% to 38.5% over five years.

- Click to explore a detailed breakdown of our findings in GOLDCRESTLtd's health report.

Review our historical performance report to gain insights into GOLDCRESTLtd's's past performance.

Hamakyorex (TSE:9037)

Simply Wall St Value Rating: ★★★★★★

Overview: Hamakyorex Co., Ltd. specializes in 3PL logistics and truck transportation services both within Japan and internationally, with a market cap of ¥83.74 billion.

Operations: Hamakyorex generates revenue primarily from its 3PL logistics and truck transportation services. The company's financial performance includes key metrics such as gross profit margin or net profit margin, which are indicative of its profitability trends.

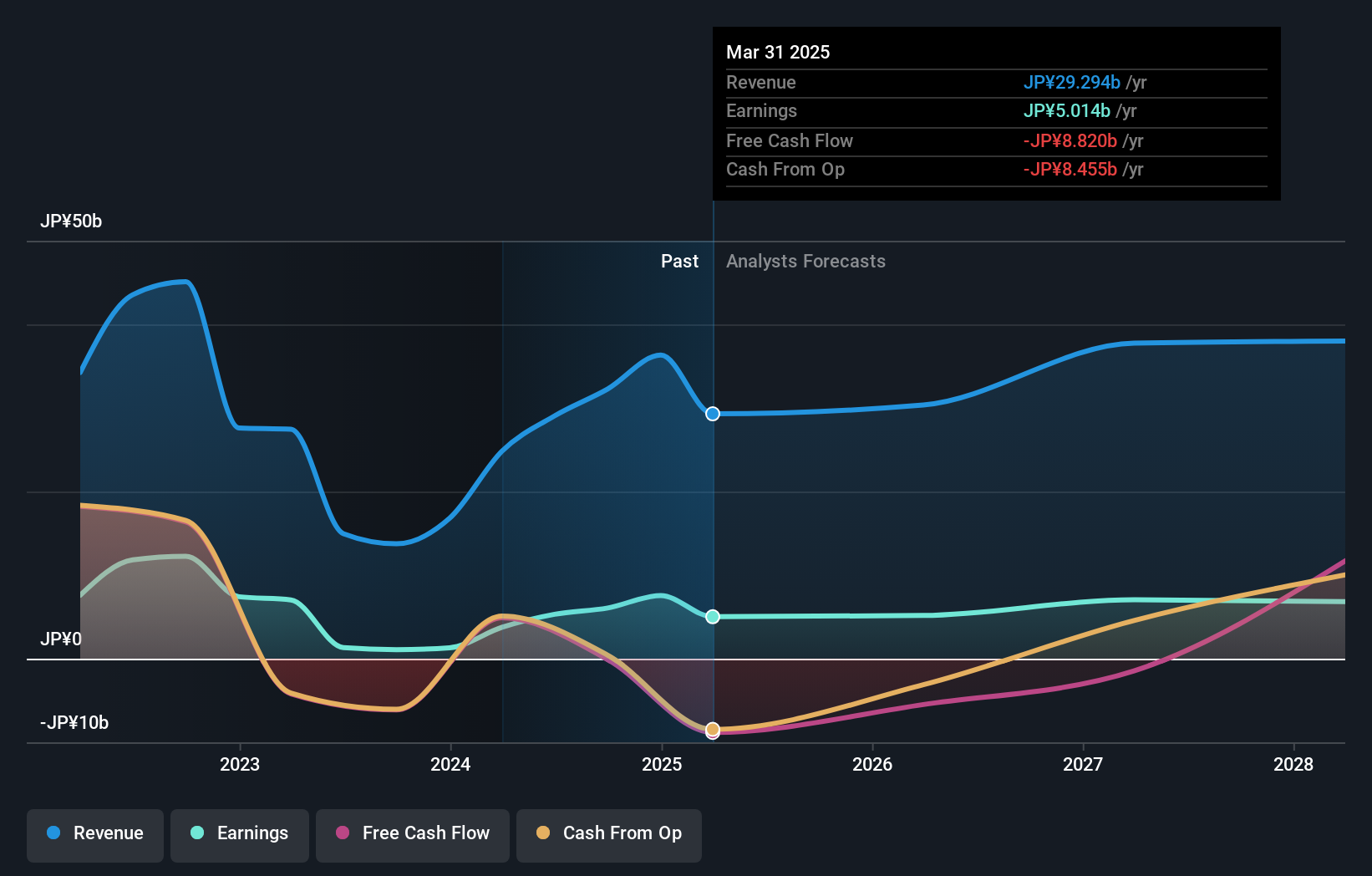

Hamakyorex has shown impressive performance, with earnings growing 16.3% over the past year, outpacing the logistics industry’s -1.3%. The company’s net debt to equity ratio stands at a satisfactory 0.05%, and its EBIT covers interest payments by 487.5 times. Trading at nearly half its estimated fair value, Hamakyorex recently repurchased 64,800 shares for ¥265.81 million as part of a broader buyback program aimed at flexible capital policies amid changing business conditions.

- Get an in-depth perspective on Hamakyorex's performance by reading our health report here.

Assess Hamakyorex's past performance with our detailed historical performance reports.

Taking Advantage

- Embark on your investment journey to our 711 Japanese Undiscovered Gems With Strong Fundamentals selection here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8871

GOLDCRESTLtd

Engages in planning, development, and sale of new condominiums in Japan.

Excellent balance sheet with proven track record and pays a dividend.