- Japan

- /

- Transportation

- /

- TSE:9006

A Look at Keikyu (TSE:9006) Valuation Following Dividend Update and Board-Approved Payout Forecast

Reviewed by Simply Wall St

Keikyu (TSE:9006) shares moved following news that the company’s board met to approve an interim dividend and revise its year-end dividend forecast for the fiscal year ending March 2026. Both of these developments are material for shareholders.

See our latest analysis for Keikyu.

With the announcement of an interim dividend and a revised year-end forecast, Keikyu’s shares jumped, notching a 1-day share price return of 5.5% and extending their recent run. Momentum is clearly building, given the 8.3% 1-month share price return and a robust 29.7% total shareholder return over the past year.

If you’re tracking transportation stocks making moves, this is a great moment to expand your search and discover See the full list for free.

But with shares rallying and the latest dividend news out, investors might wonder if Keikyu’s upside is only just beginning, or if the market is already factoring in all of its growth potential.

Most Popular Narrative: Fairly Valued

Keikyu’s latest closing price of ¥1,563.5 almost mirrors the most followed narrative’s fair value estimate of ¥1,565. This close alignment suggests that analysts see little daylight between where the market currently values Keikyu and where it should be, at least based on their core assumptions.

The ongoing urbanization and high population density in Greater Tokyo is fueling sustained increases in rail ridership, as evidenced by year-on-year passenger growth (+2.3%) and especially robust expansion in airport station traffic (+8.1%). This supports stable or growing fare revenue for Keikyu and directly boosts top-line revenue and long-term earnings power.

Want to know what hidden metrics shaped this razor-thin valuation gap? The answer centers on future growth expectations, margin forecasts, and one critical multiple. Only the full narrative explains how bold projections connect today’s price to tomorrow’s outcomes. Don’t miss the details that move markets.

Result: Fair Value of ¥1,565 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising debt costs and weakness in Keikyu’s real estate segment could challenge future earnings momentum if not addressed promptly.

Find out about the key risks to this Keikyu narrative.

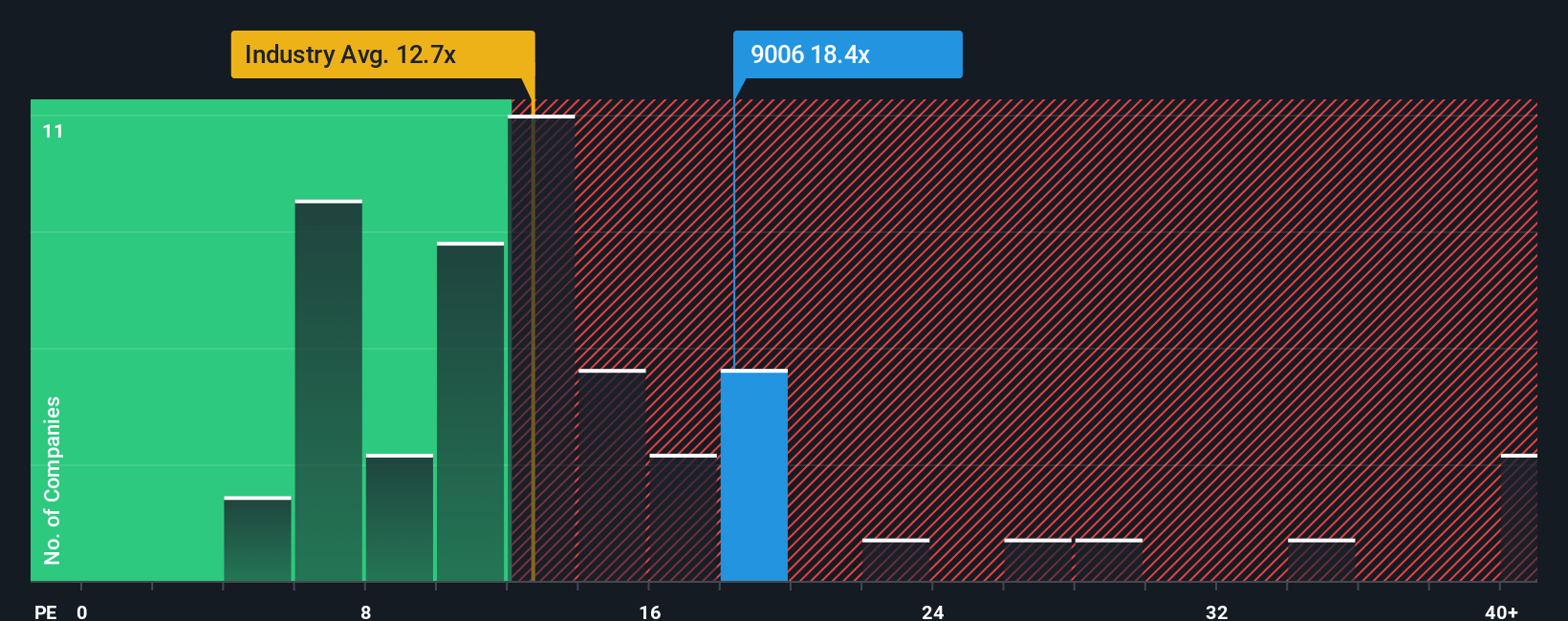

Another View: Price vs Peers and Fair Ratio

While analysts call Keikyu fairly valued, the market actually prices the company above its industry peers. Its price-to-earnings ratio of 18.4x stands well above the industry average of 12.7x and the peer average of 11.5x. In comparison to a fair ratio of 14.4x, this premium suggests investors are paying up for expected growth, introducing greater valuation risk if those prospects falter. Is the upside really worth the price?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Keikyu Narrative

If you see the story differently or want to dig into the numbers yourself, it only takes a few minutes to craft your own perspective. Do it your way

A great starting point for your Keikyu research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more smart opportunities?

The market is always moving, and Simply Wall Street’s screener surfaces standout stocks you may not have considered yet. Great ideas could be just a click away. Don’t let a future winner slip by!

- Uncover high-yield opportunities for your portfolio with these 16 dividend stocks with yields > 3% that offer attractive returns and strong financial health.

- Capitalize on game-changing artificial intelligence by checking out these 24 AI penny stocks transforming industries and setting the pace for tomorrow’s growth.

- Tap into the future of finance with these 82 cryptocurrency and blockchain stocks reshaping digital payments, security, and blockchain-powered business models.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Keikyu might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9006

Second-rate dividend payer with low risk.

Market Insights

Community Narratives