- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6971

Does Kyocera's (TSE:6971) Dividend Consistency Reflect a Deeper Shift in Capital Priorities?

Reviewed by Sasha Jovanovic

- On October 30, 2025, Kyocera Corporation announced an upward revision to its full-year financial guidance for fiscal 2026 and affirmed an interim dividend of ¥25 per share, payable on December 5, 2025, sourced from retained earnings.

- The company attributed this improved outlook to a weaker yen and less impact from U.S. tariff policies than initially anticipated, while maintaining stable shareholder returns.

- We’ll explore how Kyocera’s commitment to stable dividends underscores its approach to shareholder returns amid revised earnings forecasts.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Kyocera's Investment Narrative?

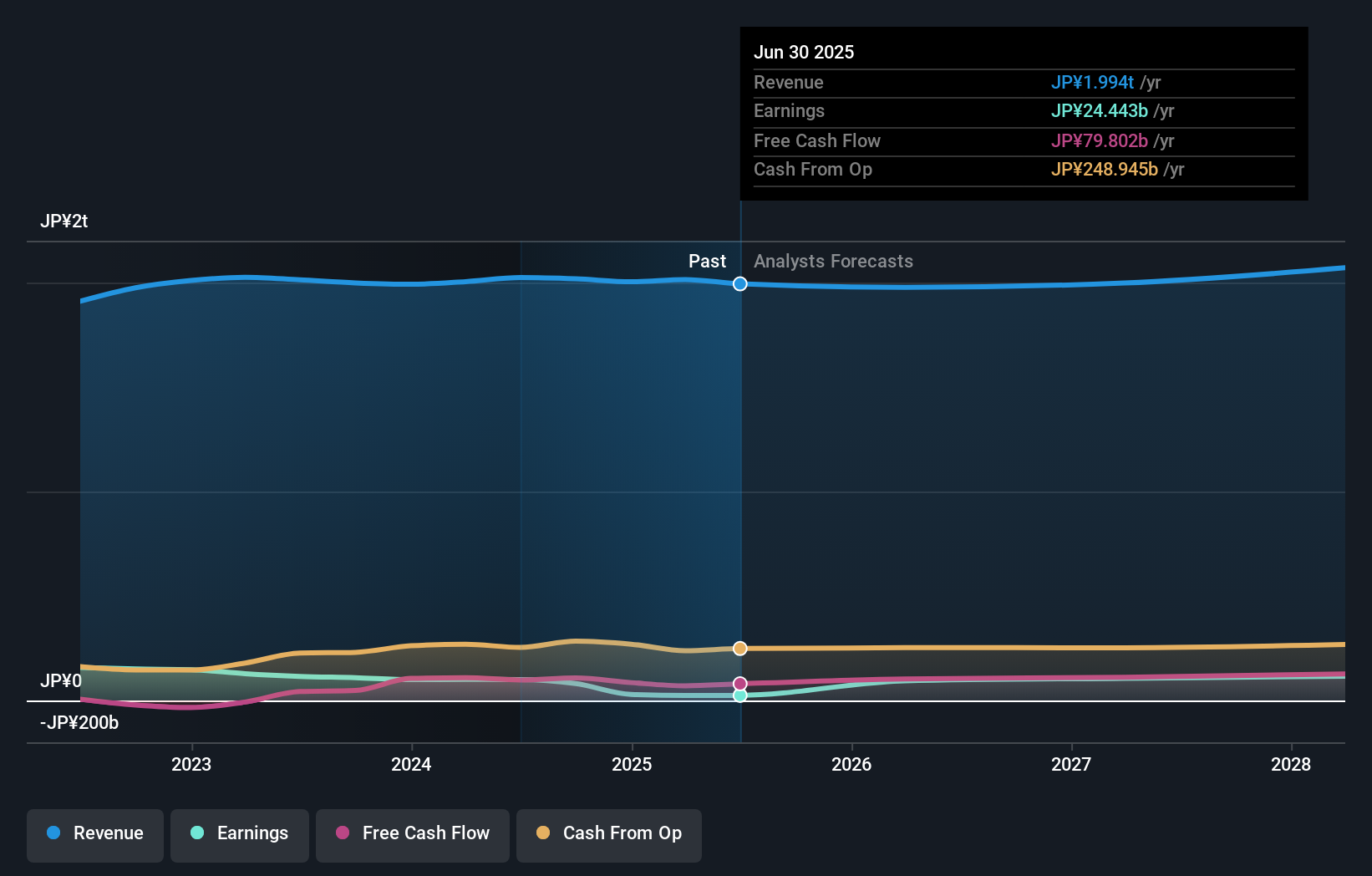

If you’re considering Kyocera as an investment, the focus tends to be on its ability to steadily grow earnings while delivering consistent shareholder returns. The company's recent upward revision of earnings guidance for fiscal 2026 suggests improved operational conditions, particularly on the back of a weaker yen and softer-than-expected impact from U.S. tariff policies. This news alleviates some immediate concerns flagged in earlier analysis, like sluggish profit growth and a compressed margin, while the maintained interim dividend signals ongoing stability in payouts. However, it doesn’t erase longer-term issues, such as low return on equity, a high price-to-earnings ratio compared to peers, and activist pressure over capital allocation. In the short term, the raised guidance is a catalyst, but global economic volatility and industry competitiveness remain critical risks to monitor.

Despite improved earnings guidance, persistent concerns about capital allocation may still matter for shareholders. Despite retreating, Kyocera's shares might still be trading 21% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore another fair value estimate on Kyocera - why the stock might be worth as much as 27% more than the current price!

Build Your Own Kyocera Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kyocera research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Kyocera research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kyocera's overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kyocera might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6971

Kyocera

Develops and sells products based on fine ceramic technologies in Japan, China, rest of Asia, Europe, the United States, and internationally.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives