- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6806

Hirose Electric (TSE:6806) Lifts Outlook as Industrial Demand Grows—Is Management’s Optimism Justified?

Reviewed by Sasha Jovanovic

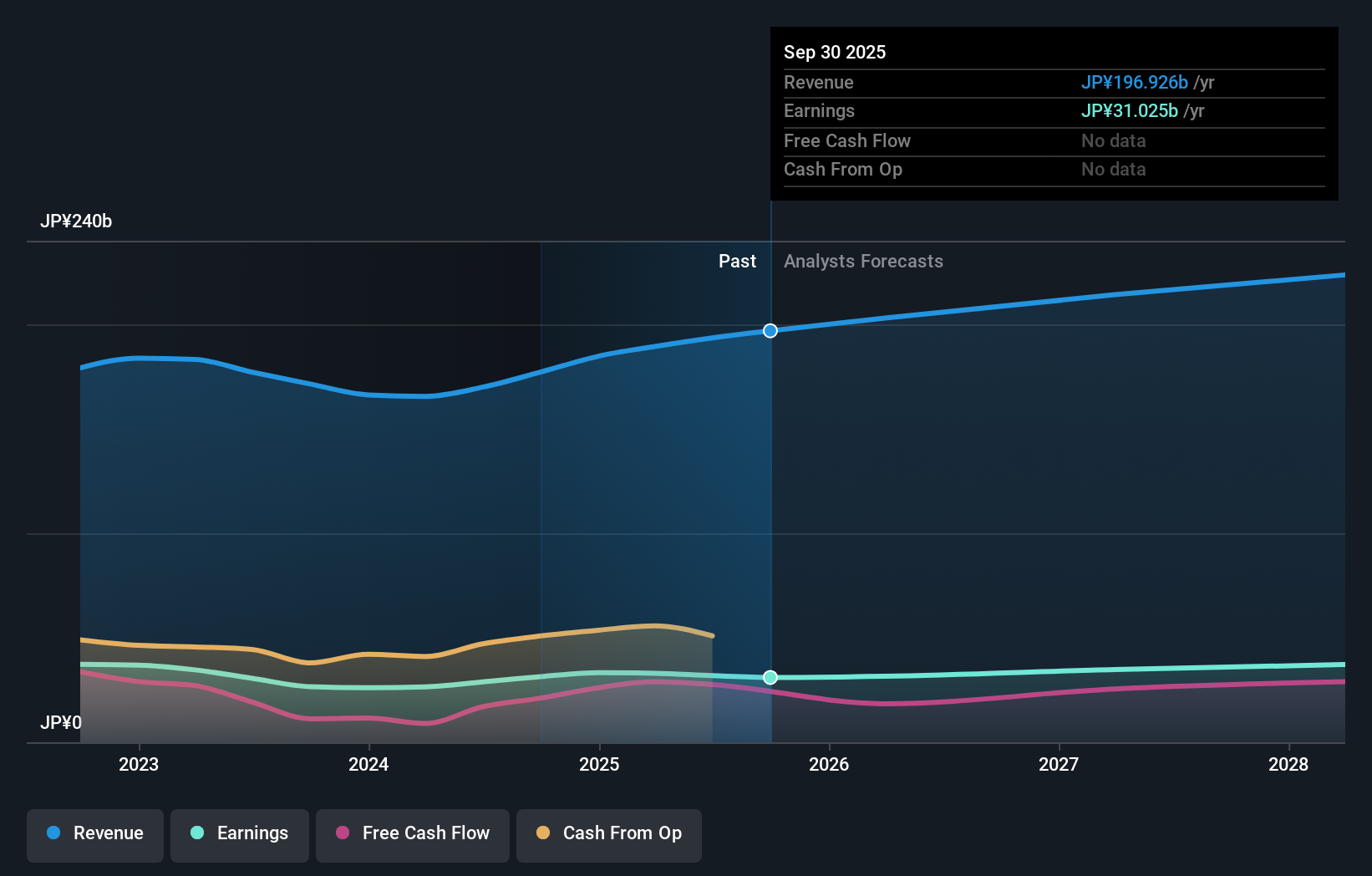

- On November 4, 2025, Hirose Electric Co., Ltd. announced its second quarter dividend of ¥245 per share, unchanged from the previous year, and raised its full-year revenue and profit forecasts for the fiscal year ending March 2026, crediting positive foreign exchange trends and a strong general industries outlook.

- The upward revision to earnings guidance reflects the company's expectation that its core industrial business will outperform earlier projections, highlighting management's confidence in demand conditions.

- We'll explore how Hirose Electric's enhanced revenue expectations influence its investment narrative, especially given the improved outlook for industrial businesses.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Hirose ElectricLtd's Investment Narrative?

To believe in Hirose Electric today, an investor needs to have faith in the company’s ability to turn operational momentum and improved earnings guidance into longer-term value, despite recent share price pressure and a track record of volatile returns. The raised revenue forecast, supported by currency tailwinds and stronger industrial demand, is a genuine near-term catalyst that adds substance to management’s confidence. This, coupled with ongoing buybacks, potentially supports shareholder returns in the coming quarters. However, risks haven’t vanished: board turnover remains high, profit margins have trended lower, and recent stock declines could signal skepticism about the sustainability of these improvements. If the updated outlook translates into better-than-expected earnings growth and margin stabilization, it could alter market sentiment meaningfully. But uncertainties around governance and return on equity still hang over the story.

On the flip side, recent governance changes could weigh heavily, investors should keep an eye on that.

Exploring Other Perspectives

Explore another fair value estimate on Hirose ElectricLtd - why the stock might be worth just ¥17620!

Build Your Own Hirose ElectricLtd Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hirose ElectricLtd research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Hirose ElectricLtd research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hirose ElectricLtd's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hirose ElectricLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6806

Hirose ElectricLtd

Manufactures and sells connectors and other electronic components in Japan, China, South Korea, and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives