- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6770

Alps Alpine (TSE:6770): One-Off Gain Clouds Earnings Quality, Challenges Profit Narrative

Reviewed by Simply Wall St

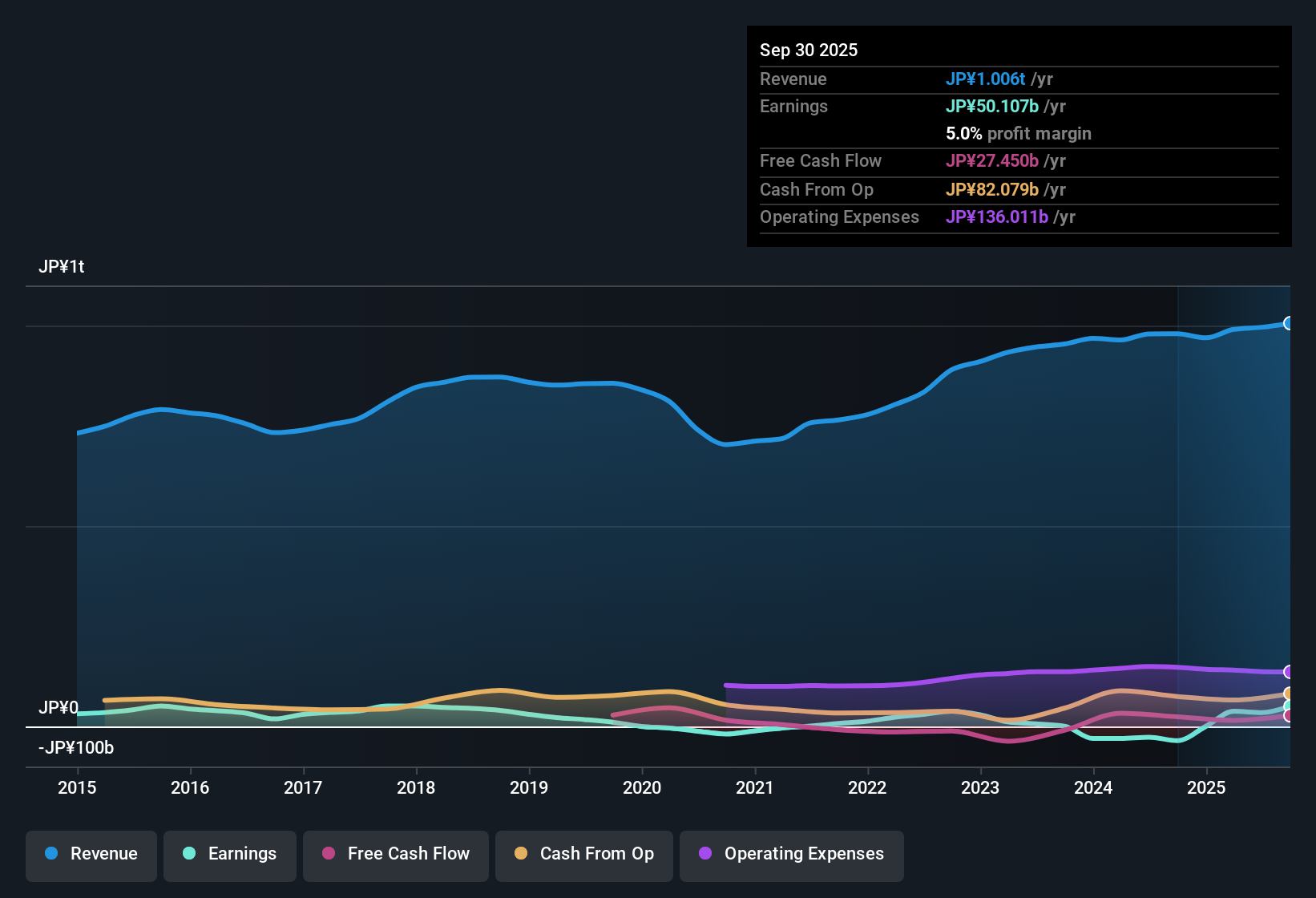

Alps Alpine (TSE:6770) became profitable over the past year, with a 12.1% annual earnings growth rate over the last five years. However, its latest net profit margin was significantly boosted by a ¥27.9 billion non-recurring income classified as a one-off gain. This makes it harder to gauge the quality of underlying earnings. Looking forward, both revenue and earnings are forecast to decline annually by 0.3% and 28.9% respectively over the next three years, putting near-term pressure on financial performance.

See our full analysis for Alps Alpine.Now, let’s see how these headline numbers line up with the most widely watched narratives around the stock. Where do they align, and where might they surprise?

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margin Gets a One-off Boost

- Alps Alpine’s latest net profit margin was significantly lifted by a ¥27.9 billion non-recurring gain, which is categorized as a one-off item. This complicates the picture for recurring profitability.

- Highlighting the prevailing market view, the quality of earnings remains under scrutiny when a large one-time gain is involved, since:

- This makes it harder for investors to judge how sustainable the current profit margin really is if such exceptional items do not recur.

- Risks flagged in the filings specifically mention ongoing concerns about earnings quality, emphasizing the need for caution in relying on the headline margin as a sign of core performance strength.

Low Price/Earnings Multiple vs Peers

- The stock is currently trading at a Price-To-Earnings ratio of 7.8x, well below both the peer average of 24.5x and the Japanese electronic industry average of 15.6x. This flags Alps Alpine as notably discounted on this key metric.

- The prevailing market analysis suggests peer-relative value remains a reward for investors, especially as:

- This low earnings multiple stands out even as the company’s share price of 1,946.00 is above the analyst price target of 1,693.57, which may limit sentiment for a re-rating higher.

- Despite the attractive P/E, caution is warranted, since future earnings growth is under pressure according to both the latest company outlook and the identified risks around dividend sustainability.

Negative Outlook for Earnings and Revenue

- Forward guidance from the company points to an expected annual decline of 28.9% in earnings and 0.3% in revenue over the next three years, signaling a period of contraction rather than expansion.

- According to the prevailing market view, this trend prompts significant skepticism about near-term upside for holders:

- Even though Alps Alpine has a strong multi-year track record of earnings growth (12.1% annualized over 5 years), this reversal suggests market focus will be on whether management can stabilize financial performance as tailwinds from non-recurring gains fade.

- The filings reinforce concerns about future dividend sustainability and underlying growth, highlighting how declining earnings are perceived as a material risk for the stock’s investment case.

With headline profit boosted by a one-off and tough forward guidance in place, market watchers remain focused on how these risks, discounts, and sector pressures shape the next chapter.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Alps Alpine's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Alps Alpine faces a challenging outlook, with declining earnings, weaker forward growth, and doubts over the sustainability of both profits and dividends.

If you’re looking for reliable income instead, check out these 2000 dividend stocks with yields > 3% to discover companies with a track record of delivering stronger and more dependable dividend yields.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6770

Alps Alpine

Manufactures and sells electronic components in Japan, China, the United States, South Korea, and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives