- Japan

- /

- Communications

- /

- TSE:6718

Aiphone (TSE:6718) Net Profit Margin Decline Tests Bullish Growth Narrative

Reviewed by Simply Wall St

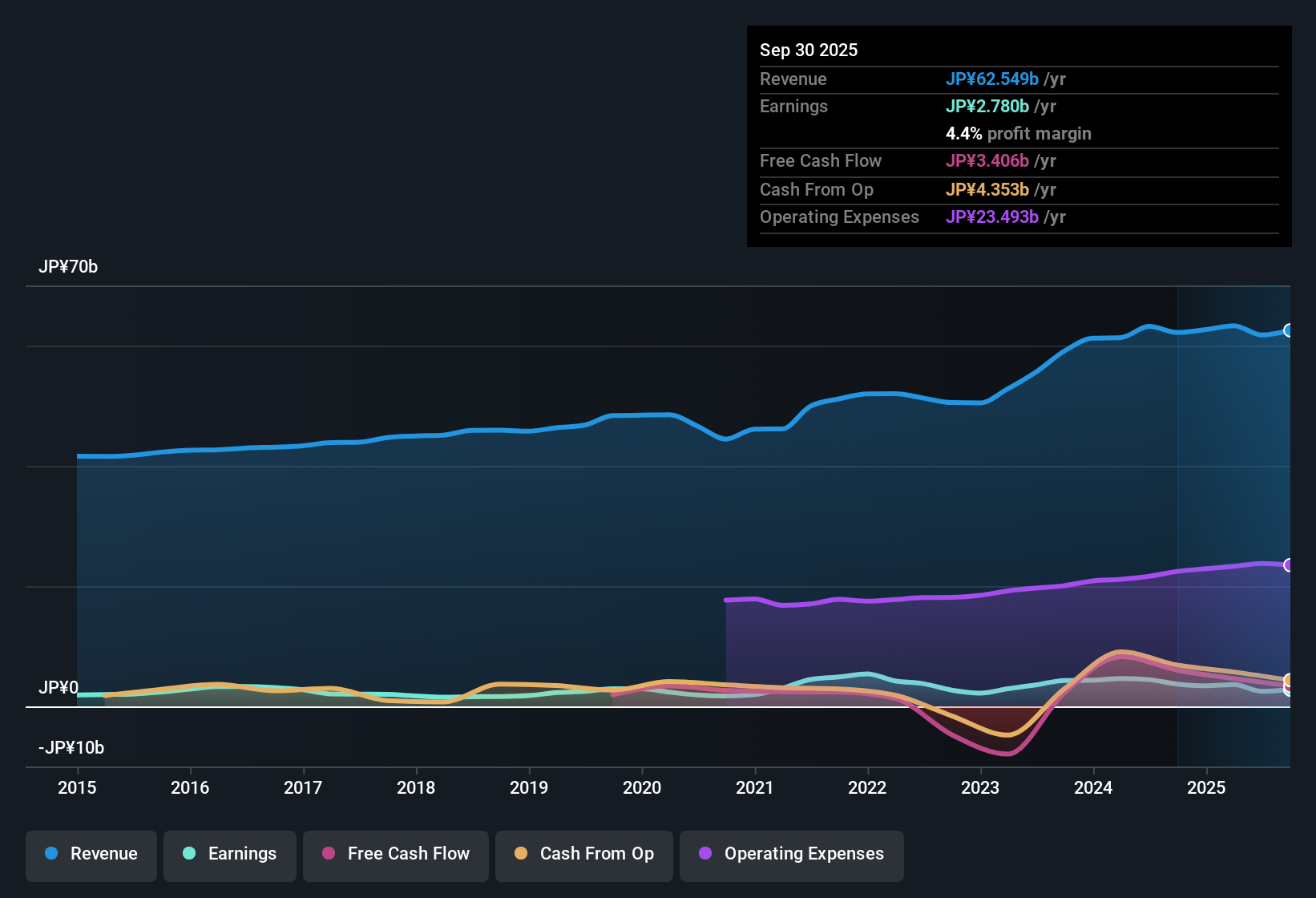

Aiphone Ltd (TSE:6718) reported net profit margins of 4.1%, down from last year’s 7%, with earnings growing at an average annual rate of 2.9% over the past five years. Looking ahead, analysts expect the company’s earnings to climb 12.2% each year, outpacing the broader Japanese market’s 7.8% growth forecast. Projected revenue growth of 4.2% trails just behind market expectations. While recent margin compression will be closely watched, investors are eyeing the company’s robust profit growth prospects and steady income potential as key drivers moving forward.

See our full analysis for AiphoneLtd.Next, we’ll see how these numbers hold up when set against the most widely followed narratives. Some expectations could get confirmed, while others may be put to the test.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Slide as Net Profits Compress

- Net profit margins dropped to 4.1% from 7% in the latest year, even as five-year average annual earnings growth held at 2.9%. This highlights that cost pressure is eroding profitability more than any pickup in steady growth can offset.

- This development prompts investors to weigh whether the attractive growth profile is overshadowed by shrinking margins. The prevailing market view notes that while Aiphone Ltd’s reputation for quality remains, the company must show earnings leverage from its revenue pipeline to regain market conviction.

- With forecasted earnings growth of 12.2% per year outpacing the Japanese market’s 7.8% forecast, some may argue that current margin weakness is a temporary trade-off for future scale, but others will want to see clear stabilization soon.

- Investors are watching for the next results to signal whether recent operating stress is a blip or the start of a new margin norm.

Premium Valuation Compared to Peers

- Aiphone Ltd trades at a P/E ratio of 18.3x, noticeably above the peer average of 14.2x, and well over an internally estimated DCF fair value of 724.80. However, this ratio is low relative to the Asian communications industry P/E of 35.5x.

- The prevailing market view acknowledges that investors are paying up for anticipated profit growth and reliable income, but this premium price tag puts pressure on the company to deliver ahead of market expectations.

- With shares trading at 2,813.00, well above modeled fair value, value-focused investors may hesitate until upside is clearer or the market reprices.

- Some highlight the track record of high-quality earnings and forecasted growth as justification, yet others can point to the downward margin trend as a key headwind for justifying the higher multiple.

Dividend and Growth Outlook Cushion the Risks

- The company continues to offer an attractive dividend alongside its 4.2% annual revenue growth forecast, only slightly under the Japanese market’s 4.5%, but pairing steady income with upside potential.

- Looking at the prevailing market view, investors are balancing income reliability with the uncertainty created by margin declines, watching for signals that profit growth can stay strong enough to protect the payout and support a premium valuation.

- Recent margin pressure raises some risk to future payouts if not addressed, but a stable payout track record could help support sentiment through near-term volatility.

- Conservative investors may prefer to see proven margin stabilization before banking on both income and growth continuing hand in hand.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on AiphoneLtd's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite forecasted earnings growth, Aiphone Ltd’s declining profit margins and a rich valuation raise concerns about its ability to sustain premium pricing.

If these margin challenges and valuation pressures are red flags, use these 840 undervalued stocks based on cash flows to find companies with stronger upside and more compelling value today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6718

AiphoneLtd

Manufactures and sells telecommunications equipment for facilities, offices, and public facilities under the AIPHONE brand name in Japan and internationally.

Flawless balance sheet 6 star dividend payer.

Similar Companies

Market Insights

Community Narratives