High Growth Tech Stocks in Japan to Watch This September 2024

Reviewed by Simply Wall St

Japan’s stock markets have shown mixed performance recently, with the Nikkei 225 Index gaining 0.5% while the broader TOPIX Index fell by 1.0%, amid a backdrop of economic adjustments and currency fluctuations. As we navigate these dynamic market conditions, identifying high-growth tech stocks can be crucial for investors looking to capitalize on innovation and technological advancements in Japan's evolving economy.

Top 10 High Growth Tech Companies In Japan

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Hottolink | 50.99% | 61.55% | ★★★★★★ |

| Cyber Security Cloud | 20.71% | 25.73% | ★★★★★☆ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Material Group | 17.82% | 28.74% | ★★★★★☆ |

| f-code | 22.70% | 22.62% | ★★★★★☆ |

| Kanamic NetworkLTD | 20.75% | 28.25% | ★★★★★★ |

| Bengo4.comInc | 20.76% | 46.76% | ★★★★★★ |

| ExaWizards | 21.96% | 75.16% | ★★★★★★ |

| Money Forward | 20.68% | 68.12% | ★★★★★★ |

Here's a peek at a few of the choices from the screener.

OMRON (TSE:6645)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: OMRON Corporation operates globally in industrial automation, device and module solutions, social systems, and healthcare sectors with a market cap of ¥1.18 trillion.

Operations: OMRON Corporation generates revenue primarily from its Industrial Automation Business (¥373.70 billion), Social Systems, Solutions and Service Business (¥156.85 billion), Healthcare Business (¥150.40 billion), and Devices & Module Solutions Business (¥143.69 billion). The company's diverse operations span across multiple sectors, contributing significantly to its overall financial performance.

OMRON's strategic partnership with Digimarc is set to revolutionize industrial automation by integrating digital watermarks with machine vision technology. This innovation enhances product identification, quality checks, and traceability, crucial for manufacturers adapting to stringent market conditions. OMRON's R&D expenses have been significant; in 2023 alone, they allocated ¥45 billion ($0.31B), reflecting a commitment to innovation. With revenue growth forecasted at 5.6% annually and earnings expected to surge by 46.22% per year, the company is poised for substantial advancement in industrial automation solutions.

- Click to explore a detailed breakdown of our findings in OMRON's health report.

Review our historical performance report to gain insights into OMRON's's past performance.

Taiyo Yuden (TSE:6976)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Taiyo Yuden Co., Ltd. develops, manufactures, and sells electronic components in Japan, China, Hong Kong, and internationally with a market cap of ¥347.65 billion.

Operations: The company generates revenue primarily from its Electronic Components Business, which reported ¥331.17 billion. The gross profit margin is a notable metric to consider when evaluating financial performance.

Taiyo Yuden's recent board decision to dispose of treasury stock as restricted stock remuneration reflects a strategic move to align management incentives with shareholder interests. The company's earnings growth of 15.5% over the past year significantly outpaced the electronic industry's 8.3%, while its revenue is forecasted to grow at 7% annually, surpassing Japan's market average of 4.3%. With an impressive annual profit growth forecast of 26.4%, Taiyo Yuden demonstrates robust potential in high-growth tech sectors, driven by substantial R&D investments and innovative product development strategies.

- Click here and access our complete health analysis report to understand the dynamics of Taiyo Yuden.

Assess Taiyo Yuden's past performance with our detailed historical performance reports.

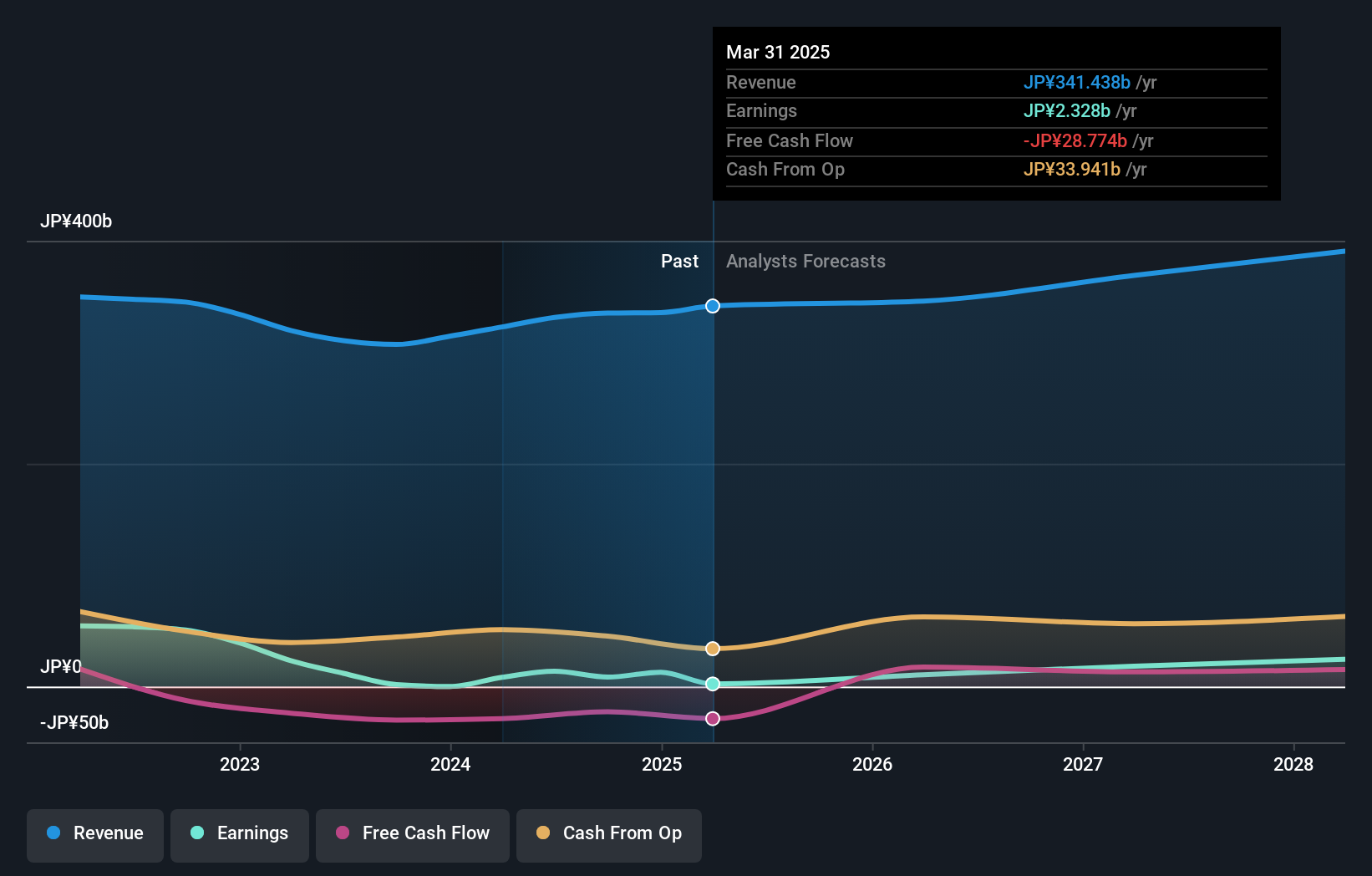

GMO internet group (TSE:9449)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: GMO Internet Group, Inc. offers a wide range of Internet services globally and has a market cap of ¥252.92 billion.

Operations: GMO Internet Group, Inc. generates revenue primarily from its Internet Infrastructure, Internet Finance Business, and Internet Advertising and Media Business segments, with the largest contribution coming from the Internet Infrastructure segment at ¥177.49 billion. The Crypto Asset Business also adds notable revenue of ¥6.49 billion.

GMO Internet Group's revenue is projected to grow at 8.2% annually, outpacing the broader Japanese market's 4.3%, with earnings expected to rise by an impressive 15% per year. The company's recent buyback plan increased authorization by 1,800,000 shares for ¥2,590 million, bringing total authorization to 2,900,000 shares worth ¥5 billion. With a robust return on equity forecast of 21.4% in three years and substantial R&D investments driving innovation across its diverse tech segments, GMO demonstrates significant growth potential in Japan's high-growth tech landscape.

- Dive into the specifics of GMO internet group here with our thorough health report.

Examine GMO internet group's past performance report to understand how it has performed in the past.

Where To Now?

- Navigate through the entire inventory of 117 Japanese High Growth Tech and AI Stocks here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9449

Very undervalued with solid track record.