A Look at NSD (TSE:9759) Valuation After New Share Buyback Program Approval

Reviewed by Simply Wall St

NSD (TSE:9759) has just announced that its Board of Directors approved a share repurchase program, targeting up to 650,000 shares, or about 1% of its issued stock, through February 2026. This move highlights NSD’s ongoing focus on shareholder returns.

See our latest analysis for NSD.

NSD’s newly announced buyback plan comes just as its momentum shows signs of steadying. The 1-year total shareholder return is a modest 2%. Investors who have held on through market ups and downs have seen longer-term gains compound impressively, with a 96.7% total shareholder return over five years. With the latest buyback vote, NSD is signaling continued confidence in its value and outlook.

If recent buyback news has you thinking about what else is driving growth, it could be the right time to broaden your search and discover fast growing stocks with high insider ownership

With NSD’s buyback program now in focus, investors may be asking whether the stock is trading below its true value or if the current price already reflects the company’s future growth potential. Is there still a buying opportunity, or is everything priced in?

Price-to-Earnings of 21.4x: Is it justified?

At NSD’s last close of ¥3,426 per share, the stock is trading at a price-to-earnings (P/E) ratio of 21.4x. This ratio puts the company roughly in line with its peer average, but it is more expensive than the broader industry.

The price-to-earnings ratio measures how much investors are willing to pay for each yen of NSD’s earnings. It is particularly important in the software sector, where investor expectations of future growth are often high. NSD’s current multiple suggests the market is willing to pay slightly above average compared to local peers, reflecting perceived stability and outlook.

However, NSD’s P/E of 21.4x appears expensive compared to the Japanese IT industry average of 17.2x. Interestingly, it is still below our estimated fair price-to-earnings ratio of 23.3x, meaning there could still be room for the multiple to rise closer to that fair level if fundamentals remain strong.

Explore the SWS fair ratio for NSD

Result: Price-to-Earnings of 21.4x (ABOUT RIGHT)

However, slower revenue growth or an unexpected dip in net income could challenge NSD’s valuation and investor confidence in the coming quarters.

Find out about the key risks to this NSD narrative.

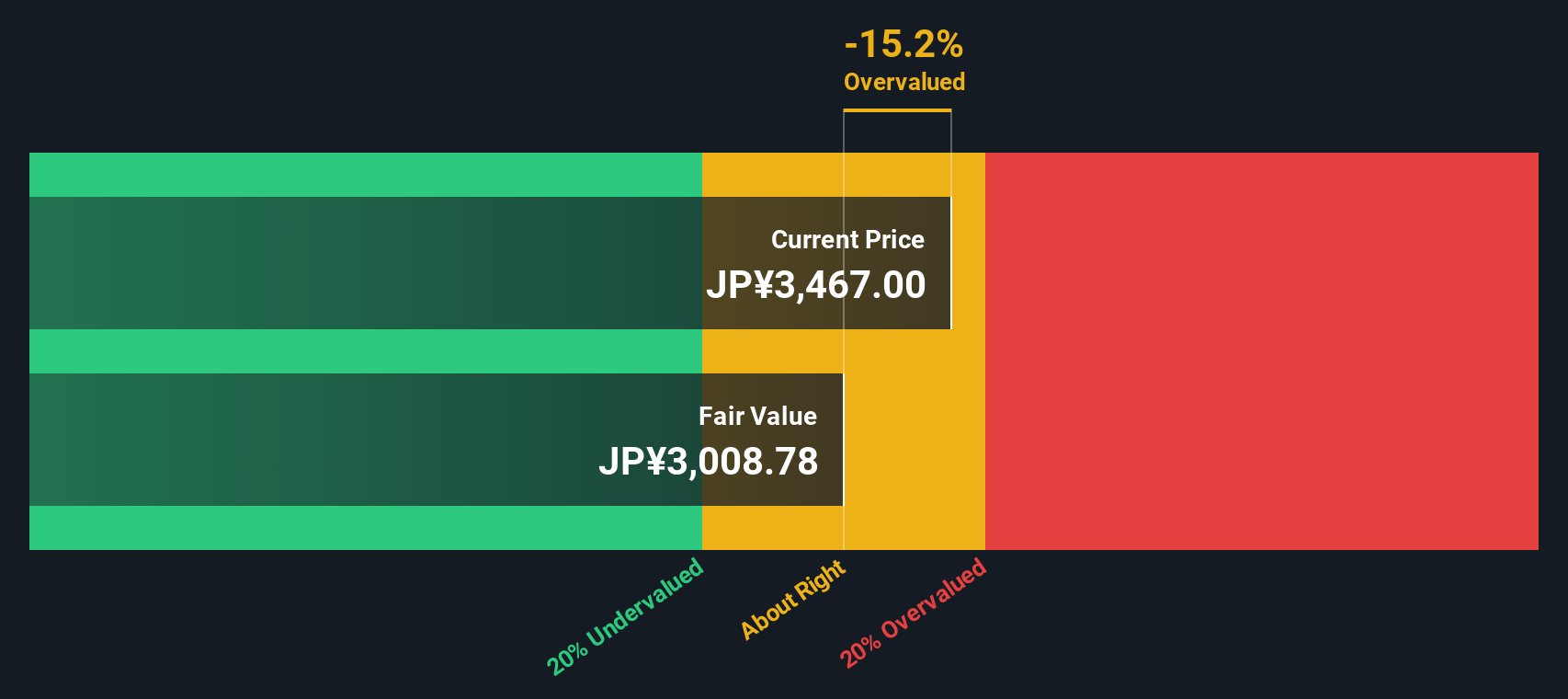

Another View: The SWS DCF Model

Looking at NSD’s valuation from another angle, our DCF model estimates a fair value of ¥3,001.67 per share. This is below the recent market price of ¥3,426, which suggests the shares may be slightly overvalued right now. Could the market be pricing in future growth that the model does not capture?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out NSD for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own NSD Narrative

If you see the story differently or want to dive into the numbers yourself, crafting your own insight only takes a few minutes, so why not Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding NSD.

Looking for More Smart Investment Moves?

Step beyond NSD and unlock new possibilities. The Simply Wall Street Screener puts breakthrough strategies and fresh opportunities right at your fingertips. Miss these, and you could overlook tomorrow’s standouts.

- Gear up for the next digital wave by tracking companies shaking up artificial intelligence, starting with these 24 AI penny stocks that are transforming entire industries.

- Amplify your returns with steady income. Find firms offering robust payouts as you browse these 16 dividend stocks with yields > 3% promising yields above 3%.

- Catch a rising trend in decentralized finance with these 82 cryptocurrency and blockchain stocks powering blockchain innovation and reshaping the financial landscape.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NSD might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9759

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives