- Switzerland

- /

- Transportation

- /

- SWX:JFN

Unveiling Three Undiscovered Gems with Strong Fundamentals

Reviewed by Simply Wall St

In a week marked by cautious Federal Reserve commentary and broad-based declines in U.S. stocks, smaller-cap indexes have notably underperformed, reflecting heightened investor sensitivity to economic indicators and interest rate forecasts. Amidst this backdrop of market volatility and economic uncertainty, identifying stocks with strong fundamentals becomes crucial for investors seeking stability and potential growth opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mendelson Infrastructures & Industries | 32.64% | 6.72% | 15.39% | ★★★★★★ |

| Suez Canal Company for Technology Settling (S.A.E) | NA | 22.31% | 13.60% | ★★★★★★ |

| Payton Industries | NA | 9.27% | 15.41% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Nikko | 33.49% | 5.29% | -7.39% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| Malam - Team | 102.85% | 10.82% | -10.47% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Inversiones Doalca SOCIMI | 16.56% | 6.15% | 10.19% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

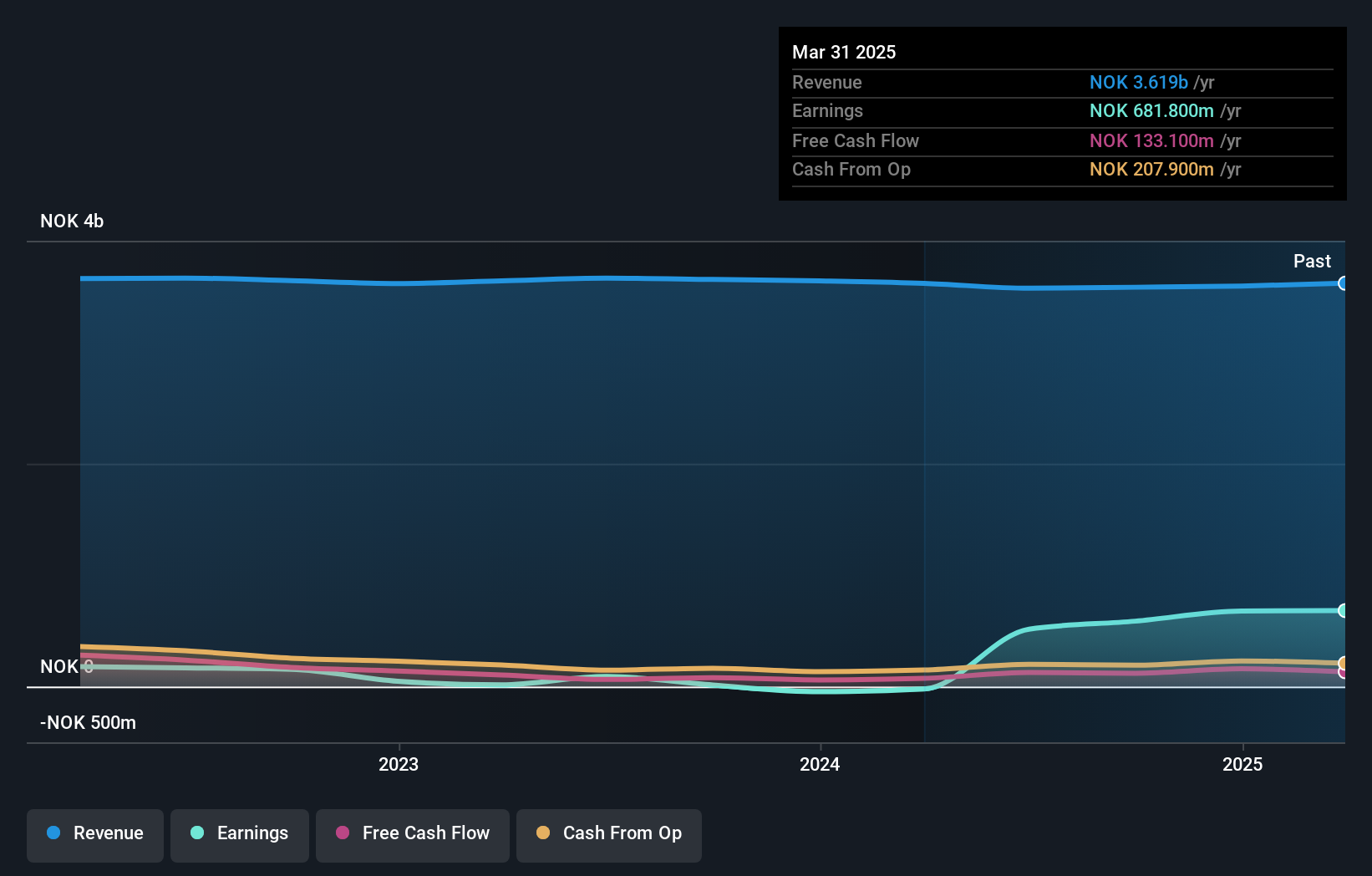

Polaris Media (OB:POL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Polaris Media ASA is a media house and printing company operating in Norway and Sweden, with a market capitalization of NOK 4.16 billion.

Operations: Polaris Media generates revenue primarily from its Media House operations in Norway and Sweden, contributing NOK 1.93 billion and NOK 1.07 billion, respectively. Additional revenue streams include Press and Distribution services in Norway and Sweden, totaling approximately NOK 378 million and NOK 755 million combined.

Polaris Media, a nimble player in the media sector, has shown impressive financial strides. With earnings skyrocketing by 4264.8% over the past year, it outpaced industry growth of 23.1%. The price-to-earnings ratio stands at a favorable 7.5x against the Norwegian market's 11.2x, indicating potential value for investors. The company's debt to equity ratio has improved significantly from 9.1% to just 1.9% over five years, suggesting prudent financial management. Recent results highlight net income rising to NOK 78 million from NOK 7 million year-on-year for Q3 and basic EPS jumping from NOK 0.14 to NOK 1.61.

- Dive into the specifics of Polaris Media here with our thorough health report.

Examine Polaris Media's past performance report to understand how it has performed in the past.

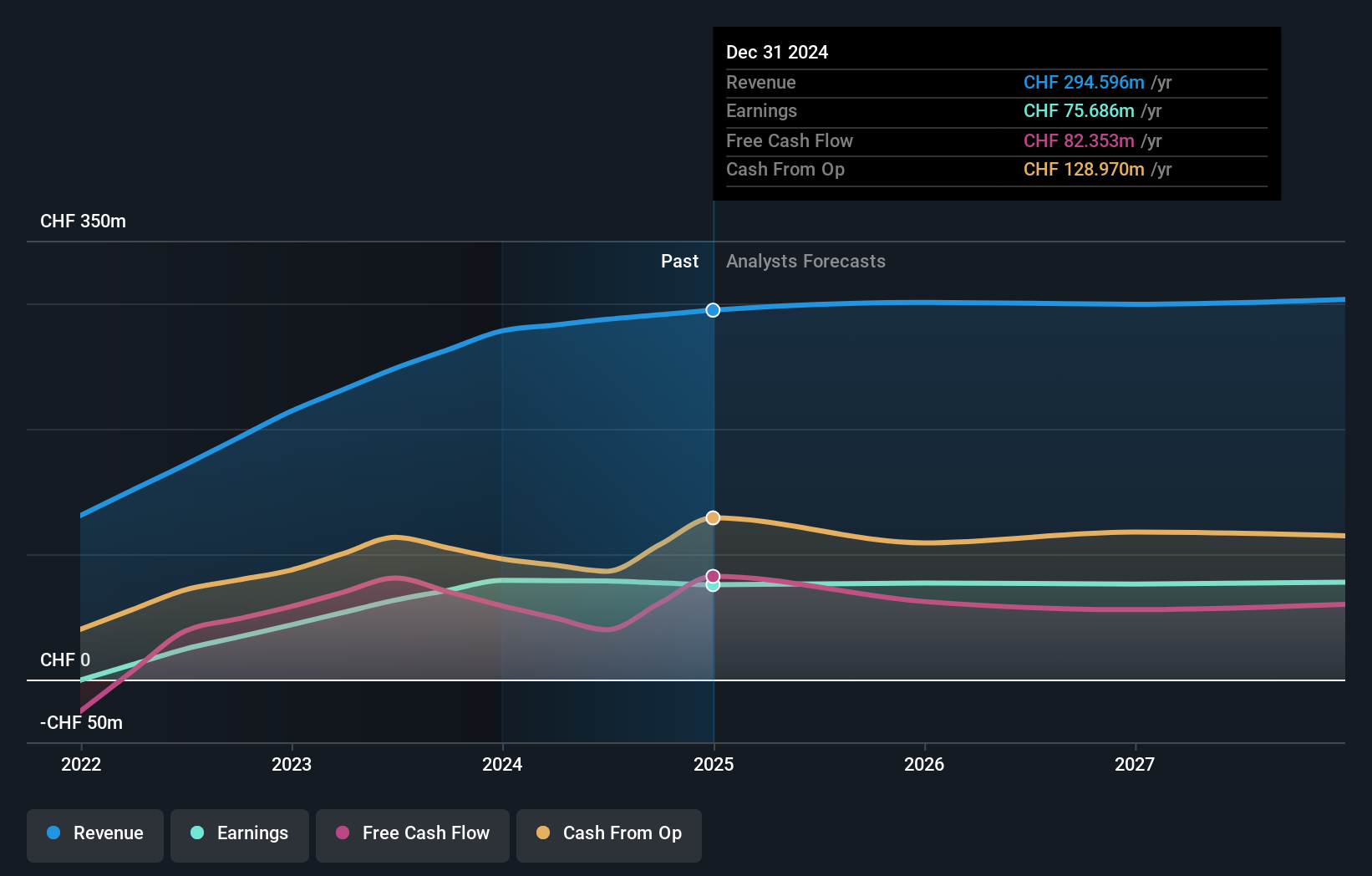

Jungfraubahn Holding (SWX:JFN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Jungfraubahn Holding AG, with a market cap of CHF935.31 million, operates cogwheel railway and winter sports facilities in the Jungfrau region of Switzerland through its subsidiaries.

Operations: Jungfraubahn Holding AG generates revenue primarily from its Jungfraujoch - TOP of Europe segment, which contributes CHF190.99 million, and the Experience Mountains segment, adding CHF51.27 million. The Winter Sports division brings in CHF40.47 million.

Jungfraubahn Holding, a niche player in the transportation sector, has shown impressive earnings growth of 24% over the past year, outpacing the industry's -15.8%. Trading at 46.3% below its estimated fair value suggests potential undervaluation. Despite an increase in its debt to equity ratio from 7.2% to 17.4% over five years, the company maintains a satisfactory net debt to equity ratio of 13.6%, indicating manageable leverage levels. With high-quality earnings and profitable operations, JFN seems well-positioned for continued financial health and stability without immediate cash concerns on its horizon.

- Click here to discover the nuances of Jungfraubahn Holding with our detailed analytical health report.

Understand Jungfraubahn Holding's track record by examining our Past report.

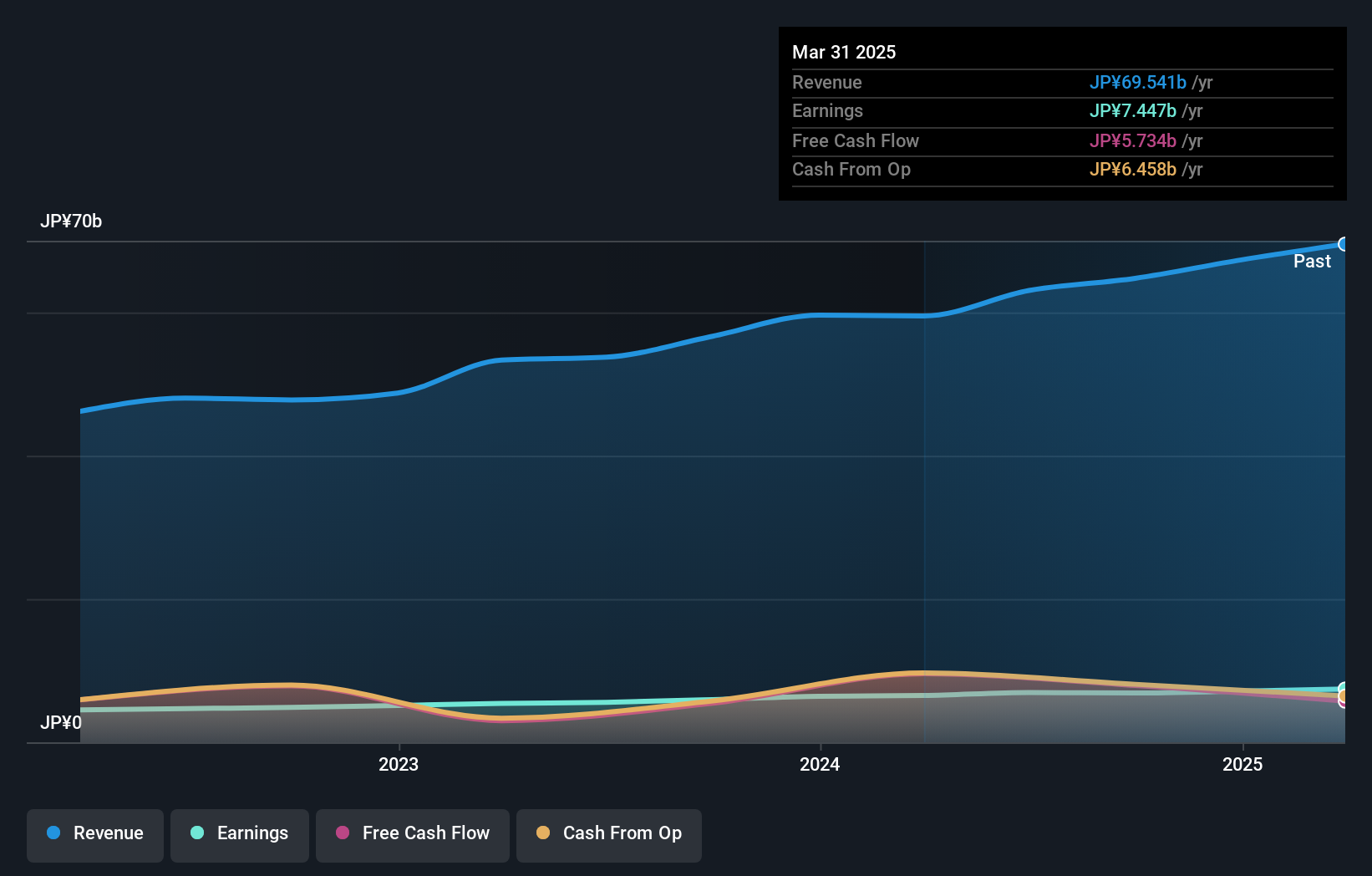

ARGO GRAPHICS (TSE:7595)

Simply Wall St Value Rating: ★★★★★★

Overview: ARGO GRAPHICS Inc. offers technical solutions in Japan with a market capitalization of ¥110.57 billion.

Operations: ARGO GRAPHICS generates revenue primarily from its PLM Business, contributing ¥43.07 billion, and EDA Business with ¥2.13 billion. The company also reports a Segment Adjustment of ¥19.56 billion, reflecting internal financial reconciliations within its operations.

Argo Graphics, a smaller player in the tech sector, is showing promising signs with its earnings growth of 15% over the past year, outpacing the IT industry average of 10%. The company is currently trading at about 20% below its estimated fair value, suggesting potential undervaluation. Notably, Argo has maintained a debt-free status for five years and boasts high-quality earnings. Its free cash flow remains positive at ¥7.93 billion as of September 2024. These factors indicate strong financial health and suggest that Argo could be an intriguing option for investors seeking under-the-radar opportunities in tech.

- Take a closer look at ARGO GRAPHICS' potential here in our health report.

Gain insights into ARGO GRAPHICS' past trends and performance with our Past report.

Key Takeaways

- Investigate our full lineup of 4627 Undiscovered Gems With Strong Fundamentals right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:JFN

Jungfraubahn Holding

Operates cogwheel railway and winter sports related facilities in Jungfrau region, Switzerland.

Excellent balance sheet second-rate dividend payer.

Market Insights

Community Narratives