Stock Analysis

Exploring PLAIDInc And Two Other High Growth Tech Stocks In Japan

Reviewed by Simply Wall St

Japan’s stock markets have shown modest gains recently, with the Nikkei 225 Index rising by 0.8% and the broader TOPIX Index up by 0.2%, amid speculation about the Bank of Japan's future monetary policy moves and a stable inflation outlook. In this environment, identifying high-growth tech stocks like PLAID Inc., which can leverage favorable economic conditions and market sentiment, becomes crucial for investors looking to capitalize on emerging opportunities in Japan's tech sector.

Top 10 High Growth Tech Companies In Japan

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Hottolink | 51.80% | 61.94% | ★★★★★★ |

| Cyber Security Cloud | 20.71% | 25.73% | ★★★★★☆ |

| f-code | 22.70% | 22.62% | ★★★★★☆ |

| Medley | 24.97% | 30.50% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Material Group | 17.82% | 28.74% | ★★★★★☆ |

| SHIFT | 21.58% | 32.81% | ★★★★★★ |

| Bengo4.comInc | 20.76% | 46.76% | ★★★★★★ |

| ExaWizards | 22.69% | 62.99% | ★★★★★★ |

| Money Forward | 20.51% | 66.90% | ★★★★★★ |

Let's dive into some prime choices out of from the screener.

PLAIDInc (TSE:4165)

Simply Wall St Growth Rating: ★★★★★☆

Overview: PLAID, Inc. develops and operates KARTE, a customer experience SaaS platform in Japan, with a market cap of ¥40.86 billion.

Operations: KARTE, the customer experience SaaS platform developed by PLAID, Inc., generates revenue primarily from its SaaS business and advertising business, totaling ¥10.39 billion.

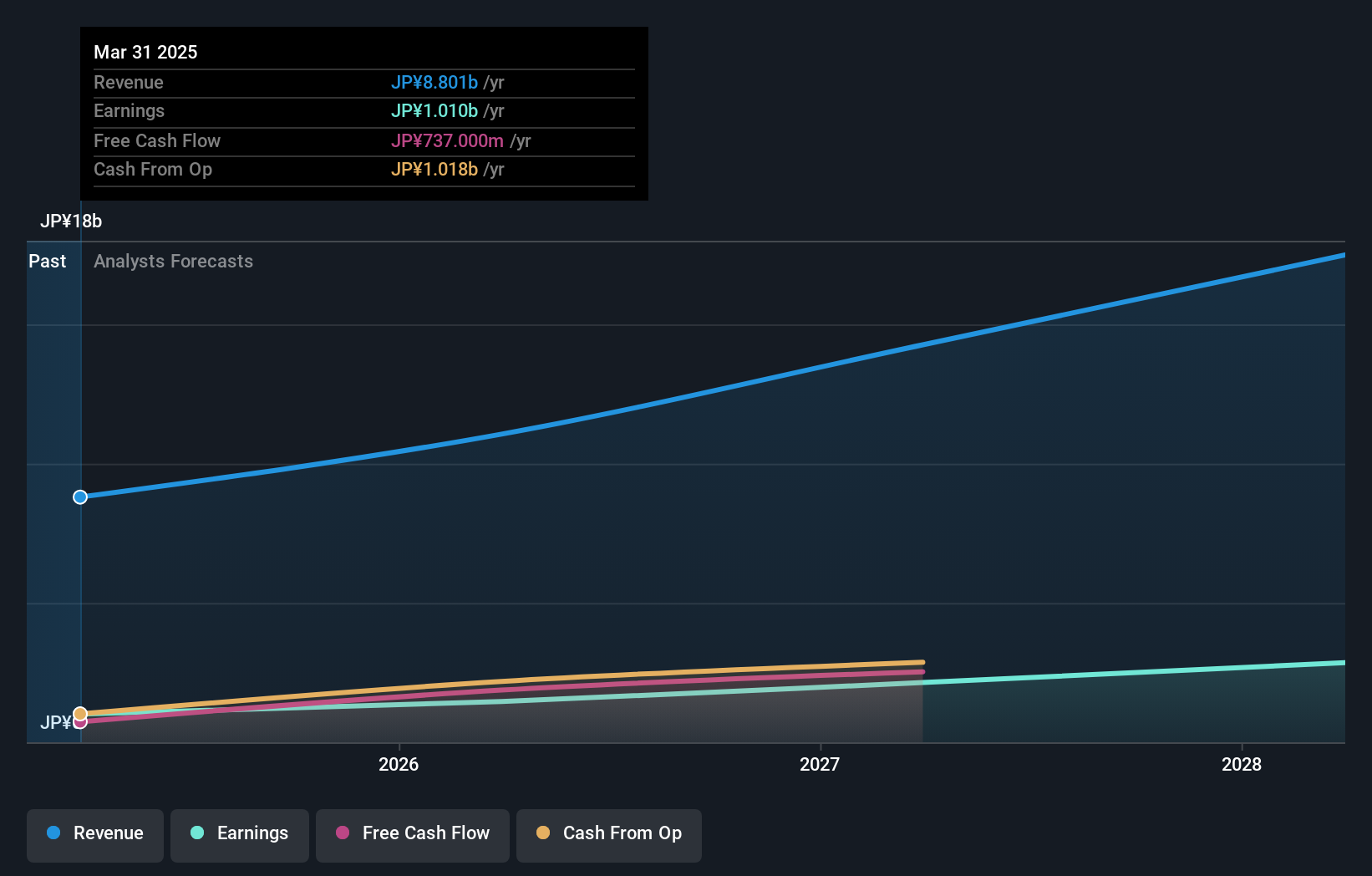

Software firms are increasingly moving to SaaS models, ensuring recurring revenue from subscriptions. PLAID Inc.'s R&D expenses have surged by 16.8%, reflecting its commitment to innovation and staying competitive in the tech landscape. Despite a highly volatile share price over the past three months, earnings are forecast to grow 113.53% per year, indicating strong future potential. The company's revenue is expected to grow at 16.8% per year, outpacing the broader JP market's forecast of 4.3%.

- Get an in-depth perspective on PLAIDInc's performance by reading our health report here.

Assess PLAIDInc's past performance with our detailed historical performance reports.

Global Security Experts (TSE:4417)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Global Security Experts Inc. is a cybersecurity education company in Japan with a market cap of ¥41.56 billion.

Operations: The company focuses on cybersecurity education in Japan. It generates revenue through various educational services and products related to cybersecurity.

Global Security Experts has demonstrated robust growth, with earnings increasing by 54.4% over the past year, significantly outpacing the IT industry's 10%. The company's R&D expenses have surged by 16.8%, underscoring its commitment to innovation and maintaining a competitive edge in cybersecurity. Revenue is forecast to grow at 16.8% per year, while earnings are expected to rise by an impressive 25.7% annually, highlighting strong future potential despite recent share price volatility. Recent buybacks of ¥281.32 million reflect strategic capital management aimed at enhancing shareholder value amidst changing business conditions.

Japan Business Systems (TSE:5036)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Japan Business Systems, Inc. specializes in cloud integration and related services with a market cap of ¥44.81 billion.

Operations: The company focuses on cloud integration and related services. It generates revenue primarily from these specialized IT solutions, leveraging its expertise in the field to cater to various client needs.

Japan Business Systems (JBS) is poised for notable growth, with earnings projected to surge by 45.8% annually over the next three years, outpacing the broader JP market's 8.5%. Despite a significant one-off loss of ¥1.7B impacting recent financial results, JBS's revenue forecast of 4.7% per year remains higher than the market average of 4.3%. The company's commitment to innovation is evident in its substantial R&D expenditure, which underscores its focus on developing cutting-edge solutions for its clients across various sectors.

Taking Advantage

- Embark on your investment journey to our 128 Japanese High Growth Tech and AI Stocks selection here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4165

PLAIDInc

Develops and operates KARTE, a customer experience SaaS platform in Japan.