Stock Analysis

Exploring High Growth Tech Stocks Including Sword Group

Reviewed by Simply Wall St

In recent weeks, global markets have shown a mixed performance with major U.S. stock indexes like the S&P 500 and Nasdaq Composite reaching record highs, while small-cap stocks as represented by the Russell 2000 have faced declines. Amid this backdrop of diverging market trends and economic indicators such as job growth rebounding in November, investors are keenly watching high-growth tech stocks like Sword Group that may offer potential opportunities for capitalizing on technological advancements and sector-specific momentum.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 27.24% | 28.74% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

Click here to see the full list of 1286 stocks from our High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

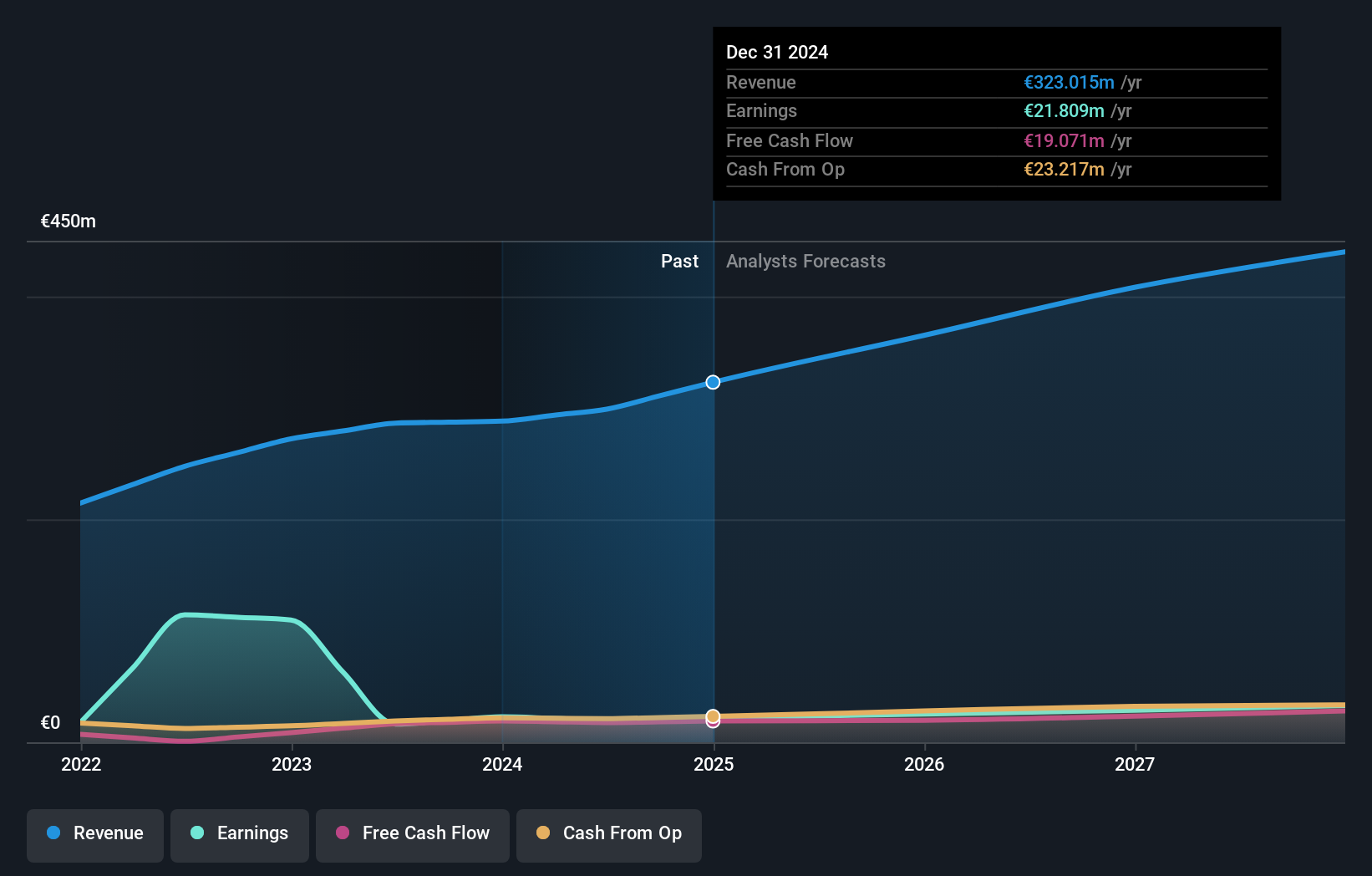

Sword Group (ENXTPA:SWP)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sword Group S.E. is a company that offers IT and software solutions globally, with a market capitalization of €343.20 million.

Operations: Sword Group S.E. generates revenue through its IT and software solutions, with key contributions from its Services segments in Belux (€104.26 million), Switzerland (€105.75 million), and the United Kingdom (€88.88 million).

Sword Group, in the rapidly evolving tech sector, has demonstrated robust financial health with earnings growth of 23.2% over the past year, outpacing the IT industry's -5.6%. With revenues projected to increase by 13.8% annually, surpassing the French market's 5.6%, and earnings expected to rise by 18.8% per year—faster than the market average of 12.5%—the company is on a solid trajectory for sustained growth. This performance is underpinned by significant investments in R&D, crucial for maintaining competitive edge and fostering innovation in a sector driven by technological advancements.

- Navigate through the intricacies of Sword Group with our comprehensive health report here.

Examine Sword Group's past performance report to understand how it has performed in the past.

Digital Garage (TSE:4819)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Digital Garage, Inc. operates as a context company in Japan and internationally with a market cap of ¥174.54 billion.

Operations: Digital Garage generates revenue primarily through its Platform Solutions and Long-Term Incubation segments, with ¥23.29 billion and ¥11.93 billion respectively. The company also engages in Global Investment Incubation, contributing a smaller portion of revenue at ¥72 million.

Digital Garage is navigating a transformative landscape with strategic organizational changes aimed at enhancing its security and technological capabilities, as evidenced by recent executive shifts and departmental enhancements. This pivot underscores its commitment to innovation, especially in the burgeoning field of FinTech. Despite a volatile share price recently, Digital Garage's revenue growth is impressive at 16% annually, outpacing Japan's market average of 4.1%. Moreover, earnings are expected to surge by approximately 80.5% per year as it moves towards profitability within three years. These developments highlight Digital Garage’s proactive approach in adapting to dynamic market demands while investing heavily in future growth through focused R&D initiatives and strategic leadership restructuring.

- Take a closer look at Digital Garage's potential here in our health report.

Understand Digital Garage's track record by examining our Past report.

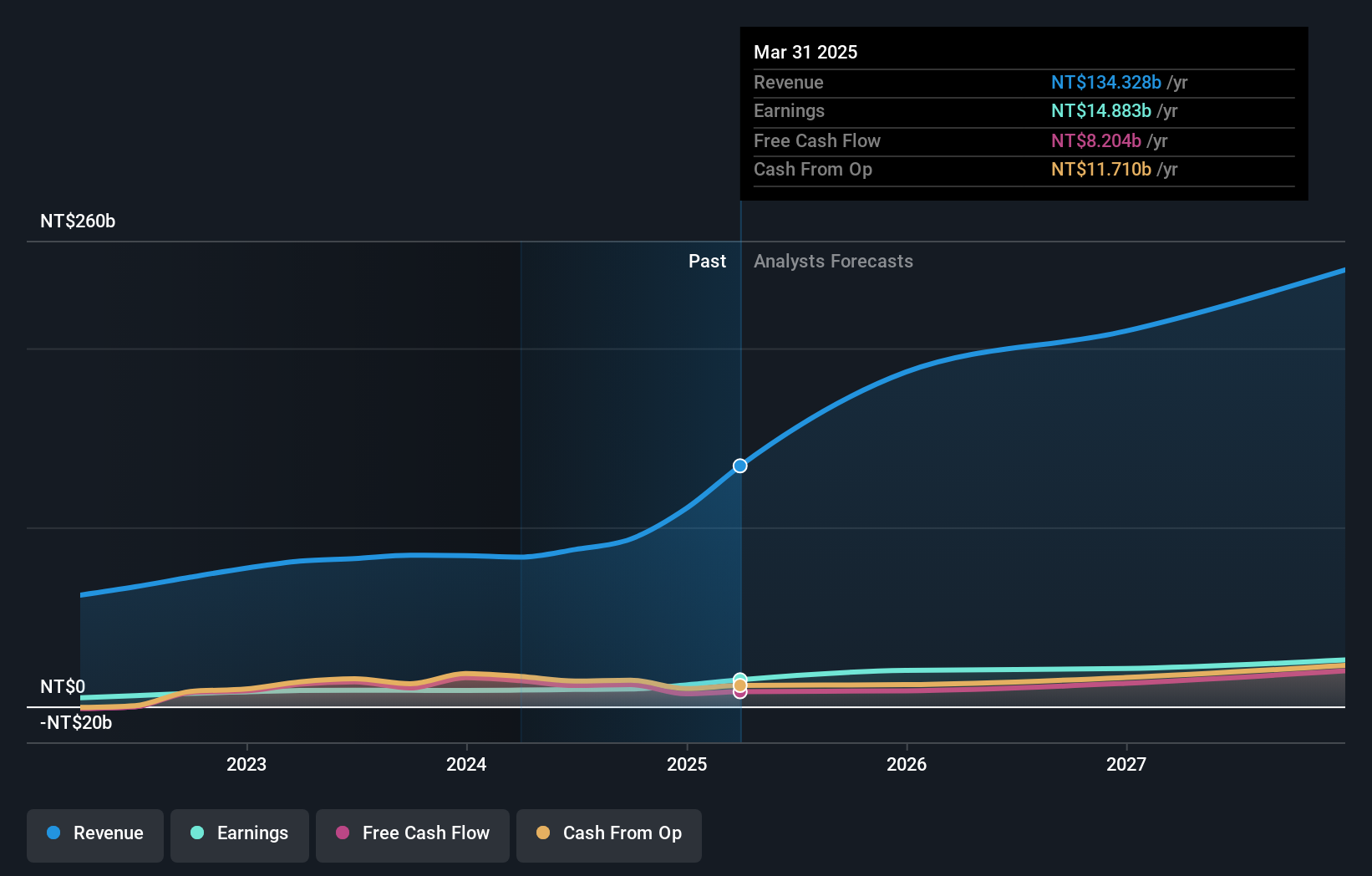

Accton Technology (TWSE:2345)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Accton Technology Corporation is engaged in the research, development, manufacturing, and sales of network communication equipment across Taiwan, America, Asia, Europe, and internationally with a market capitalization of NT$402.41 billion.

Operations: Accton Technology Corporation generates revenue primarily from its computer networks segment, amounting to NT$93.41 billion. The company focuses on the development and sale of network communication equipment across various regions globally.

Accton Technology's strategic focus on hyperscale data center network technologies and AI applications is evident from its recent product launches, including advanced networking solutions for AI and ML workloads. These innovations are critical as the company expands its capabilities in response to growing demands for high-performance computing infrastructure. With a robust R&D commitment, Accton invested TWD 1,280 million in capacity expansion to support these technological advancements. This aligns with their financial performance where revenue surged by 25.9% year-over-year to TWD 28.2 billion in Q3 2024, reflecting a strong market reception to their enhanced product offerings and strategic expansions like the Vietnam factory which entails a total investment of USD 51.5 million aimed at boosting production capacities. Moreover, Accton's dedication to R&D is highlighted by their significant expenditure growth, ensuring they remain at the forefront of technology trends that shape hyperscale data centers globally. The establishment of an ESG committee further underscores their commitment to sustainable operations amidst these expansions. Their earnings have also shown promising growth with a notable increase of 7.9% over the past year, outpacing industry averages significantly and positioning them well for future technological pivots in an increasingly digital landscape.

Where To Now?

- Dive into all 1286 of the High Growth Tech and AI Stocks we have identified here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:SWP

Sword Group

Provides IT and software solutions worldwide.