Exploring Co-Tech Development And 2 Emerging Small Caps With Strong Potential

Reviewed by Simply Wall St

As global markets navigate the complexities of U.S.-China trade relations and fluctuating oil prices, small-cap indices like the Russell 2000 have shown resilience, outperforming their large-cap counterparts. In this dynamic environment, identifying promising stocks involves looking for companies that demonstrate strong fundamentals and adaptability to evolving economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| TI Cloud | NA | 12.55% | 6.36% | ★★★★★★ |

| Daphne International Holdings | NA | -5.92% | 82.03% | ★★★★★★ |

| Q P Group Holdings | 17.07% | -2.56% | -2.55% | ★★★★★★ |

| MOBI Industry | 18.09% | 6.66% | 22.02% | ★★★★★★ |

| Sure Global Tech | NA | 10.11% | 15.42% | ★★★★★★ |

| Nofoth Food Products | NA | 15.49% | 26.47% | ★★★★★★ |

| Wison Engineering Services | 28.12% | -0.65% | 12.25% | ★★★★★★ |

| Taiyo KagakuLtd | 0.67% | 5.77% | 2.06% | ★★★★★☆ |

| Pizu Group Holdings | 41.45% | -2.37% | -15.01% | ★★★★☆☆ |

| TSTE | 38.15% | 4.63% | -6.91% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Co-Tech Development (TPEX:8358)

Simply Wall St Value Rating: ★★★★★★

Overview: Co-Tech Development Corporation, along with its subsidiaries, specializes in producing and selling copper foil for the printed circuit board industry in Taiwan and China, with a market cap of NT$56.29 billion.

Operations: Co-Tech generates revenue primarily from the sale of copper foil, amounting to NT$7.23 billion. The company's financials reveal a focus on this single revenue stream within the printed circuit board industry in Taiwan and China.

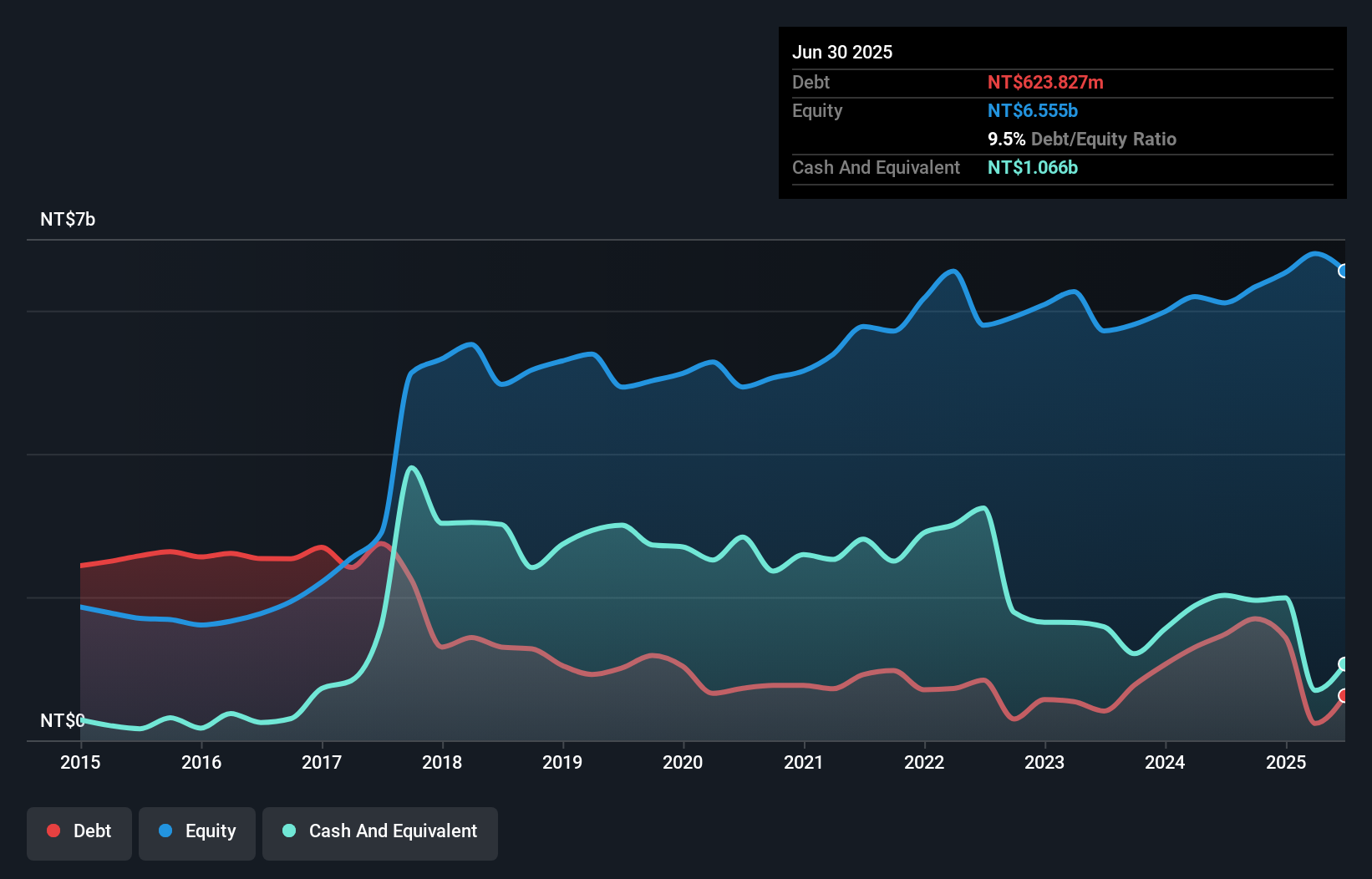

Co-Tech Development, a smaller player in the electronics sector, is making waves with its promising financial metrics. The company's earnings grew 9.8% last year, outpacing the industry's -1.2%. Despite a volatile share price recently, Co-Tech's debt-to-equity ratio improved from 14.7 to 9.5 over five years, indicating better financial health. Its interest payments are comfortably covered by EBIT at an impressive 283 times coverage, showcasing robust fiscal management. Although net income for Q2 dipped to TWD 167 million from TWD 291 million last year, sales increased to TWD 2 billion from TWD 1.82 billion in the same period.

- Get an in-depth perspective on Co-Tech Development's performance by reading our health report here.

Explore historical data to track Co-Tech Development's performance over time in our Past section.

JustSystems (TSE:4686)

Simply Wall St Value Rating: ★★★★★★

Overview: JustSystems Corporation focuses on the planning, development, and provision of software and related services mainly in Japan, with a market cap of ¥295.43 billion.

Operations: The company generates revenue primarily from its Software Related Business, which amounted to ¥46.56 billion.

JustSystems, a nimble player in the software industry, stands out with its debt-free status and high-quality earnings. Over the past five years, it has achieved an average annual earnings growth of 3.6%, although recent growth at 10% lagged behind the broader software sector's 21.1%. The company enjoys positive free cash flow and does not face concerns over interest payments due to its lack of debt. Despite a volatile share price recently, JustSystems' profitability ensures that cash runway isn't an issue, providing a stable foundation for future operations and potential expansion opportunities within its niche market.

- Click here to discover the nuances of JustSystems with our detailed analytical health report.

Review our historical performance report to gain insights into JustSystems''s past performance.

Topco ScientificLtd (TWSE:5434)

Simply Wall St Value Rating: ★★★★★☆

Overview: Topco Scientific Co., Ltd. is a global provider of precision materials, manufacturing equipment, and components with a market capitalization of NT$61.13 billion.

Operations: Topco Scientific generates revenue primarily from its Semiconductor and Electronic Materials Business Department, which contributed NT$57.20 billion. The Environmental Engineering Division added NT$6.40 billion to the total revenue.

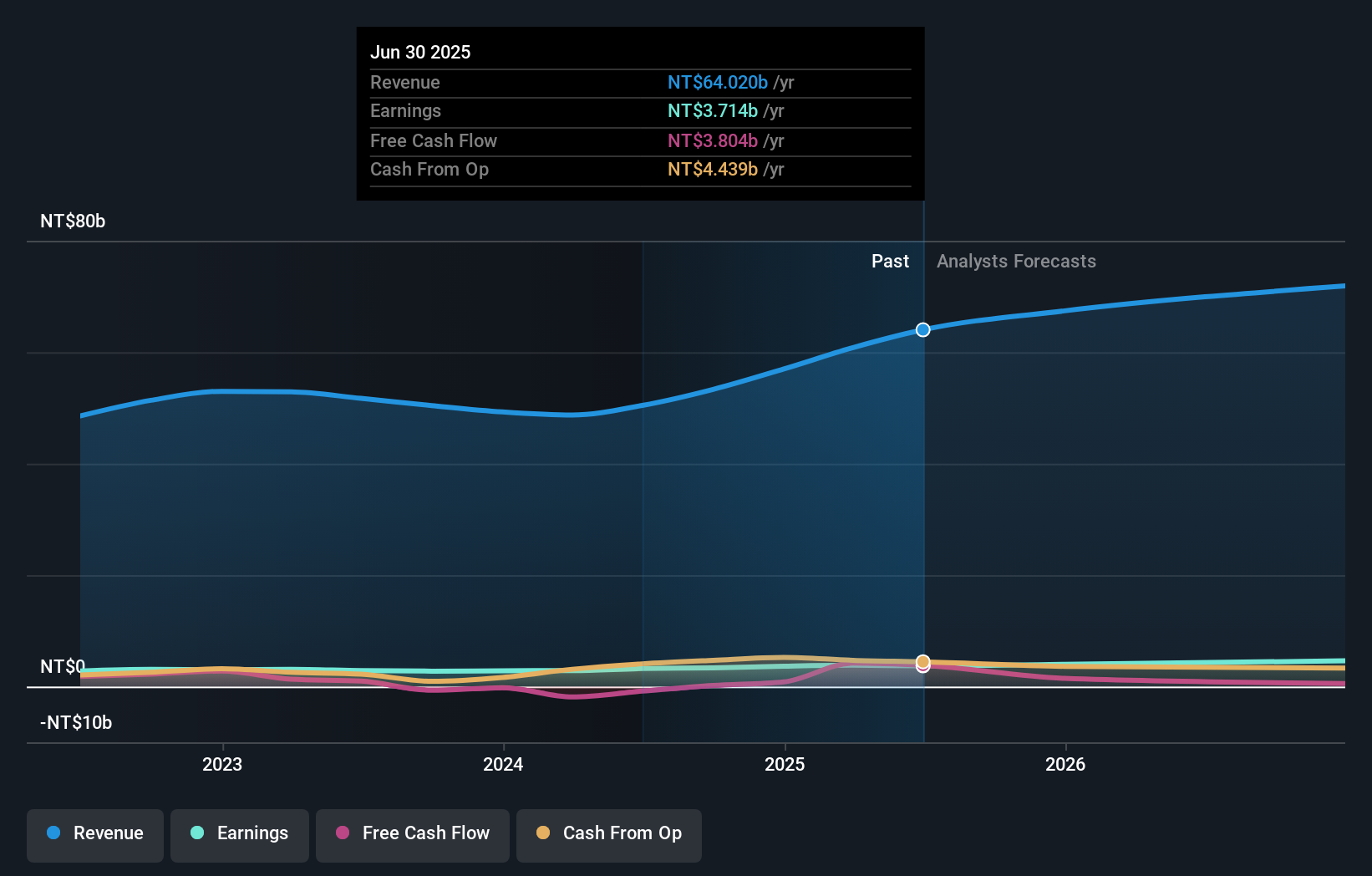

Topco Scientific Ltd, a small cap player in the semiconductor industry, has shown impressive earnings growth of 15.3% over the past year, outpacing the industry's -5.9%. With a price-to-earnings ratio of 17.7x, it trades below the TW market average of 20.9x, suggesting good relative value compared to peers. Despite an increase in its debt to equity ratio from 13.3% to 19.8% over five years, Topco remains financially robust with more cash than total debt and high-quality earnings that cover interest payments comfortably. Earnings are projected to grow at a rate of 12.69% annually, indicating potential for future expansion within its sector.

Taking Advantage

- Access the full spectrum of 2940 Global Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4686

JustSystems

Plans, develops, and provides software and related services primarily in Japan.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives