Stock Analysis

Japan’s stock markets have experienced modest gains recently, with the Nikkei 225 Index rising by 0.8% and the broader TOPIX Index up by 0.2%, amid speculation about the Bank of Japan's monetary policy adjustments. As we look at high-growth tech stocks in Japan for August 2024, it's crucial to consider companies that are well-positioned to benefit from both market stability and advancements in technology sectors.

Top 10 High Growth Tech Companies In Japan

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Hottolink | 51.80% | 61.94% | ★★★★★★ |

| Cyber Security Cloud | 20.71% | 25.73% | ★★★★★☆ |

| f-code | 22.70% | 22.62% | ★★★★★☆ |

| Medley | 24.97% | 30.50% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Material Group | 17.82% | 28.74% | ★★★★★☆ |

| SHIFT | 21.58% | 32.81% | ★★★★★★ |

| Bengo4.comInc | 20.76% | 46.76% | ★★★★★★ |

| ExaWizards | 22.69% | 62.99% | ★★★★★★ |

| Money Forward | 20.51% | 66.90% | ★★★★★★ |

Let's uncover some gems from our specialized screener.

GNI Group (TSE:2160)

Simply Wall St Growth Rating: ★★★★★☆

Overview: GNI Group Ltd. engages in the research, development, manufacture, and sale of pharmaceutical drugs in Japan and internationally, with a market cap of ¥96.26 billion.

Operations: GNI Group Ltd. focuses on the pharmaceutical industry, encompassing research, development, manufacturing, and sales of drugs both domestically and internationally. The company operates with a market cap of ¥96.26 billion and generates revenue through its diverse pharmaceutical product portfolio.

GNI Group's revenue is projected to grow at an impressive 30% annually, outpacing the Japanese market's 4.3%. The company's earnings forecast also shows a robust growth rate of 25.7% per year, significantly higher than the market average of 8.5%. In Q2 2024, they announced approval for Avatrombopag Maleate Tablets in China, adding to their diverse product lineup and strengthening their position in rare disease treatments. Their R&D expenses reflect a strategic focus on innovation and expansion within this niche market.

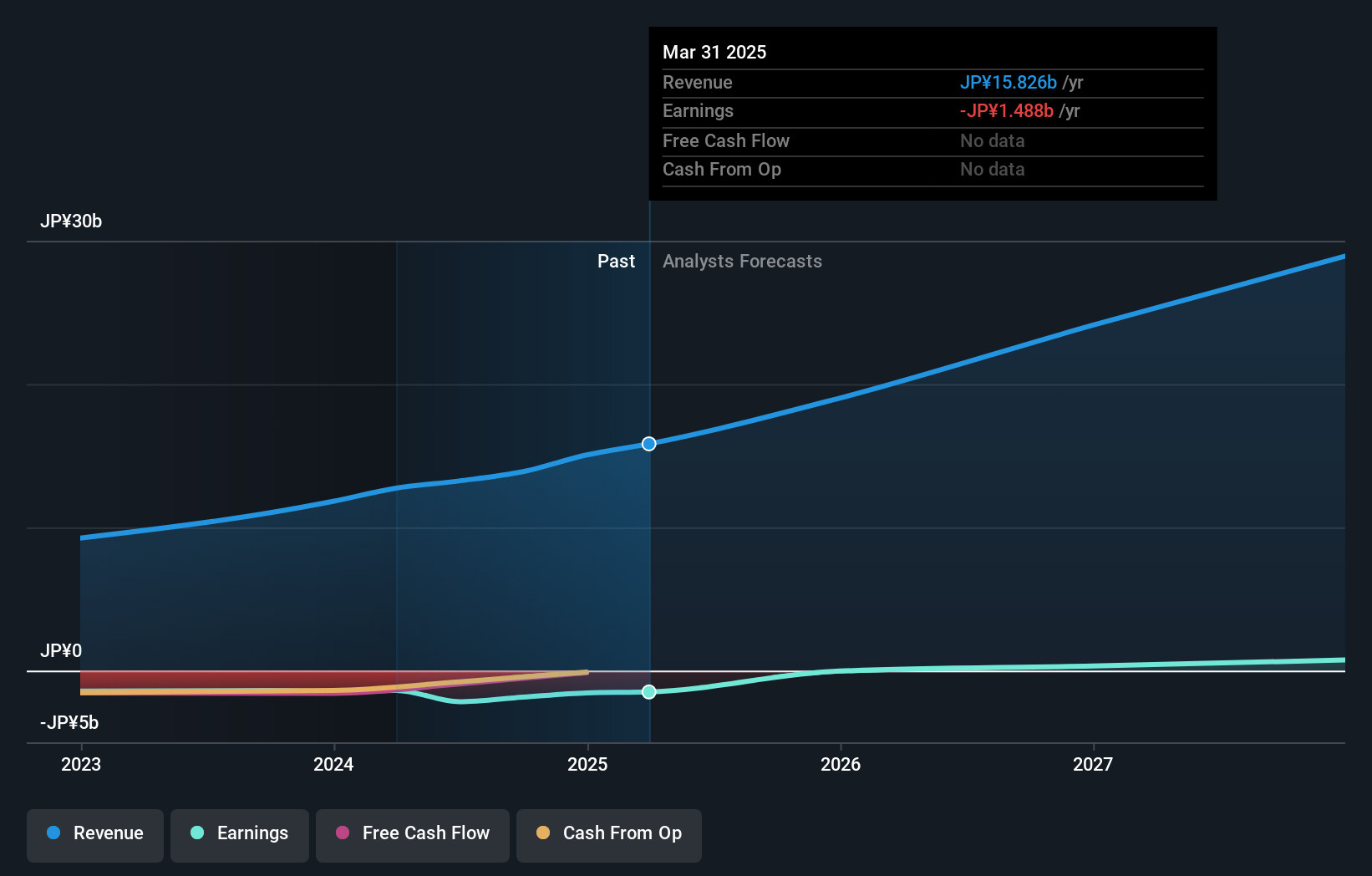

Safie (TSE:4375)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Safie Inc. develops and operates a cloud-based video recording platform under the Safie brand in Japan, with a market cap of ¥41.77 billion.

Operations: Safie Inc. generates revenue primarily through its cloud-based video recording platform, catering to various sectors in Japan. The company's business model focuses on subscription fees for its services, contributing significantly to its income streams.

Safie, a prominent player in Japan's tech landscape, is forecasted to grow its revenue by 17.9% annually, significantly outpacing the broader market's 4.3%. Despite being unprofitable currently, earnings are expected to surge by an impressive 98.5% per year over the next three years. Their R&D expenses underscore a commitment to innovation and growth; last year alone saw ¥1.2 billion invested in developing cutting-edge AI solutions for their cloud-based security systems.

- Dive into the specifics of Safie here with our thorough health report.

Understand Safie's track record by examining our Past report.

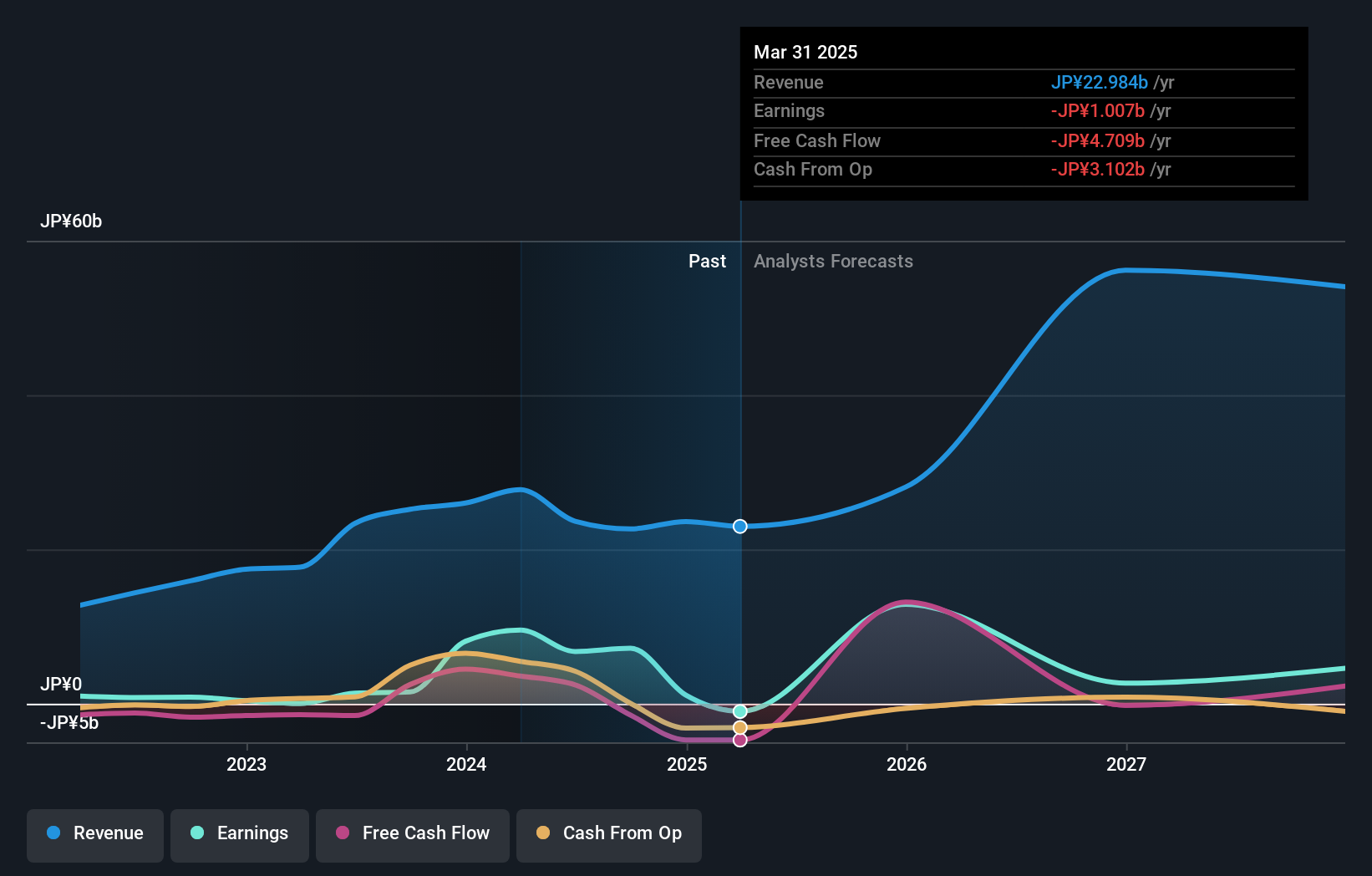

Macbee Planet (TSE:7095)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Macbee Planet, Inc. operates in analytics consulting and marketing technology businesses in Japan with a market cap of ¥44.52 billion.

Operations: The company generates revenue primarily from its LTV Marketing Business, which contributed ¥39.18 billion. The analytics consulting and marketing technology services form the core of its business operations in Japan.

Macbee Planet, a notable entity in Japan's tech sector, showcases robust growth prospects with earnings projected to rise by 19.5% annually and revenue by 16.2% per year, outpacing the broader JP market's 8.5% and 4.3%, respectively. The company’s R&D expenditure reflects its dedication to innovation; last year saw ¥1 billion allocated towards enhancing AI-driven marketing solutions. Despite recent share price volatility, Macbee Planet’s strong earnings growth of 45.6% over the past year underscores its potential in the evolving tech landscape.

- Click here to discover the nuances of Macbee Planet with our detailed analytical health report.

Explore historical data to track Macbee Planet's performance over time in our Past section.

Turning Ideas Into Actions

- Unlock our comprehensive list of 128 Japanese High Growth Tech and AI Stocks by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7095

Macbee Planet

Operates in analytics consulting and marketing technology businesses in Japan.