Japan's stock markets have recently faced downward pressure, with the Nikkei 225 Index and the broader TOPIX Index experiencing declines amid easing domestic inflation and speculation about future Bank of Japan interest rate moves. In this environment, identifying high-growth tech stocks requires a focus on companies that demonstrate strong innovation potential and resilience to market fluctuations, making them noteworthy in the current economic landscape.

Top 10 High Growth Tech Companies In Japan

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Hottolink | 50.99% | 61.55% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| f-code | 22.70% | 22.62% | ★★★★★☆ |

| Bengo4.comInc | 20.76% | 46.76% | ★★★★★★ |

| Kanamic NetworkLTD | 20.75% | 28.25% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| ExaWizards | 21.96% | 75.16% | ★★★★★★ |

| Money Forward | 21.22% | 71.29% | ★★★★★★ |

Here we highlight a subset of our preferred stocks from the screener.

SAKURA Internet (TSE:3778)

Simply Wall St Growth Rating: ★★★★★☆

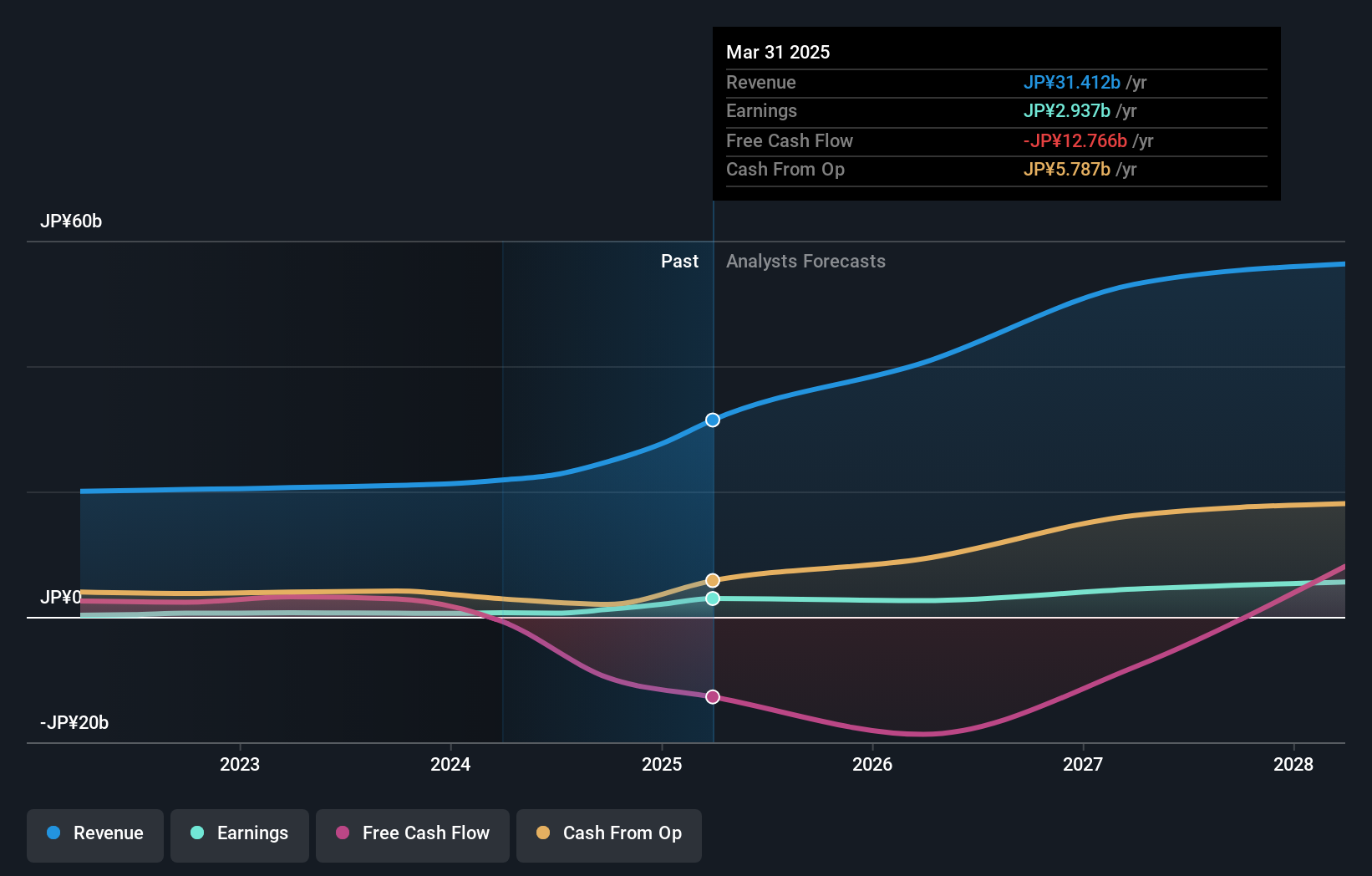

Overview: SAKURA Internet Inc. offers cloud computing services in Japan and has a market capitalization of ¥164.91 billion.

Operations: The primary revenue stream for SAKURA Internet Inc. is its Internet Infrastructure Business, which generated ¥22.66 billion. The company focuses on cloud computing services within Japan.

SAKURA Internet, amidst a volatile share price, shows promising growth prospects with earnings expected to surge by 55.6% annually. This performance starkly outpaces the broader Japanese market's forecast of 8.7%. The company's commitment to innovation is underscored by its R&D spending trends, which are critical for sustaining long-term competitiveness in the tech sector. Recently, SAKURA projected a significant increase in dividends and provided an optimistic financial outlook for the upcoming fiscal periods, reflecting confidence in their operational strategy and future revenue streams. These factors make SAKURA an interesting entity within Japan's tech landscape, potentially poised for substantial future growth despite current market challenges.

- Click here and access our complete health analysis report to understand the dynamics of SAKURA Internet.

Examine SAKURA Internet's past performance report to understand how it has performed in the past.

Global Security Experts (TSE:4417)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Global Security Experts Inc. is a cybersecurity education company based in Japan with a market capitalization of ¥39.06 billion.

Operations: The company focuses on providing cybersecurity education services in Japan. It operates with a market capitalization of approximately ¥39.06 billion.

Global Security Experts Inc. has demonstrated robust growth, with earnings forecasted to increase by 25.7% annually, outpacing the broader Japanese market's projection of 8.7%. This surge is supported by a significant R&D investment strategy, crucial for maintaining competitive edge in the tech industry; indeed, their commitment to innovation is evident as they allocated substantial funds towards R&D expenses. Recently added to the S&P Global BMI Index, this firm benefits from high-quality past earnings and an expected revenue jump of 16.8% per year—indications of strong market confidence and potential for sustained growth despite a highly volatile share price over the past three months.

- Click to explore a detailed breakdown of our findings in Global Security Experts' health report.

Explore historical data to track Global Security Experts' performance over time in our Past section.

Sansan (TSE:4443)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sansan, Inc. is a Japanese company specializing in the planning, development, and sale of cloud-based solutions with a market capitalization of ¥285.32 billion.

Operations: Sansan, Inc. primarily generates revenue through its Sansan/Bill One Business segment, contributing ¥31.79 billion, while the Eight Business segment adds ¥3.80 billion to its revenue streams. The company focuses on delivering innovative cloud-based solutions in Japan's market.

Sansan, a notable entity in Japan's tech landscape, has shown promising growth dynamics, with revenue forecasted to climb by 16.2% annually. This growth is bolstered by an aggressive R&D investment strategy, where the company has allocated 39.5% of its revenue towards enhancing and developing new technologies—a clear indicator of its commitment to innovation. Moreover, Sansan recently repurchased shares worth ¥299.95 million, reflecting confidence in its future prospects and stability within the volatile tech sector. These strategic moves underscore Sansan’s potential to adapt and thrive amidst evolving market demands.

Make It Happen

- Embark on your investment journey to our 118 Japanese High Growth Tech and AI Stocks selection here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3778

Flawless balance sheet with high growth potential.