Stock Analysis

- Japan

- /

- Electronic Equipment and Components

- /

- TSE:7732

SHIFT Leads 3 High Growth Tech Stocks in Japan

Reviewed by Simply Wall St

Japan's stock markets have recently experienced volatility, influenced by political developments and shifts in monetary policy, with the Nikkei 225 Index and TOPIX Index both registering declines. In this climate of uncertainty, identifying high-growth tech stocks like SHIFT becomes crucial as investors look for companies that can navigate economic challenges while capitalizing on innovation and technological advancements.

Top 10 High Growth Tech Companies In Japan

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Hottolink | 50.99% | 61.55% | ★★★★★★ |

| Cyber Security Cloud | 20.71% | 25.73% | ★★★★★☆ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| f-code | 22.70% | 22.62% | ★★★★★☆ |

| Kanamic NetworkLTD | 20.75% | 28.25% | ★★★★★★ |

| Bengo4.comInc | 20.76% | 46.76% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| ExaWizards | 21.96% | 75.16% | ★★★★★★ |

| Money Forward | 20.68% | 68.12% | ★★★★★★ |

Let's review some notable picks from our screened stocks.

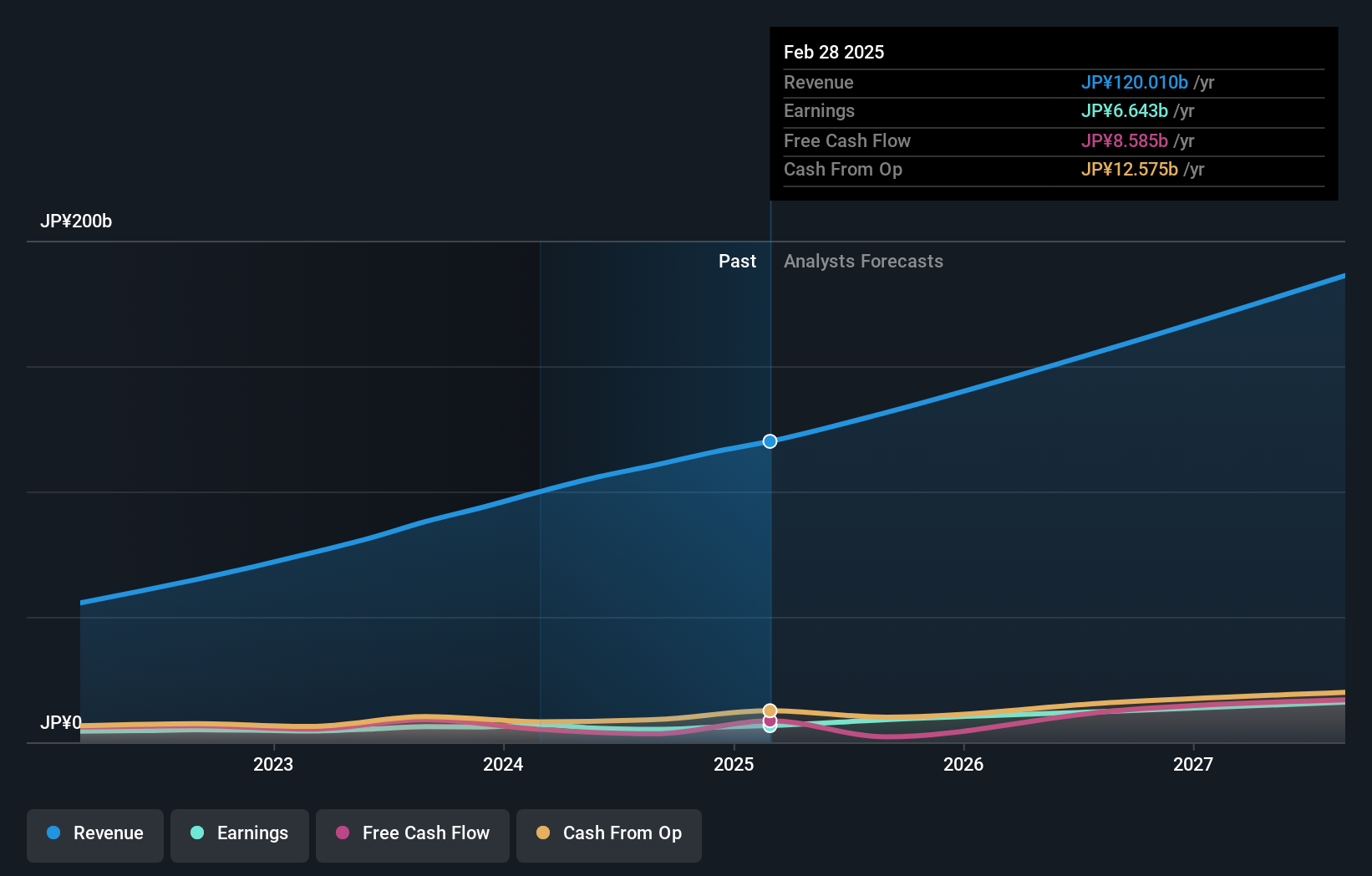

SHIFT (TSE:3697)

Simply Wall St Growth Rating: ★★★★★☆

Overview: SHIFT Inc. is a company that specializes in providing software quality assurance and testing solutions in Japan, with a market capitalization of approximately ¥253.79 billion.

Operations: SHIFT Inc. generates revenue primarily from software testing related services, contributing ¥68.64 billion, and software development related services, which add ¥33.55 billion to their income stream.

SHIFT, a contender in Japan's tech arena, demonstrates robust growth metrics that align with its aggressive R&D investments. With a focus on enhancing software solutions, the company has ramped up its R&D spending to 32.2% of total revenue, fostering innovation and competitive edge in a rapidly evolving market. This strategic allocation has coincided with an impressive revenue uptick projected at 19.5% annually, outpacing the broader Japanese market's growth rate of 4.2%. Moreover, SHIFT's earnings are expected to surge by 32.21% each year, reflecting potent operational efficacy and market demand for its offerings. Despite not leading the high-growth tech segment in Japan outrightly, SHIFT’s substantial investment in development and strong forecasted financial performance underscore its potential pivotal role in shaping industry trends and customer engagements moving forward.

- Click to explore a detailed breakdown of our findings in SHIFT's health report.

Examine SHIFT's past performance report to understand how it has performed in the past.

freee K.K (TSE:4478)

Simply Wall St Growth Rating: ★★★★★☆

Overview: freee K.K. provides cloud-based accounting and HR software solutions in Japan, with a market capitalization of ¥164.34 billion.

Operations: The company specializes in cloud-based software solutions for accounting and HR, primarily targeting the Japanese market. Its revenue model is driven by subscription fees for its software services. The business focuses on enhancing operational efficiency for small to medium-sized enterprises through digital transformation tools.

Freee K.K., navigating through Japan's competitive tech landscape, is poised for significant growth with a projected revenue increase of 18.2% annually, outstripping the broader market's 4.2%. This surge is underpinned by strategic R&D investments which have escalated to a substantial portion of their budget, reflecting a robust commitment to innovation and market adaptation. Recent executive shifts aim to further harness this potential, with new CPO Yasuhiro Kimura steering product strategy towards enhancing integrated ERP systems—critical moves that could shape its trajectory in leveraging technology for small businesses.

- Navigate through the intricacies of freee K.K with our comprehensive health report here.

Explore historical data to track freee K.K's performance over time in our Past section.

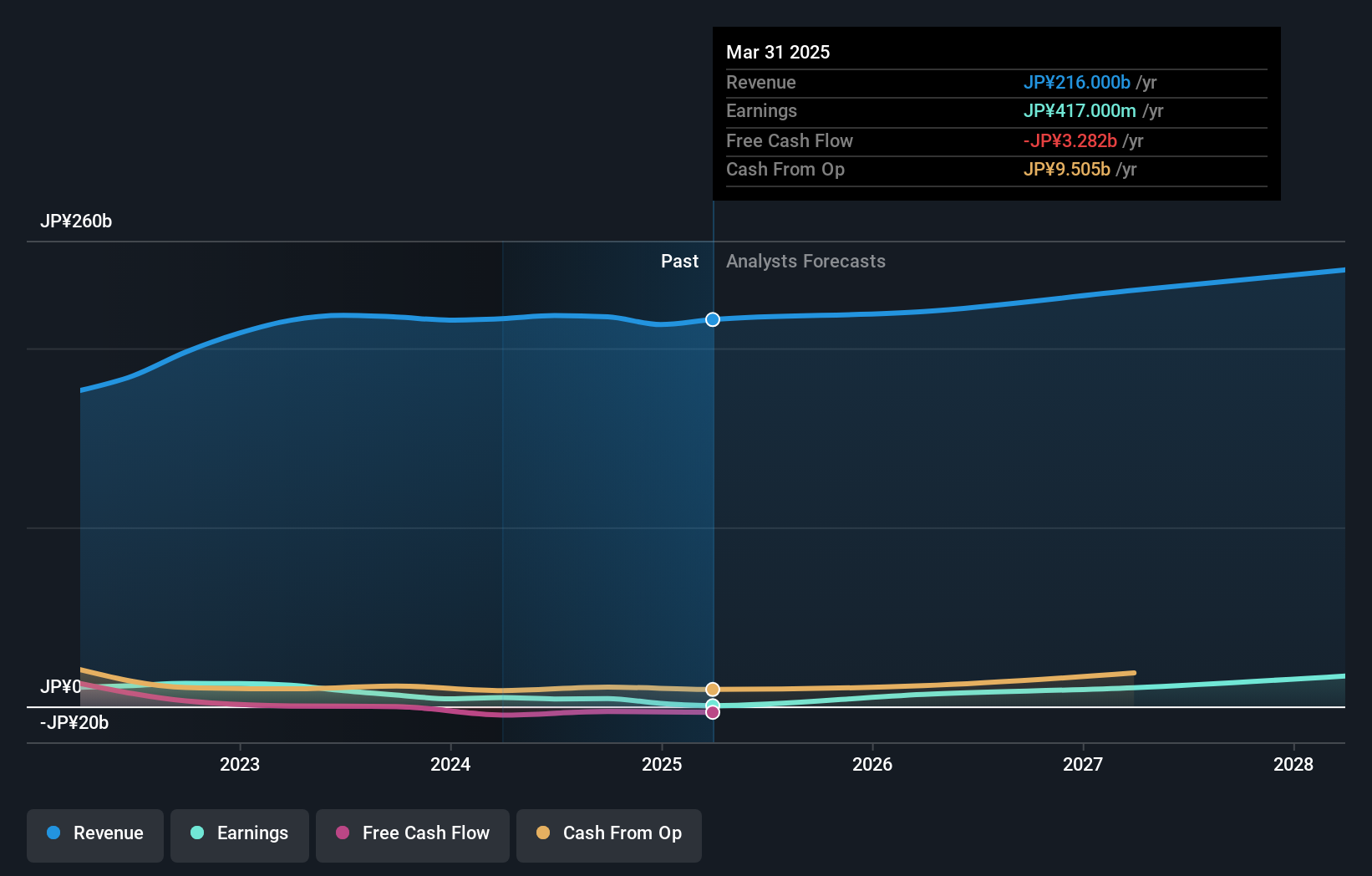

Topcon (TSE:7732)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Topcon Corporation, with a market cap of ¥171.35 billion, operates globally through its development, manufacturing, and sales of positioning systems, eye care solutions, and smart infrastructure products.

Operations: The company's primary revenue streams are from its positioning business, generating ¥148.60 billion, and its eye care business, contributing ¥67.89 billion.

Topcon Corporation, while not leading the pack in Japan's high-growth tech sector, shows promise with its strategic focus on R&D, dedicating 5.4% of its revenue to foster innovation—a critical move for sustaining competitiveness. Despite a challenging year with earnings down by 52.5%, projections indicate a robust recovery with an expected profit growth of 24.8% annually, outpacing the Japanese market average of 8.7%. This resilience is underscored by recent corporate guidance forecasting significant increases in net sales and operating profit for FY2025, alongside stable dividend payouts reflecting confidence in financial health and commitment to shareholder value.

- Click here to discover the nuances of Topcon with our detailed analytical health report.

Evaluate Topcon's historical performance by accessing our past performance report.

Where To Now?

- Discover the full array of 120 Japanese High Growth Tech and AI Stocks right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Topcon might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7732

Topcon

Develops, manufactures, and sells positioning, eye care, and smart infrastructure products in Japan and internationally.