Mitsubishi Research Institute (TSE:3636) Margin Surge Reinforces Bullish Value Narrative

Reviewed by Simply Wall St

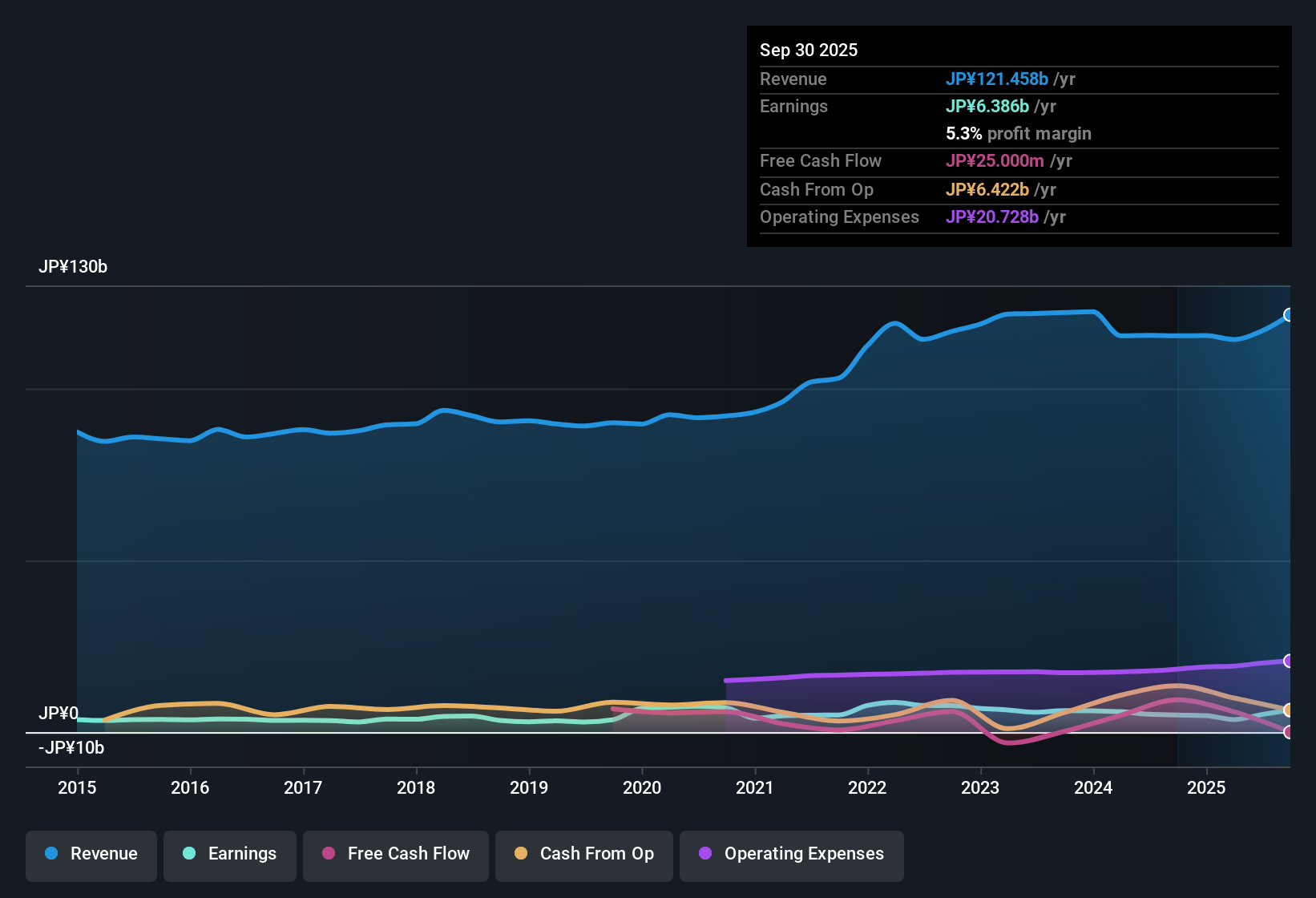

Mitsubishi Research Institute (TSE:3636) posted a net profit margin of 5.3%, up from last year’s 4.3%, as EPS surged 27.6% over the past year, a reversal from an average -3.4% annual decline over the last five years. Forecasts now point to 4% annual earnings growth, which lags behind the Japanese market’s 7.9% average. Revenue is expected to rise 4.7% per year, just above the market’s 4.5%. With a price-to-earnings ratio of 12x, well below peers, and recent margin strength, investors may see a compelling value story emerging from these results.

See our full analysis for Mitsubishi Research Institute.Next, we will see how these headline figures compare with the most widely followed narratives in the market, highlighting where they align and where the data tells a different story.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Outpace Market, But Growth Slows

- Net profit margin has climbed to 5.3%, well above last year's 4.3%. However, projected annual earnings growth for Mitsubishi Research Institute is just 4%, trailing the broader Japanese market's 7.9%.

- Bulls emphasize that margin expansion supports the argument for durable earnings quality, even as headline growth lags peers.

- What stands out is that recent margin gains are backed by operational improvements rather than short-term cost cuts. This often suggests greater stability for future results.

- Unlike previous years of declining earnings, the current margin profile lends credibility to bullish claims about the company's resilience in a competitive sector.

Valuation Discount Versus Peers and DCF

- Mitsubishi Research Institute is trading at a price-to-earnings ratio of 12x, which is well below the industry average of 17.4x and the peer group’s 23x. It also trades at a steep discount to its DCF fair value of 17,102.07 yen compared to the current share price of 4,880 yen.

- This valuation gap supports the case that the stock remains undervalued despite its recent margin rebound.

- The sharp discount to both sector and peer valuations underlines the idea that the market has yet to fully price in the company’s profitability improvements.

- The current share price is also meaningfully lower than model-based fair value signals, which strengthens the argument for “deep value” among investors looking for quality at a bargain.

Dividend Attractiveness Adds to Reward Profile

- The filing highlights Mitsubishi Research Institute’s attractive dividend, which stands out as a core part of the investment appeal for value-focused shareholders.

- Advocates for the reward case point out that, amid margin and value upside, the reliable dividend stream only deepens the overall return potential.

- The combination of undervaluation and steady dividend income creates a double incentive for investors seeking both immediate yield and long-term upside.

- This reinforces the sense that the company’s fundamentals appeal to those hunting for stability in the Japanese equity market.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Mitsubishi Research Institute's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While Mitsubishi Research Institute is delivering margin gains and value, its slower earnings growth lags well behind the broader market’s upward trajectory.

If consistent profit expansion and steady outlooks are your top priority, use stable growth stocks screener (2094 results) to zero in on companies that reliably deliver strong growth through every cycle.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3636

Mitsubishi Research Institute

Provides research, consulting, and ICT solution to public and private sectors in Japan.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives