NS Solutions (TSE:2327): Valuation Insight Following Upgraded Earnings Guidance and Higher Interim Dividend

Reviewed by Simply Wall St

NS Solutions (TSE:2327) shared its forecast for the upcoming fiscal year and revealed a higher interim dividend. These announcements quickly put the company in the spotlight for investors focused on earnings and steady shareholder returns.

See our latest analysis for NS Solutions.

After announcing strong earnings guidance and lifting its interim dividend, NS Solutions attracted attention in a market where tech valuations have sparked plenty of debate. While the latest share price sits at ¥3,707, momentum has seen some ups and downs lately. A modest dip year-to-date contrasts with a stellar 3-year total shareholder return of 125% and 159% over five years, showing long-term investors have been well rewarded even if recent moves have been less impressive.

If the recent guidance has you watching for what’s next, this is a perfect moment to broaden your scope and discover fast growing stocks with high insider ownership

With robust new guidance and a dividend hike already lifted into view, the question for investors is whether NS Solutions still has room to surprise or if the market has fully factored in these future gains.

Price-to-Earnings of 25.2x: Is it justified?

NS Solutions currently trades at a price-to-earnings (P/E) ratio of 25.2x, which is noticeably higher than the recent closing price of ¥3,707 would suggest for typical sector norms. This signals a rich valuation relative to listed peers and the broader IT sector in Japan.

The P/E ratio is a key tool for understanding how much investors are willing to pay for each yen of current earnings. For a technology company like NS Solutions, this multiple reflects market expectations for growth and profitability. A higher-than-average P/E often implies investors anticipate stronger future earnings growth compared to sector peers.

However, NS Solutions' P/E is well above both the peer average of 21.6x and the broader JP IT industry average of 17.2x. Even when compared with the estimated fair P/E of 26.1x, the current multiple is only marginally below that target, suggesting little room for upside unless earnings accelerate. If the market revises its growth outlook, the P/E could adjust quickly towards the fair ratio.

Explore the SWS fair ratio for NS Solutions

Result: Price-to-Earnings of 25.2x (OVERVALUED)

However, slower revenue growth or further dips in market sentiment could quickly challenge bullish expectations for NS Solutions in the months ahead.

Find out about the key risks to this NS Solutions narrative.

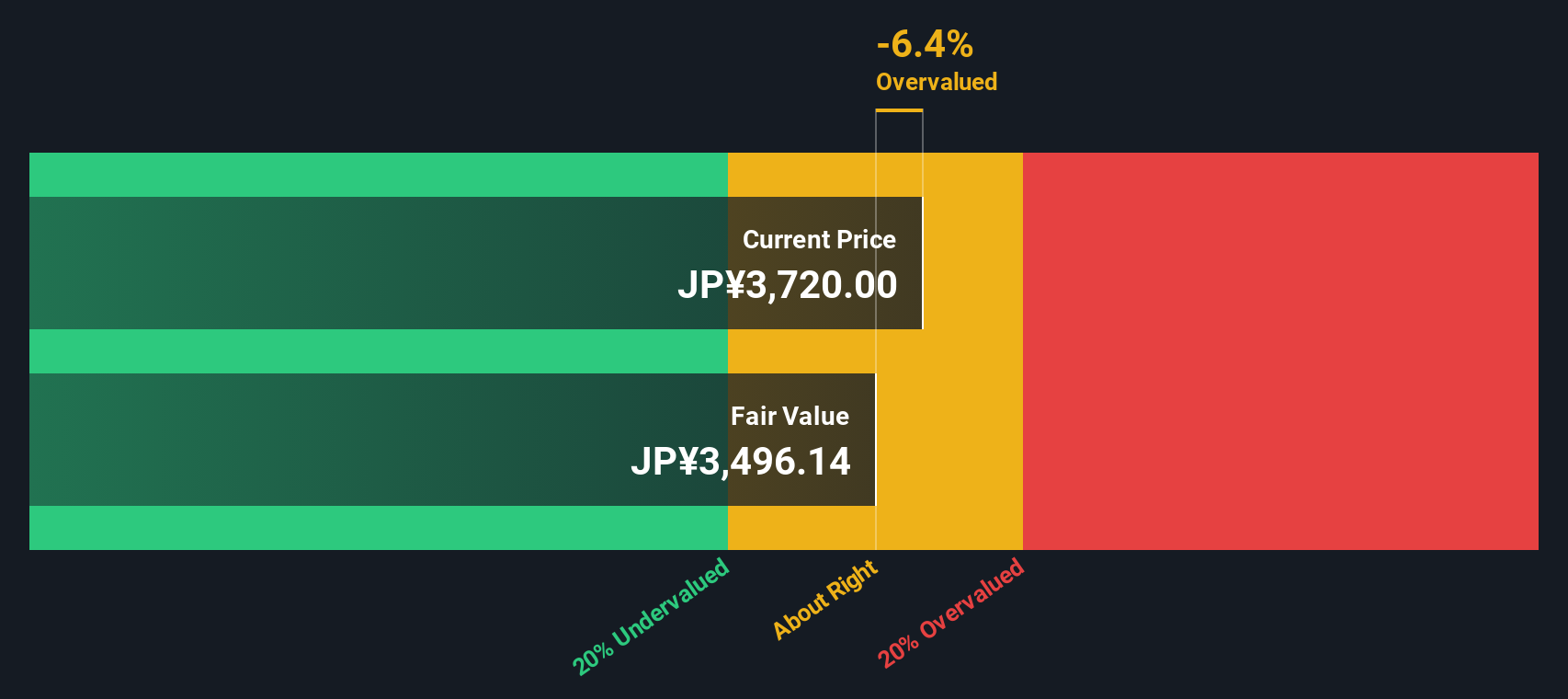

Another View: Discounted Cash Flow Perspective

Looking from the lens of our DCF model, NS Solutions is trading above its estimated fair value. At ¥3,707, the current price sits roughly 4.7% higher than the calculated DCF fair value of ¥3,540. This could be a red flag for value-hunting investors. Does this call for caution, or is the market pricing in strategic growth that models cannot see?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out NS Solutions for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own NS Solutions Narrative

If you have a different angle or want to examine NS Solutions’ future using your own insights, you can shape your view in just a few minutes. Why not Do it your way?

A great starting point for your NS Solutions research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Ready for Your Next Move?

There are countless other companies bursting with potential beyond NS Solutions. Take advantage of Simply Wall Street’s powerful tools to confidently target your next smart investment.

- Tap into the future of healthcare by evaluating innovation leaders using these 32 healthcare AI stocks and position yourself ahead of medical technology trends.

- Unlock returns from companies offering consistent payouts by exploring these 16 dividend stocks with yields > 3%, featuring yields higher than 3% for steady income potential.

- Seize opportunities in digital finance by following these 82 cryptocurrency and blockchain stocks where companies are reshaping payment systems and blockchain adoption worldwide.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NS Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2327

NS Solutions

Provides information technology solutions in Japan and internationally.

Flawless balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives