Systena (TSE:2317) Margin Growth Reinforces Market View of Quality Despite Recent Price Volatility

Reviewed by Simply Wall St

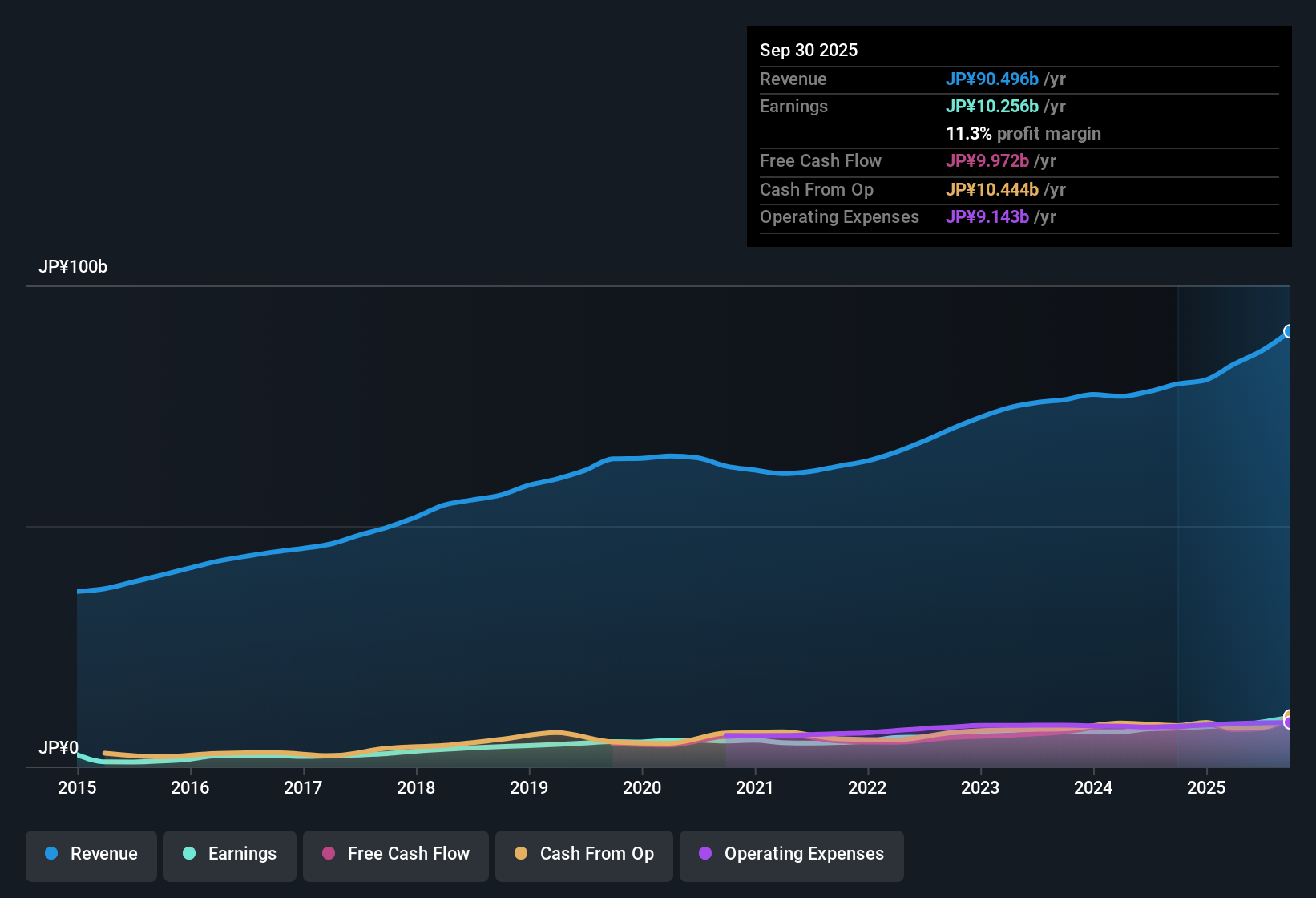

Systena (TSE:2317) delivered a 28.5% jump in earnings over the past year, easily outpacing its own five-year average of 13.3% annual growth. Earnings per share are forecast to grow 5.63% per year, with revenue set to rise by 4.9%, beating the broader Japanese market’s expected 4.5% revenue growth. Net profit margins now stand at 11.3%, up from 10% a year ago, underlining continued operational improvement and providing yield-focused investors with another reason to pay attention.

See our full analysis for Systena.The next section puts these results side by side with the market’s prevailing narratives. We will see where the latest data bolsters popular opinions and where it pushes back.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margin Expansion Outpaces Sector Norms

- Systena’s net profit margin reached 11.3%, rising from 10% in the prior year and marking a clear operational improvement compared to sector peers.

- What stands out is that, despite a moderate revenue growth forecast of 4.9%, this increase in profitability is seen as a positive differentiator by investors.

- The margin gain sets Systena apart from Japanese software sector averages and reinforces the view that operational execution is currently a core strength.

- Ongoing sector trends toward digital transformation support Systena's position and suggest its business model is well aligned with long-term growth drivers.

Peer Value Advantage at 18.5x P/E

- The company’s Price-to-Earnings Ratio of 18.5x is well below peer averages (55.8x) and also below the Japanese software sector mean of 21x, indicating a value orientation amid continued growth.

- Market consensus notes that Systena’s valuation is regarded as fair-to-attractive, especially when considered alongside its historical earnings quality and steady expansion rate.

- The absence of any significant premium in its valuation may appeal to investors who prioritize stable fundamentals and wish to avoid overpaying for growth stories in the sector.

- Yield-focused shareholders may also see value in dividend rewards, which are highlighted as a key strength and add to the appeal for those seeking consistent returns along with capital appreciation potential.

Share Price Lags Despite Strong Underlying Growth

- Although Systena recorded a 28.5% increase in earnings year over year, its share price has been unstable in the past three months, creating a noteworthy contrast between business momentum and market response.

- The prevailing view in the market is that this recent price volatility does not change the perception of Systena as a low-risk, quality operator.

- Consistent profit growth and sector alignment continue to outweigh short-term share price fluctuations, reinforcing the company’s reputation for reliability.

- Investors may benefit if future strategic achievements or sector-wide factors lead to greater market recognition of Systena’s steady results.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Systena's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite Systena’s strong margin gains and fair valuation, the recent share price volatility highlights its inability to consistently translate earnings momentum into stable returns for investors.

If you’re seeking steadier performance, check out stable growth stocks screener (2094 results) to discover companies delivering consistent earnings and revenue growth regardless of short-term market swings.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2317

Systena

Engages in the solution and framework design, IT service, business solution, and cloud businesses in Japan.

Outstanding track record with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives