- Japan

- /

- Semiconductors

- /

- TSE:8035

The Bull Case For Tokyo Electron (TSE:8035) Could Change Following Upgraded Guidance and Higher Dividend—Learn Why

Reviewed by Sasha Jovanovic

- On October 31, 2025, Tokyo Electron Limited raised its full-year earnings guidance for the fiscal year ending March 31, 2026, and increased its interim dividend to ¥264 per share, citing stronger-than-expected first-half financial results.

- This adjustment aligns with Tokyo Electron's policy of linking shareholder returns to performance, highlighting improved profitability and a commitment to maintain a payout ratio around 50% of net income attributable to owners of parent.

- We'll explore how Tokyo Electron's upward earnings guidance and interim dividend increase impact its long-term growth and earnings outlook.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 35 companies in the world exploring or producing it. Find the list for free.

Tokyo Electron Investment Narrative Recap

To be a shareholder in Tokyo Electron, you fundamentally need to believe in a robust long-term demand for advanced semiconductor equipment, including persistent investment by global chipmakers as technology migrates to denser, next-generation nodes. The recent upward earnings guidance and interim dividend boost signal improved short-term profitability and reinforce management’s performance-linked return policy, yet they do not materially shift the biggest near-term catalyst, the scheduled ramp-up in AI server spending from late 2026, or the main immediate risk of further customer investment delays or cyclical softness impacting equipment orders.

Among recent announcements, the October 31, 2025 guidance revision, raising full-year forecasts for revenue, operating income, and net income, is closest to this news event and directly addresses Tokyo Electron’s near-term earnings power. While it highlights operational resilience and sustained profitability, the core drivers shaping the company’s long-term outlook remain linked to broader industry capital expenditure cycles.

However, investors should be aware that a prolonged slowdown in customer capital spending or further export headwinds could...

Read the full narrative on Tokyo Electron (it's free!)

Tokyo Electron's outlook anticipates ¥2,966.7 billion in revenue and ¥666.1 billion in earnings by 2028. This is based on an annual revenue growth rate of 6.9% and reflects a ¥130.4 billion increase in earnings from the current level of ¥535.7 billion.

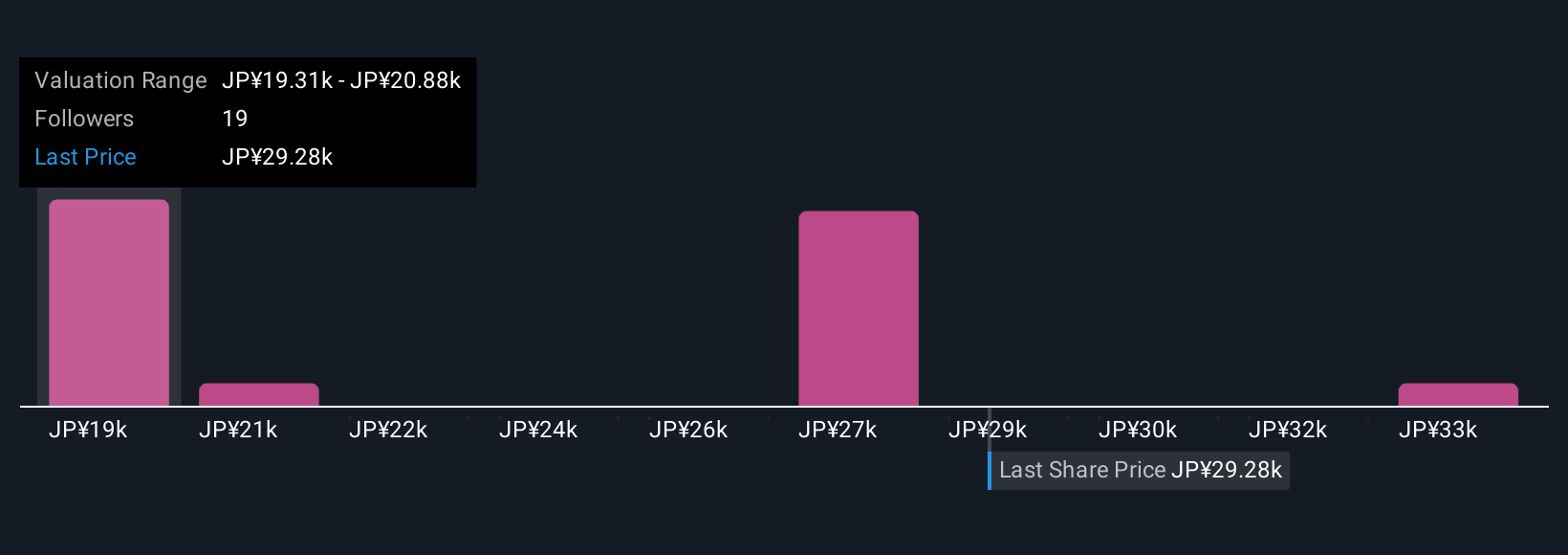

Uncover how Tokyo Electron's forecasts yield a ¥29351 fair value, a 14% downside to its current price.

Exploring Other Perspectives

Six retail investor forecasts from the Simply Wall St Community range from ¥17,247 to ¥35,063 per share, reflecting diverse expectations. With industry cyclicality persisting and customer investment pauses still a risk, you may want to consider several alternative viewpoints for a fuller picture.

Explore 6 other fair value estimates on Tokyo Electron - why the stock might be worth 50% less than the current price!

Build Your Own Tokyo Electron Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tokyo Electron research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Tokyo Electron research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tokyo Electron's overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tokyo Electron might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8035

Tokyo Electron

Develops, manufactures, and sells semiconductor production equipment in Japan, South Korea, Taiwan, China, North America, Europe, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives