Sumco Corporation (TSE:3436) shareholders won't be pleased to see that the share price has had a very rough month, dropping 29% and undoing the prior period's positive performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 13% in that time.

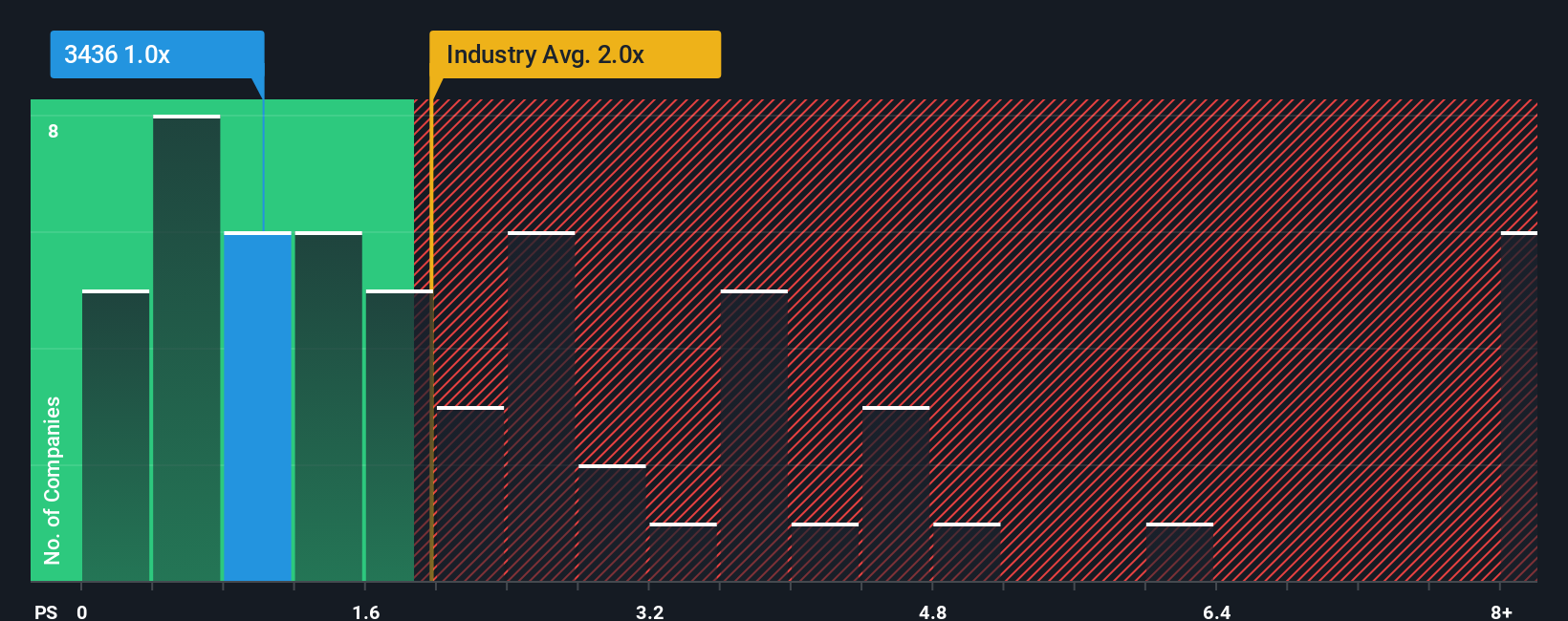

Even after such a large drop in price, Sumco may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 1x, since almost half of all companies in the Semiconductor industry in Japan have P/S ratios greater than 2x and even P/S higher than 4x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Sumco

What Does Sumco's P/S Mean For Shareholders?

Recent times haven't been great for Sumco as its revenue has been rising slower than most other companies. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Sumco.Is There Any Revenue Growth Forecasted For Sumco?

The only time you'd be truly comfortable seeing a P/S as low as Sumco's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. This isn't what shareholders were looking for as it means they've been left with a 2.5% decline in revenue over the last three years in total. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 7.5% per year as estimated by the analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 8.1% per year, which is not materially different.

In light of this, it's peculiar that Sumco's P/S sits below the majority of other companies. It may be that most investors are not convinced the company can achieve future growth expectations.

The Bottom Line On Sumco's P/S

The southerly movements of Sumco's shares means its P/S is now sitting at a pretty low level. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

It looks to us like the P/S figures for Sumco remain low despite growth that is expected to be in line with other companies in the industry. The low P/S could be an indication that the revenue growth estimates are being questioned by the market. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

You need to take note of risks, for example - Sumco has 3 warning signs (and 1 which shouldn't be ignored) we think you should know about.

If these risks are making you reconsider your opinion on Sumco, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:3436

Sumco

Manufactures and sells silicon wafers for the semiconductor industry in Japan, the United States, China, Taiwan, South Korea, Europe, and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives