- Japan

- /

- Specialty Stores

- /

- TSE:7419

Nojima (TSE:7419): Valuation Insights Following Upgraded Dividend and New Financial Outlook

Reviewed by Simply Wall St

Nojima (TSE:7419) unveiled a higher interim dividend and shared new financial guidance for the coming fiscal year. This gives investors fresh insight into the company’s performance expectations and cash return plans for the months ahead.

See our latest analysis for Nojima.

Nojima’s 1-year total shareholder return of 52.5% stands out, reflecting strong momentum and positive sentiment around recent moves such as the upgraded dividend and new earnings guidance. The 3-year total return of 168% suggests longer-term shareholders have seen robust gains, even as the stock’s share price recently pulled back from its highs.

If this kind of growth and earnings clarity sparks your interest, now is a smart time to see what’s out there. Broaden your horizons and discover fast growing stocks with high insider ownership

With shares still below recent highs but long-term returns beating the market, the key question for investors now is whether Nojima remains undervalued or if the market is already anticipating continued growth from this point.

Price-to-Earnings of 8.6x: Is it justified?

Nojima’s last close at ¥1,115 leaves it trading at a price-to-earnings (P/E) ratio of 8.6x, well below both its peers and the broader JP Specialty Retail industry. This suggests the market may be undervaluing its recent earnings trajectory, especially in light of strong results and upgraded guidance.

The P/E ratio measures how much investors are willing to pay for each yen of current earnings. In the retail sector, it often reflects expectations for profit stability and growth. A low P/E compared to industry norms can mean the market doubts recent gains are sustainable or is overlooking upside potential.

Nojima stands out in this regard because its P/E of 8.6x is far below the JP Specialty Retail industry average of 13.7x and the peer average of 15.4x. This strong discrepancy highlights a possible disconnect between the company’s delivered performance and market expectations. Investors could see sentiment shift if positive momentum is maintained or earnings quality remains high.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 8.6x (UNDERVALUED)

However, ongoing market volatility or weaker-than-expected retail demand could dampen sentiment and present challenges to the optimistic outlook for Nojima’s shares.

Find out about the key risks to this Nojima narrative.

Another View: Discounted Cash Flow Perspective

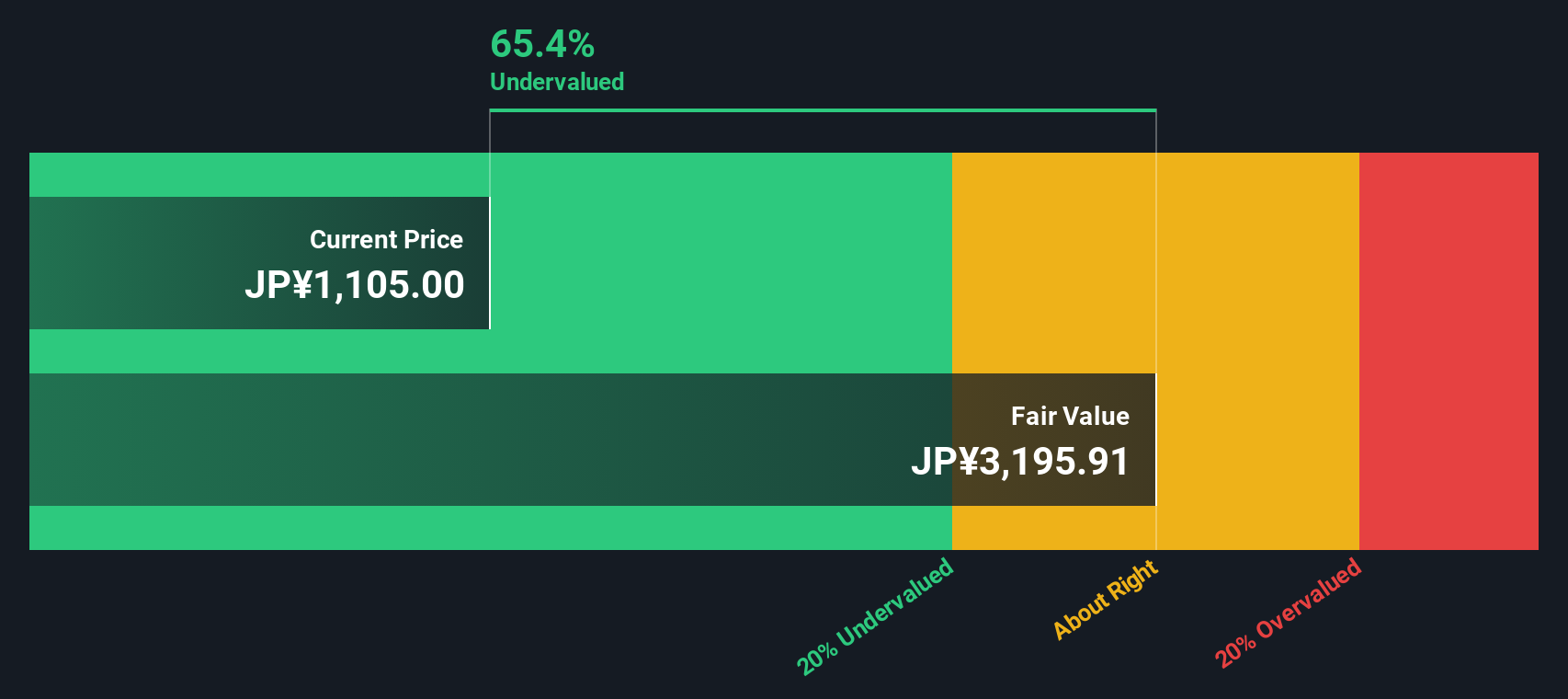

It is worth looking at Nojima through our SWS DCF model as well. On this measure, the stock appears deeply undervalued, trading around 65% below our intrinsic fair value estimate of ¥3,238. This significant gap raises questions about whether the market is fully accounting for Nojima’s underlying business strength or future growth potential.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Nojima for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Nojima Narrative

If you think there is more to Nojima’s story, or want to analyze the numbers for yourself, it’s simple to build your own investment case in minutes. Do it your way

A great starting point for your Nojima research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let great opportunities pass you by. Use the Simply Wall Street Screener to unlock stocks with promising momentum, powerful trends, and untapped growth just waiting to be found.

- Start building wealth with reliable income by targeting these 16 dividend stocks with yields > 3% with annual yields above 3% for steady cash flow.

- Amplify your potential with market disruptors and explore these 24 AI penny stocks driving innovation in artificial intelligence and automation.

- Seize the chance to get ahead with these 870 undervalued stocks based on cash flows that may be trading below their intrinsic value and could offer future upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nojima might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7419

Nojima

Operates digital home electronics retail stores in Japan and internationally.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives