In September 2024, Japan's stock markets have experienced notable fluctuations, with the Nikkei 225 Index down by 5.8% and the broader TOPIX Index registering a 4.2% loss. Despite these challenges, solid wage growth and expectations of further interest rate hikes by the Bank of Japan suggest underlying economic resilience. Identifying promising stocks in such an environment requires focusing on companies with strong fundamentals, innovative capabilities, and potential for long-term growth despite short-term market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals In Japan

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ryoyu Systems | NA | 1.08% | 8.08% | ★★★★★★ |

| QuickLtd | 0.73% | 9.61% | 14.56% | ★★★★★★ |

| AOKI Holdings | 28.27% | 0.91% | 37.15% | ★★★★★★ |

| Nice | 71.69% | -1.98% | 36.48% | ★★★★★★ |

| Ad-Sol Nissin | NA | 4.02% | 7.90% | ★★★★★★ |

| Maezawa Kasei Industries | 0.81% | 2.01% | 18.42% | ★★★★★★ |

| Innotech | 38.96% | 7.08% | 6.36% | ★★★★★☆ |

| AJIS | 0.69% | 0.07% | -12.44% | ★★★★★☆ |

| Kappa Create | 74.42% | -0.45% | 3.62% | ★★★★★☆ |

| Nippon Sharyo | 61.34% | -1.68% | -17.07% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Access (TSE:4813)

Simply Wall St Value Rating: ★★★★★★

Overview: Access Co., Ltd. provides mobile and network software technologies to various industries worldwide, including telecom carriers, consumer electronics manufacturers, broadcasting and publishing companies, the automotive industry, and energy infrastructure providers; it has a market cap of ¥64.31 billion.

Operations: Access generates revenue primarily from its Network Business (¥10.37 billion), IoT Business (¥5.54 billion), and Web Platform Business (¥2.07 billion).

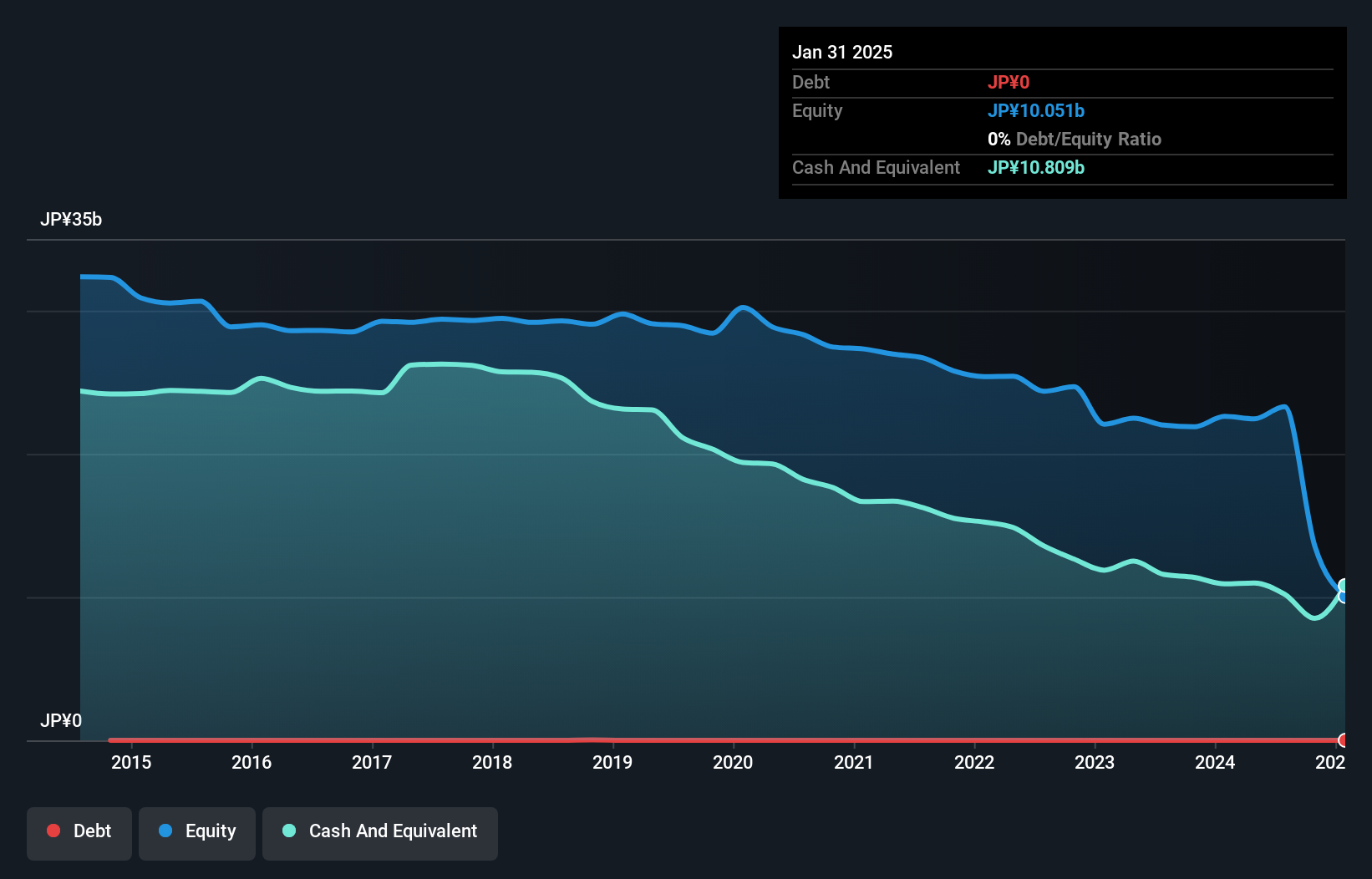

Access Co., Ltd. has shown significant promise, becoming profitable this year and boasting high-quality earnings. The company is debt-free, a status unchanged over the past five years, and its share price has been highly volatile in the last three months. Despite not being free cash flow positive, Access remains profitable with no concerns about cash runway. Notably, they will report Q2 2025 results on August 30th, 2024.

- Take a closer look at Access' potential here in our health report.

Explore historical data to track Access' performance over time in our Past section.

Nohmi Bosai (TSE:6744)

Simply Wall St Value Rating: ★★★★★★

Overview: Nohmi Bosai Ltd. develops, markets, installs, and maintains fire protection systems across Japan, China, the rest of Asia, and the United States with a market cap of ¥155.33 billion.

Operations: Nohmi Bosai Ltd. generates revenue primarily from Fire Alarm Systems (¥44.38 billion), Fire Extinguishing Systems (¥39.33 billion), and Maintenance and Services (¥32.43 billion).

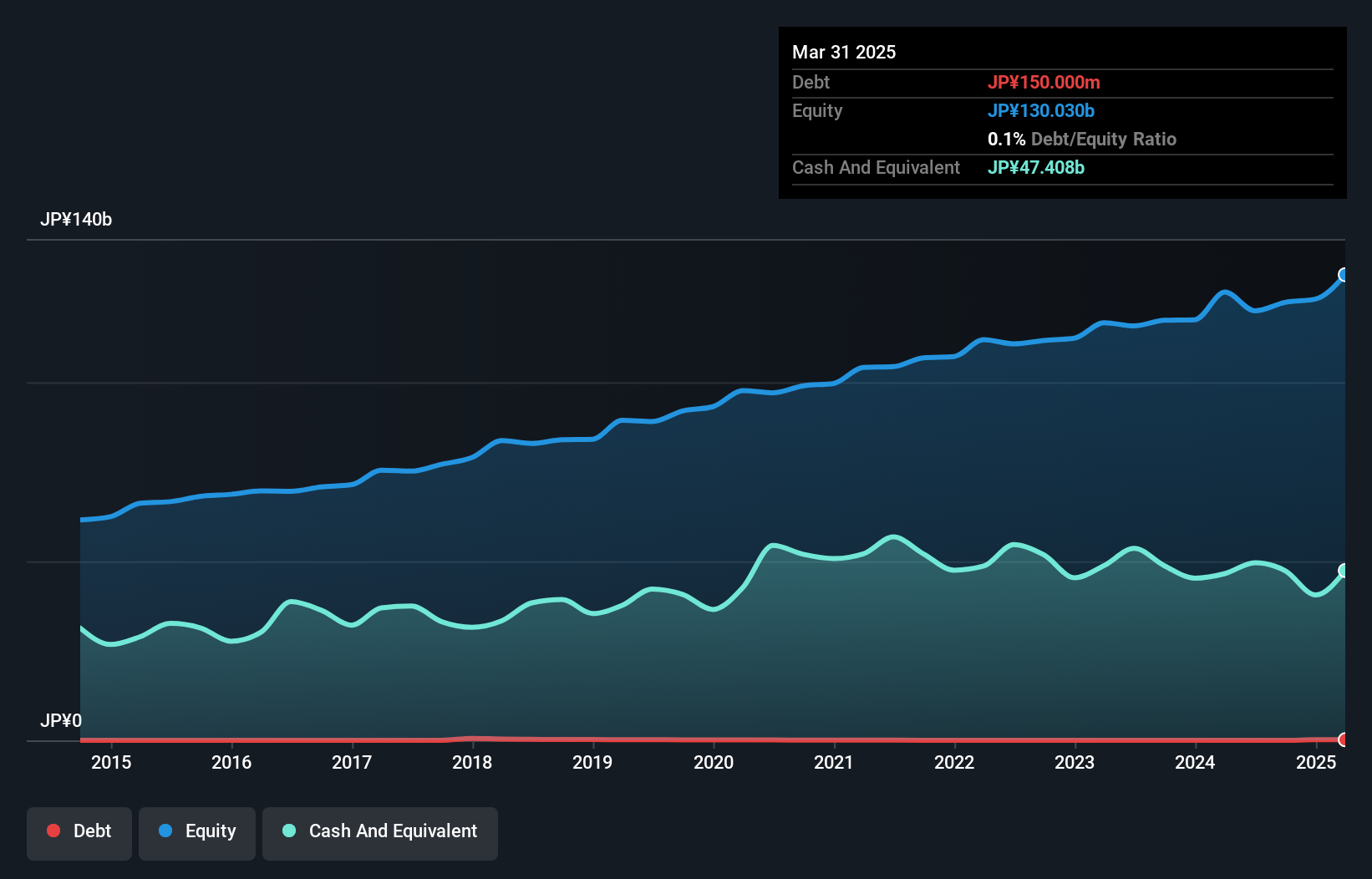

Nohmi Bosai, a small cap in Japan's fire protection industry, boasts impressive financial health with no debt and a 21.9% earnings growth over the past year. The company repurchased shares recently, indicating confidence in its value. Its net profit margin stands at 8%, reflecting efficient operations. Forecasted annual earnings growth of 2.69% suggests steady future performance, making it an interesting pick for investors looking for stable yet growing companies in niche markets.

- Unlock comprehensive insights into our analysis of Nohmi Bosai stock in this health report.

Gain insights into Nohmi Bosai's historical performance by reviewing our past performance report.

Nojima (TSE:7419)

Simply Wall St Value Rating: ★★★★★★

Overview: Nojima Corporation operates digital home electronics retail stores in Japan and internationally, with a market cap of ¥175.61 billion.

Operations: Nojima Corporation generates revenue primarily from its Digital Home Electronics Specialty Store Operation Business (¥273.98 billion) and Career Show Management Business (¥350.30 billion). Other notable segments include Foreign Operations (¥75.74 billion) and Internet Business (¥66.93 billion).

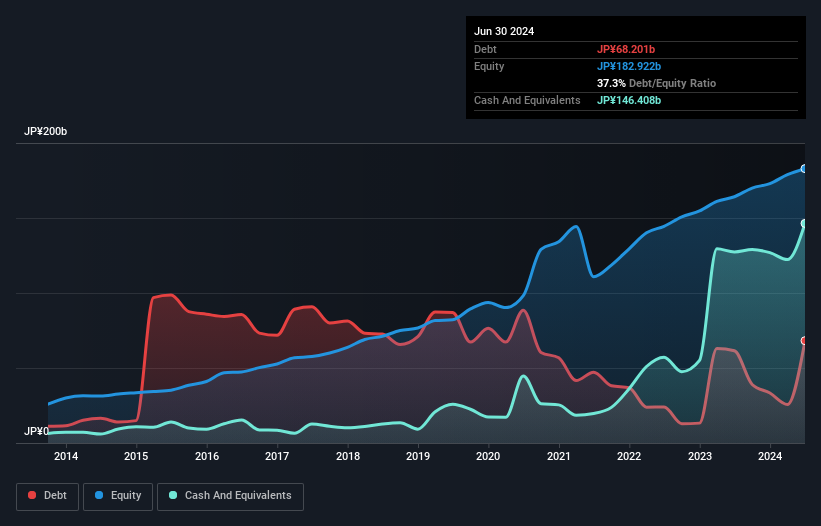

Nojima, a notable player in Japan's retail sector, has seen its debt to equity ratio improve from 105.8% to 37.3% over the past five years. The company repurchased 897,900 shares for ¥1.53 billion between April and June 2024. Earnings grew by 8.3% last year, outpacing the industry average of 7.8%. With net income expected at ¥21 billion and earnings per share projected at ¥214.54 for FY2025, Nojima shows promising financial health and growth potential in the market.

- Navigate through the intricacies of Nojima with our comprehensive health report here.

Examine Nojima's past performance report to understand how it has performed in the past.

Make It Happen

- Click here to access our complete index of 750 Japanese Undiscovered Gems With Strong Fundamentals.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4813

Access

Provides mobile and network software technologies to telecom carriers, consumer electronics manufacturers, broadcasting and publishing companies, automotive industry, and energy infrastructure providers worldwide.

Flawless balance sheet with acceptable track record.