J. Front Retailing (TSE:3086): Evaluating Valuation After Third Straight Month of Department Store Sales Growth

Reviewed by Simply Wall St

J. Front Retailing (TSE:3086) just reported that department store sales rose 8.2% year-on-year in October. This marks three straight months of gains as demand from overseas visitors and cool weather drove apparel sales.

See our latest analysis for J. Front Retailing.

Momentum is building for J. Front Retailing, with this year’s steady share price climb reflecting renewed optimism after a stretch of robust store sales and stronger tourist demand. Over the past year, the stock’s total shareholder return has soared nearly 40%, underscoring growing confidence in its recovery story.

If you’re interested in what’s driving impressive returns beyond department stores, it is a great moment to broaden your search and discover fast growing stocks with high insider ownership

Given the strong share price rally and consecutive sales growth, investors now face a key question: is J. Front Retailing currently undervalued, or could the market already be factoring in all potential upside?

Price-to-Earnings of 18.8x: Is it justified?

At a price-to-earnings ratio of 18.8x, J. Front Retailing is trading at a significant premium versus peers, despite a last close price of ¥2,320.5.

The price-to-earnings (P/E) ratio measures how much investors are paying for each yen of current earnings. For retailers, a higher P/E may signal that the market expects strong future profit growth or values stability and brand strength.

In J. Front Retailing’s case, the P/E of 18.8x is not just above the peer average of 15.2x but is also higher than the estimated fair value P/E of 18.6x. This suggests the market is either anticipating outperformance or is potentially buying into the recent momentum rather than long-term fundamentals. If the market shifts expectations, this premium could shrink quickly.

Compared to the broader JP Multiline Retail industry P/E average of 15.8x, J. Front Retailing's valuation looks especially rich. The fair P/E signals a level the stock could move towards if excitement over current gains fades and performance comes back in line with sector norms.

Explore the SWS fair ratio for J. Front Retailing

Result: Price-to-Earnings of 18.8x (OVERVALUED)

However, any slowdown in tourist spending or a reversal in recent sales momentum could quickly shift sentiment and put pressure on J. Front Retailing's elevated valuation.

Find out about the key risks to this J. Front Retailing narrative.

Another View: What Does the SWS DCF Model Say?

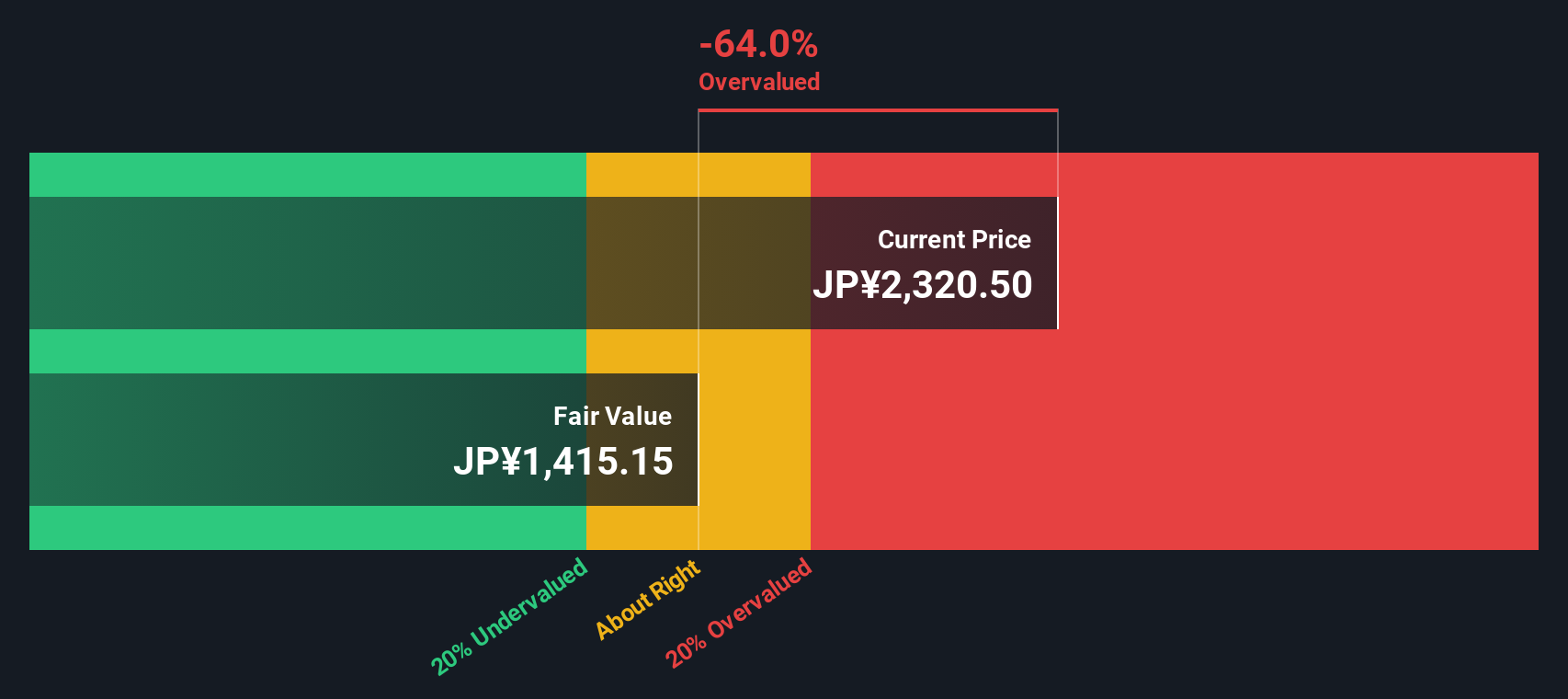

While the price-to-earnings ratio suggests J. Front Retailing is expensive compared to peers and its fair ratio, our DCF model provides an even less favorable outlook. According to the SWS DCF model, the current share price is well above its estimated intrinsic value, indicating the stock is overvalued from a discounted cash flow perspective. Could the current optimism be outpacing the company’s true cash-generating potential?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out J. Front Retailing for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own J. Front Retailing Narrative

If you have a different perspective or want to dive deeper into the numbers, it is easy to explore the data and build your own view in just a few minutes, so why not Do it your way

A great starting point for your J. Front Retailing research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Take your portfolio up a notch by acting on opportunities most investors overlook. Missing these trends now could mean missing out on tomorrow’s biggest winners.

- Boost your income with high-yield potential by checking out these 16 dividend stocks with yields > 3%, which offers consistent returns above 3%.

- Catch the next wave in medical innovation when you browse these 32 healthcare AI stocks. This sector is transforming healthcare with artificial intelligence breakthroughs.

- Capitalize on future tech and quantum breakthroughs by scanning these 27 quantum computing stocks, which is powering the next generation of computing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3086

Adequate balance sheet average dividend payer.

Market Insights

Community Narratives