- Japan

- /

- Specialty Stores

- /

- TSE:2730

EDION (TSE:2730) Valuation in Focus After Profits Drop Despite Modest Sales Growth

Reviewed by Simply Wall St

EDION (TSE:2730) has released its mid-year earnings for September 2025, showing net sales grew 1% compared to last year. However, profits declined across the board. The results highlight ongoing cost pressures affecting overall profitability.

See our latest analysis for EDION.

Shares of EDION have seen momentum fluctuate over the past year, with investors weighing the solid year-to-date share price return of 10.3% against near-term volatility. The company’s one-year total shareholder return stands at 14.3%, and its impressive five-year total return of nearly 129% suggests potential long-term value, even as recent cost pressures weigh on sentiment.

If EDION’s trajectory has you rethinking your next move, this could be a smart time to broaden your search and discover fast growing stocks with high insider ownership

With the latest earnings underwhelming on the profit front but long-term returns still strong, investors are left to wonder whether EDION’s recent dip signals an undervalued opportunity or if the market is already factoring in future growth potential.

Price-to-Earnings of 13.9x: Is it justified?

EDION’s shares are trading at a price-to-earnings ratio of 13.9x, which puts it above the Specialty Retail industry average of 13.7x and marginally below the broader Japanese market’s average of 14.3x.

The price-to-earnings (P/E) ratio measures how much investors are paying for each yen of earnings. For a retailer like EDION, this gauge helps investors compare market expectations for profit growth to those of peers and the broader sector.

While EDION’s P/E ratio suggests the stock is slightly more expensive than its closest rivals, it is notably in line with the overall Japanese market. The ratio still sits below the estimated “fair” ratio of 14.6x, so the market could move higher if sentiment or performance improves further.

Explore the SWS fair ratio for EDION

Result: Price-to-Earnings of 13.9x (ABOUT RIGHT)

However, uncertainty remains as cost pressures persist and analyst price targets are below recent closing levels. This leaves room for short-term volatility.

Find out about the key risks to this EDION narrative.

Another View: What Does Our DCF Model Say?

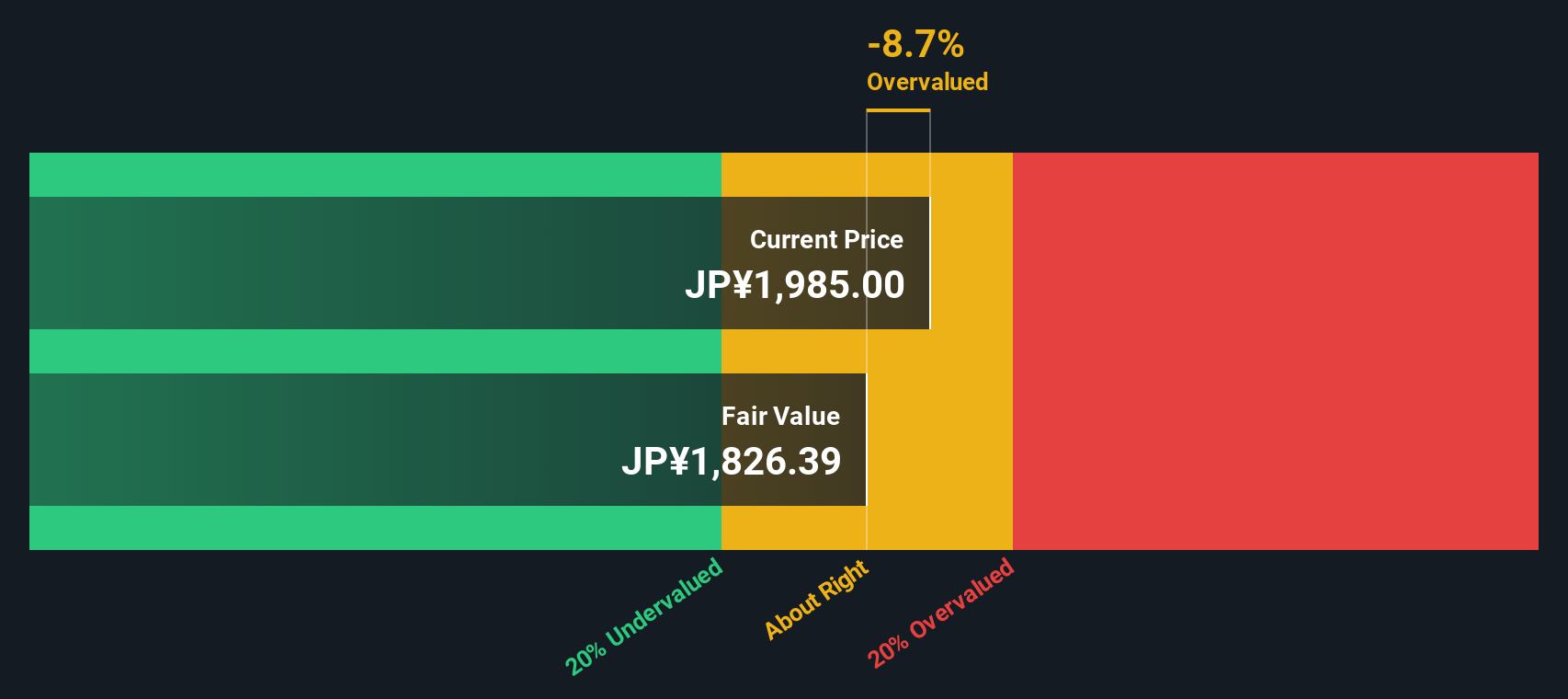

Looking from a different angle, the SWS DCF model estimates EDION’s fair value at ¥1,826.39, which is below the recent closing price of ¥1,985. This suggests the market might be pricing in more optimism than the fundamentals support. Could the shares be a bit ahead of themselves?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out EDION for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own EDION Narrative

If you have a different perspective or want to dive into the numbers yourself, you can easily craft your own take in just a few minutes. Do it your way

A great starting point for your EDION research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Never limit your strategy to just one stock. Expand your opportunities and spot the next star performer by using the tools smart investors rely on.

- Supercharge your search for steady returns with these 16 dividend stocks with yields > 3%, which offers yields above 3% backed by strong fundamentals.

- Tap into market shifts by checking out these 870 undervalued stocks based on cash flows, which is based on compelling cash flow signals and robust financial health.

- Ride the wave of healthcare innovation as you review these 32 healthcare AI stocks, transforming modern medicine with groundbreaking AI solutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EDION might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2730

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives