- Japan

- /

- Specialty Stores

- /

- TSE:2681

Undiscovered Gems In Japan With Strong Fundamentals For August 2024

Reviewed by Simply Wall St

Japan’s stock markets have shown modest gains recently, with the Nikkei 225 Index rising by 0.8% and the broader TOPIX Index up by 0.2%. Amid this backdrop of cautious optimism, investors are increasingly looking for small-cap stocks with strong fundamentals as potential opportunities. In a market characterized by fluctuating economic indicators and evolving monetary policies, identifying companies with robust financial health and growth potential can be particularly rewarding.

Top 10 Undiscovered Gems With Strong Fundamentals In Japan

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Tokyo Tekko | 10.81% | 7.30% | 7.30% | ★★★★★★ |

| Togami Electric Mfg | 1.55% | 3.53% | 7.20% | ★★★★★★ |

| AOKI Holdings | 28.27% | 0.91% | 37.15% | ★★★★★★ |

| ITOCHU-SHOKUHIN | NA | -0.08% | 12.04% | ★★★★★★ |

| Soliton Systems K.K | 0.58% | 5.04% | 16.76% | ★★★★★★ |

| Yashima Denki | 2.93% | -2.38% | 13.99% | ★★★★★★ |

| Innotech | 38.96% | 7.08% | 6.36% | ★★★★★☆ |

| Marusan Securities | 5.33% | 1.01% | 10.00% | ★★★★★☆ |

| Imuraya Group | 26.21% | 2.37% | 32.09% | ★★★★★☆ |

| Toho Bank | 98.27% | 0.43% | 22.80% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Geo Holdings (TSE:2681)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Geo Holdings Corporation operates amusement businesses in Japan and has a market cap of approximately ¥62.70 billion.

Operations: Geo Holdings Corporation generates revenue through its amusement businesses in Japan. The company has a market cap of approximately ¥62.70 billion.

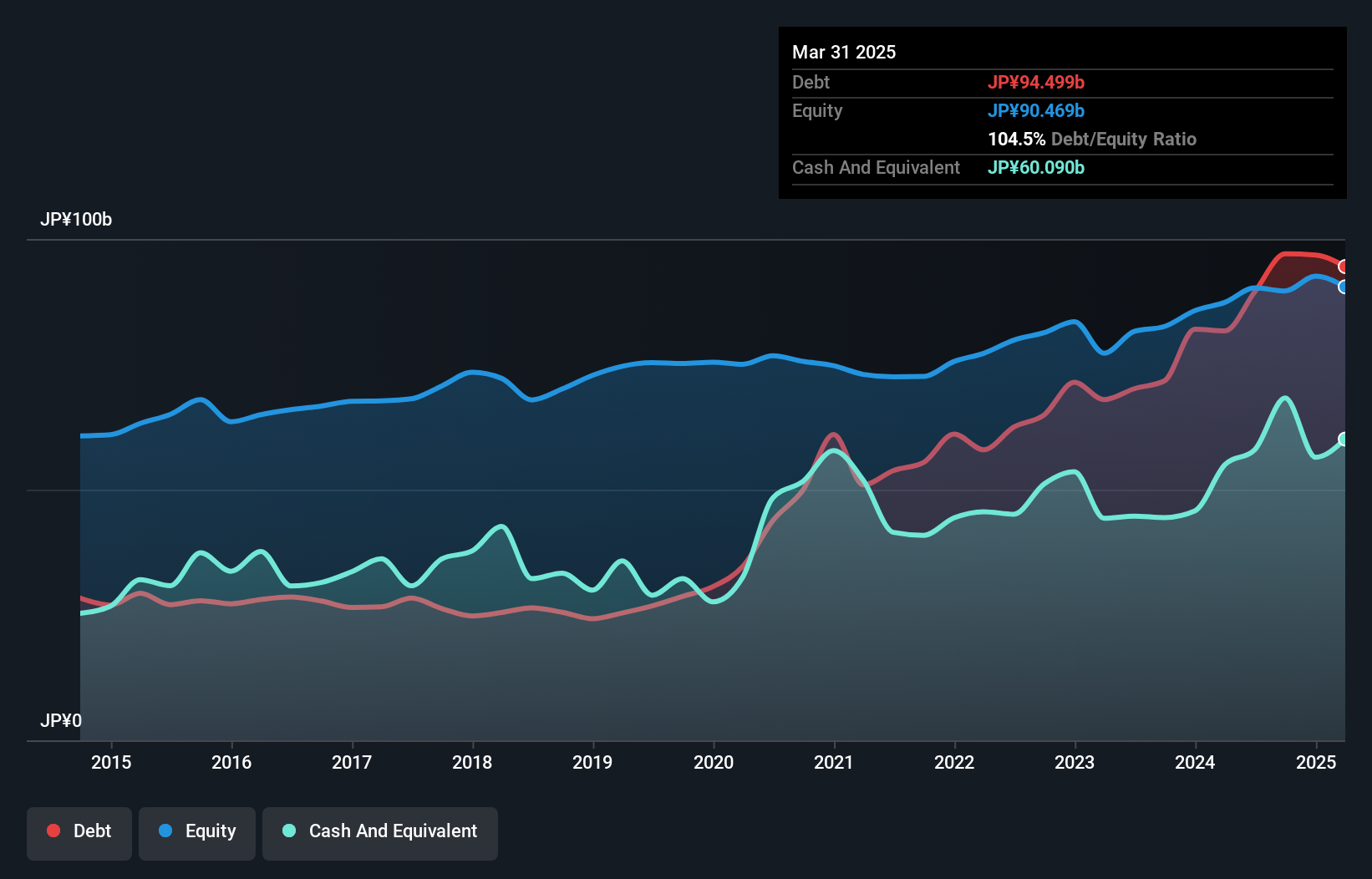

Geo Holdings, a small-cap player in the specialty retail sector, has shown impressive earnings growth of 28.7% over the past year, outpacing the industry average of 7%. The company’s net debt to equity ratio stands at a satisfactory 34.9%, and its interest payments are well covered by EBIT at an impressive 81.9x coverage. Trading at 12.6% below estimated fair value and with high-quality past earnings, Geo Holdings seems poised for continued success with projected annual earnings growth of 13.37%.

- Delve into the full analysis health report here for a deeper understanding of Geo Holdings.

Gain insights into Geo Holdings' historical performance by reviewing our past performance report.

HalowsLtd (TSE:2742)

Simply Wall St Value Rating: ★★★★★☆

Overview: Halows Co., Ltd. operates a network of supermarket stores in Hiroshima, Okayama, Kagawa, Ehime, Tokushima, and Hyogo of Japan with a market cap of ¥93.19 billion.

Operations: Halows Co., Ltd. generates its revenue primarily through its network of supermarket stores across several regions in Japan. The company has a market cap of ¥93.19 billion and focuses on retail sales within these supermarkets.

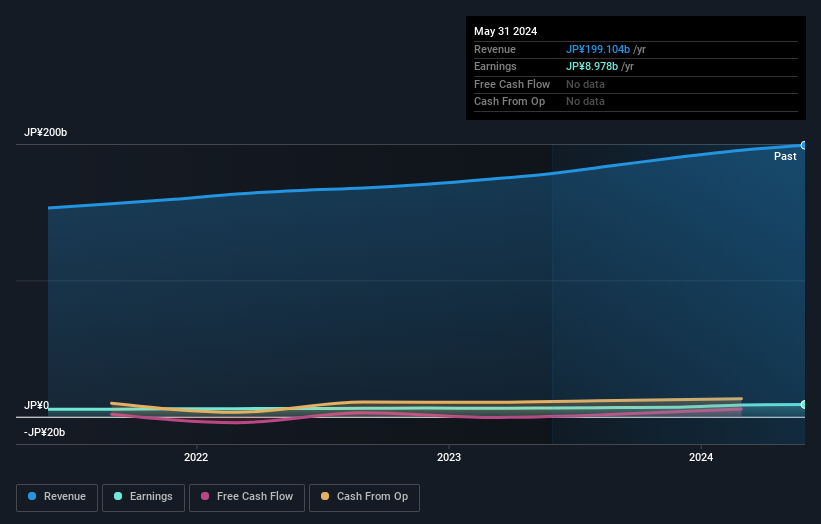

Halows Ltd. has demonstrated strong financial health with earnings growth of 40.6% over the past year, outpacing the Consumer Retailing industry’s 24.5%. The company’s debt to equity ratio improved from 38.1% to 20.3% over five years, and it trades at a value below its estimated fair value by 5.9%. Additionally, Halows' EBIT covers interest payments by an impressive margin of 114 times, indicating robust profitability and efficient debt management.

- Unlock comprehensive insights into our analysis of HalowsLtd stock in this health report.

Explore historical data to track HalowsLtd's performance over time in our Past section.

Sinfonia TechnologyLtd (TSE:6507)

Simply Wall St Value Rating: ★★★★★★

Overview: Sinfonia Technology Co., Ltd. manufactures and sells various equipment and has a market cap of ¥108.97 billion.

Operations: Sinfonia Technology generates revenue primarily from Motion Equipment (¥38.02 billion), Engineering & Service (¥25.71 billion), Clean Conveyance System (¥22.27 billion), and Power Electronics Equipment (¥24.80 billion).

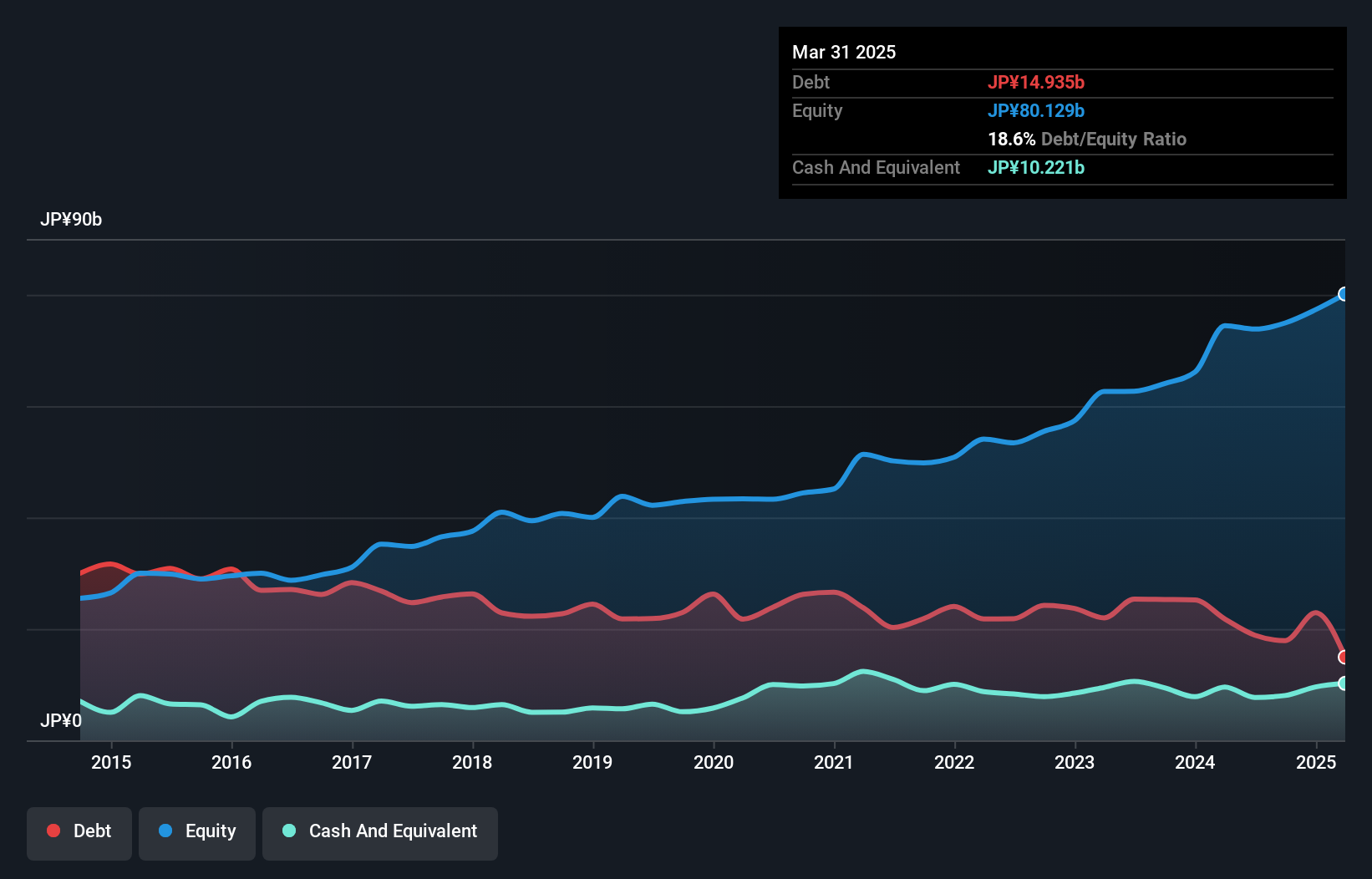

Sinfonia Technology, with a price-to-earnings ratio of 12.7x, is considered undervalued compared to the JP market's 13.4x. Over the past five years, its earnings have grown at a robust 25.1% annually, although recent growth of 10.2% lagged behind the Electrical industry’s 20.2%. The company’s net debt to equity ratio stands at a satisfactory 15.1%, and it has successfully reduced this from 51.8% over five years while maintaining high-quality earnings throughout this period.

- Click here and access our complete health analysis report to understand the dynamics of Sinfonia TechnologyLtd.

Learn about Sinfonia TechnologyLtd's historical performance.

Summing It All Up

- Click here to access our complete index of 757 Japanese Undiscovered Gems With Strong Fundamentals.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2681

Solid track record and good value.