- Japan

- /

- Construction

- /

- TSE:1975

Dividend Stocks On The Japanese Exchange To Consider

Reviewed by Simply Wall St

Japan’s stock markets have seen modest gains recently, with the Nikkei 225 Index rising 0.8% and the broader TOPIX Index up 0.2%. Amidst this backdrop, investors are paying close attention to the Bank of Japan's commitment to normalizing monetary policy as it gains confidence in achieving stable inflation. In such a dynamic market environment, dividend stocks can offer a reliable income stream and potential for growth. Here are three dividend stocks on the Japanese exchange that investors might consider.

Top 10 Dividend Stocks In Japan

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.22% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.15% | ★★★★★★ |

| Globeride (TSE:7990) | 4.14% | ★★★★★★ |

| Mitsubishi Research Institute (TSE:3636) | 3.77% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 4.85% | ★★★★★★ |

| Innotech (TSE:9880) | 4.64% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.51% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.11% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.49% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.36% | ★★★★★★ |

Click here to see the full list of 462 stocks from our Top Japanese Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Wakachiku Construction (TSE:1888)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Wakachiku Construction Co., Ltd. operates in the construction and real estate sectors, with a market cap of ¥47.53 billion.

Operations: Wakachiku Construction Co., Ltd. generates revenue primarily from its construction and real estate businesses.

Dividend Yield: 3.2%

Wakachiku Construction offers a 3.22% dividend yield, which is below the top 25% of JP market payers at 3.73%. Despite this, the company has shown reliable and stable dividend growth over the past decade with a low payout ratio of 38.1%, indicating dividends are well covered by earnings but not free cash flows. The stock's price-to-earnings ratio of 11.8x is attractive compared to the JP market average of 13.4x, suggesting potential value for investors focused on dividends and stability.

- Click here and access our complete dividend analysis report to understand the dynamics of Wakachiku Construction.

- Our expertly prepared valuation report Wakachiku Construction implies its share price may be too high.

Asahi Kogyosha (TSE:1975)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Asahi Kogyosha Co., Ltd. primarily engages in air-conditioning and sanitation installation works in Japan, with a market cap of ¥34.16 billion.

Operations: Asahi Kogyosha Co., Ltd. generates revenue from two main segments: Facility Construction (¥88.24 billion) and Equipment Manufacturing Sales Business (¥3.44 billion).

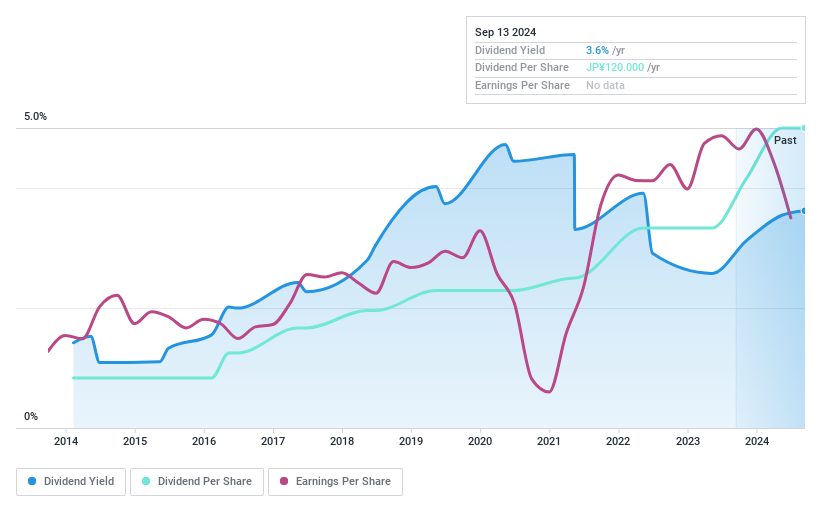

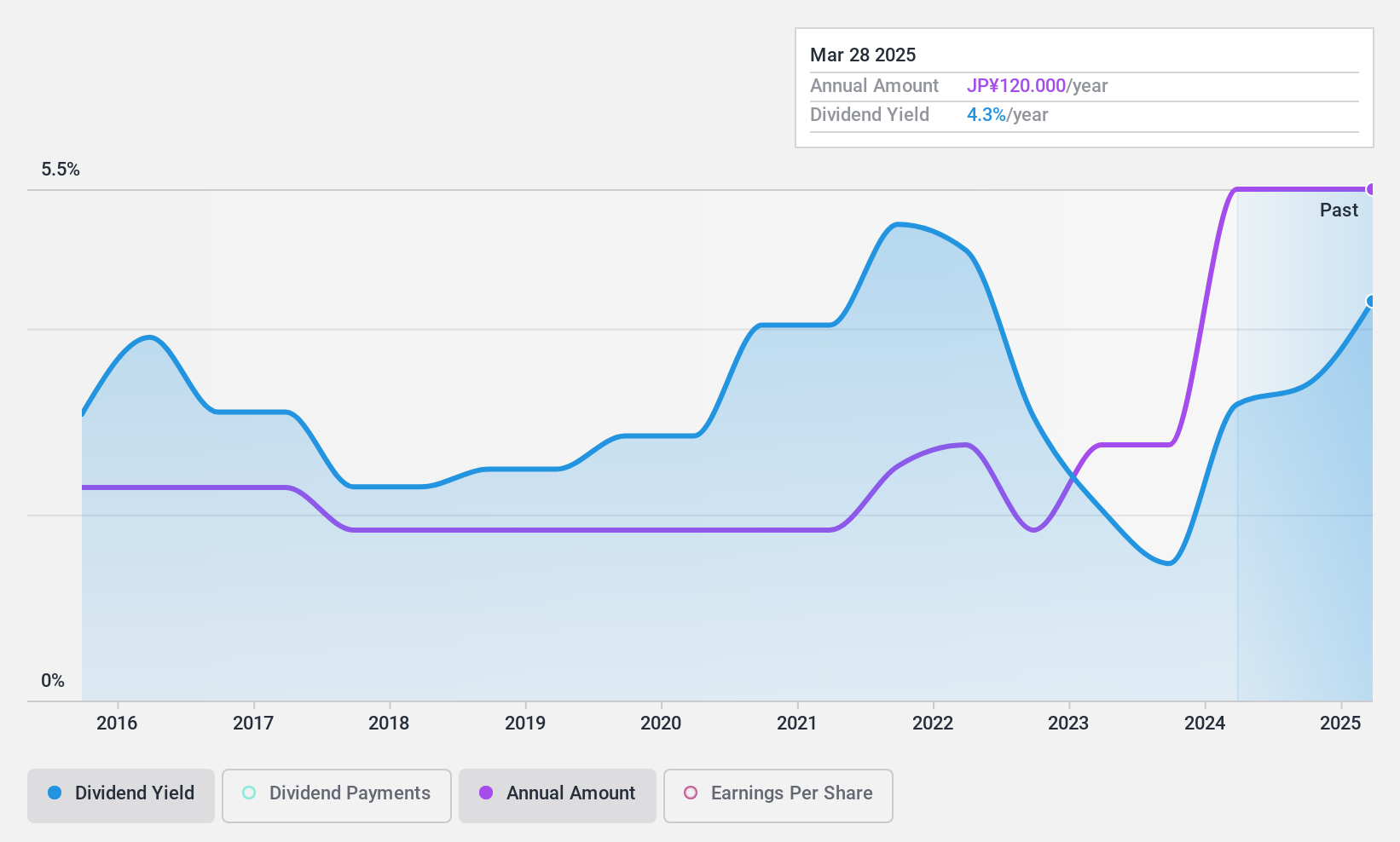

Dividend Yield: 3.8%

Asahi Kogyosha offers a dividend yield of 3.77%, placing it in the top 25% of Japanese market payers. The company’s dividends are well covered by earnings with a payout ratio of 27.7% and cash flows at 74.6%. Despite recent growth in earnings by 49.7%, the dividend track record has been volatile over the past decade, making it less reliable for consistent income seekers. The stock's price-to-earnings ratio is an attractive 9.2x, below the JP market average of 13.4x, indicating potential value for investors focusing on dividends and valuation metrics.

- Click to explore a detailed breakdown of our findings in Asahi Kogyosha's dividend report.

- According our valuation report, there's an indication that Asahi Kogyosha's share price might be on the expensive side.

Daikoku Denki (TSE:6430)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Daikoku Denki Co., Ltd. specializes in the development, production, and sale of computer and information system equipment for pachinko halls in Japan, with a market cap of ¥50.75 billion.

Operations: Daikoku Denki Co., Ltd. generates revenue primarily from the development, production, and sale of computer and information system equipment for pachinko halls in Japan.

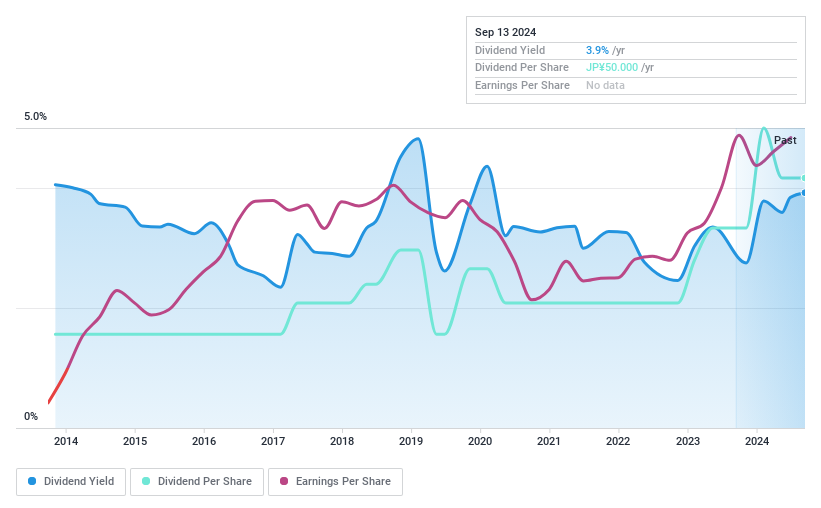

Dividend Yield: 3.5%

Daikoku Denki's dividend payments are well covered by earnings and cash flows, with a payout ratio of 6.6% and a cash payout ratio of 28.2%. However, its dividend yield of 3.5% is slightly below the top quartile in Japan (3.73%). Despite a significant earnings growth of 47.1% over the past year, the company has an unstable dividend track record over the last decade, making it less reliable for consistent income seekers.

- Delve into the full analysis dividend report here for a deeper understanding of Daikoku Denki.

- Our valuation report unveils the possibility Daikoku Denki's shares may be trading at a discount.

Next Steps

- Delve into our full catalog of 462 Top Japanese Dividend Stocks here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1975

Asahi Kogyosha

Primarily engages in the air-conditioning and sanitation installation works in Japan.

Flawless balance sheet with solid track record and pays a dividend.