- Japan

- /

- Office REITs

- /

- TSE:8987

Assessing Japan Excellent’s (TSE:8987) Valuation After New Multi-Year Debt Financing Deals

Reviewed by Simply Wall St

Japan Excellent (TSE:8987) just unveiled a series of new debt financing deals with several major banks, securing sizable loans on multi-year terms. For investors, this move speaks directly to the company’s evolving capital strategy and financial flexibility.

See our latest analysis for Japan Excellent.

Japan Excellent’s appetite for fresh debt financing comes at a time when the stock has delivered a robust 33.75% total shareholder return over the past year, outpacing many peers and hinting at growing investor confidence. Recent momentum is strong as well, with a year-to-date share price return of 26.26%. This suggests the market is responding positively to both the company’s financial moves and its longer-term strategy.

If you’re interested in uncovering what’s next, this could be the ideal moment to broaden your search and discover fast growing stocks with high insider ownership

With shares trading just a few percent below analyst price targets and solid gains already delivered, the real question now is whether Japan Excellent’s current momentum still leaves room for upside or if future growth is already fully reflected in the valuation.

Price-to-Earnings of 23.6x: Is it justified?

Japan Excellent has a price-to-earnings (P/E) ratio of 23.6x, slightly above both its peer group and the broader Asian Office REITs average. Shares at ¥150,000 are pricing in a market expectation higher than that of most direct competitors. The peer average stands at 22.6x while the sector median is 20.2x.

The price-to-earnings ratio compares the company’s market capitalization to its net earnings, effectively revealing how much investors are willing to pay for each yen of profit. In the context of office REITs, the multiple reflects anticipated future cash flows, earnings stability, and perceived growth potential.

This elevated P/E suggests that investors may be optimistic about Japan Excellent’s prospects or the perceived stability of its income streams, despite earnings having declined by 1.8% per year over the past five years. It could also indicate confidence in the company’s high-quality past earnings and board experience, or simply broader positive sentiment about the sector’s outlook. Compared to industry averages, Japan Excellent is priced at a premium.

Result: Price-to-Earnings of 23.6x (OVERVALUED)

See what the numbers say about this price — find out in our valuation breakdown.

However, investors should also consider external market volatility and any unexpected shifts in office demand, which could challenge Japan Excellent’s optimistic valuation.

Find out about the key risks to this Japan Excellent narrative.

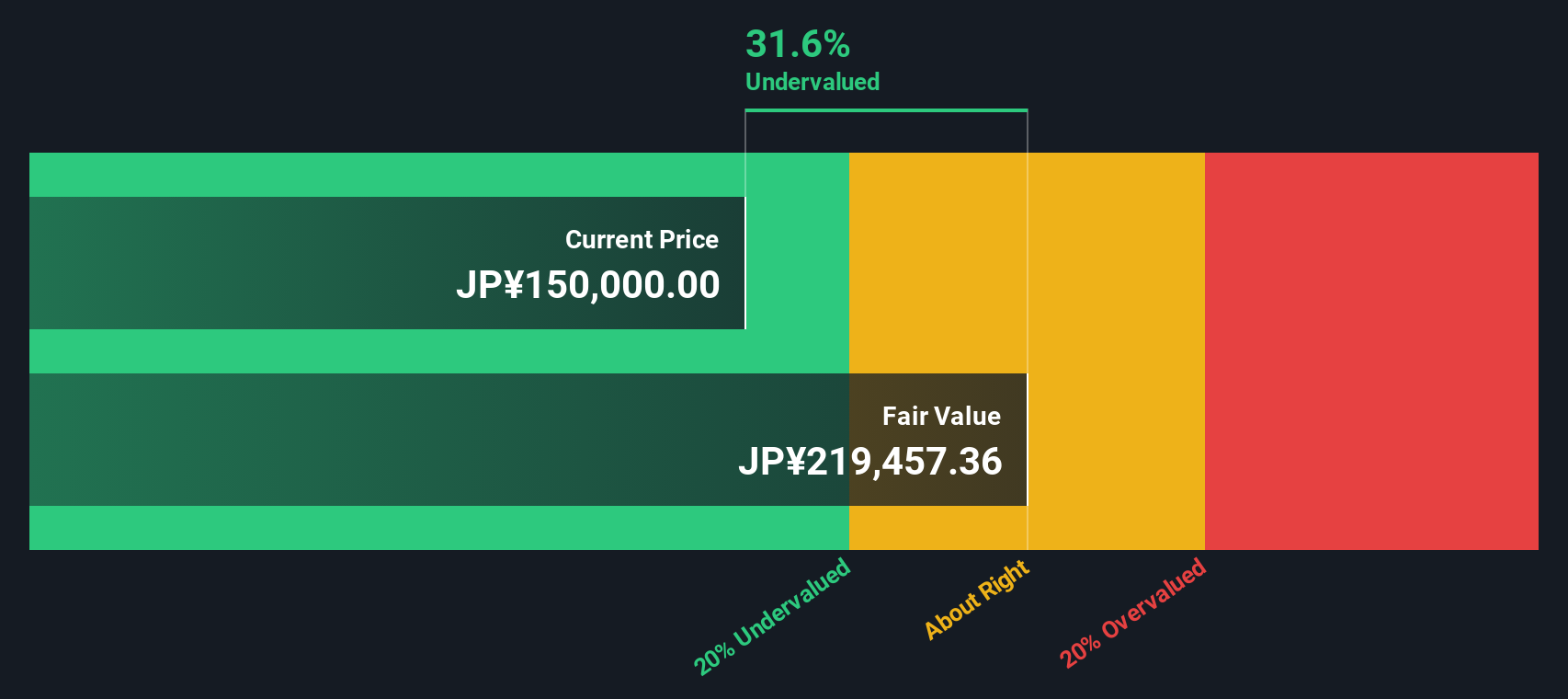

Another View: Discounted Cash Flow Signals Room to Run

Switching gears, our DCF model draws a very different conclusion. By estimating future cash flows, it suggests that Japan Excellent is trading about 32% below its fair value. This perspective views the shares as undervalued. Could the market be overlooking something substantial here?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Japan Excellent for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 865 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Japan Excellent Narrative

If you have a different perspective or want to dive deeper into the numbers, you can quickly shape your own view in just a few minutes. Do it your way

A great starting point for your Japan Excellent research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let great opportunities pass you by. The Simply Wall Street Screener can help you target the hottest sectors, hidden bargains, and future leaders.

- Catch the rise of digital money by tracking these 82 cryptocurrency and blockchain stocks, which is making real-world impacts in payment systems and blockchain innovation.

- Amplify your returns by targeting these 16 dividend stocks with yields > 3%, designed for stable income and long-term compounding power.

- Ride the wave of tomorrow’s breakthroughs with these 24 AI penny stocks, driving transformation in everything from software to robotics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8987

Japan Excellent

Japan Excellent, Inc. (hereinafter, “JEI”), established on February 20, 2006 under the Law Concerning Investment Trusts and Investment Corporations of Japan (the “Investment Trust Law”), is a real estate investment corporation which primarily invests in office buildings.

Established dividend payer with low risk.

Market Insights

Community Narratives