- Japan

- /

- Hotel and Resort REITs

- /

- TSE:3287

Hoshino Resorts REIT (TSE:3287): Evaluating Valuation After New AQUAIGNIS/Yunoyama Sosuikyo Acquisition

Reviewed by Simply Wall St

Hoshino Resorts REIT (TSE:3287) has decided to acquire the AQUAIGNIS/Yunoyama Sosuikyo property in Mie Prefecture. This move furthers its focus on stable, long-term cash flows and strengthens future portfolio profitability.

See our latest analysis for Hoshino Resorts REIT.

Beyond the latest property acquisition, Hoshino Resorts REIT has been active by shoring up funding with new loans and planning a head office move in Tokyo. This momentum is reflected in its share price, which has surged nearly 21% year-to-date, while the one-year total shareholder return stands at a strong 22%. Investors seem to be warming to its steady growth strategy after a challenging multi-year stretch.

If these developments have you thinking about what else is out there, now might be the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With Hoshino Resorts REIT shares near their year’s highs and recent acquisitions fueling optimism, the next big question is whether there is still upside for investors or if the market has already priced in future growth.

Price-to-Earnings of 28.2x: Is it justified?

Hoshino Resorts REIT currently trades at a price-to-earnings ratio of 28.2x, placing it well above industry averages and suggesting a premium compared to peers.

The price-to-earnings ratio tells investors how much they are paying for each yen of profit. For real estate investment trusts, this metric is an important signal of market confidence in future profit streams and growth sustainability.

At 28.2x, the multiple is more than double the average for Asian Hotel and Resort REITs. It also exceeds both the peer average of 18x and the estimated fair ratio of 27.6x. This may indicate bullishness, possibly tied to the anticipated growth in profits and recent momentum. If market sentiment shifts or growth falls short, the stock could be due for a valuation adjustment toward the fair ratio.

Explore the SWS fair ratio for Hoshino Resorts REIT

Result: Price-to-Earnings of 28.2x (OVERVALUED)

However, any slowdown in annual profit growth or a dip from its premium valuation could quickly challenge the current momentum and investor confidence.

Find out about the key risks to this Hoshino Resorts REIT narrative.

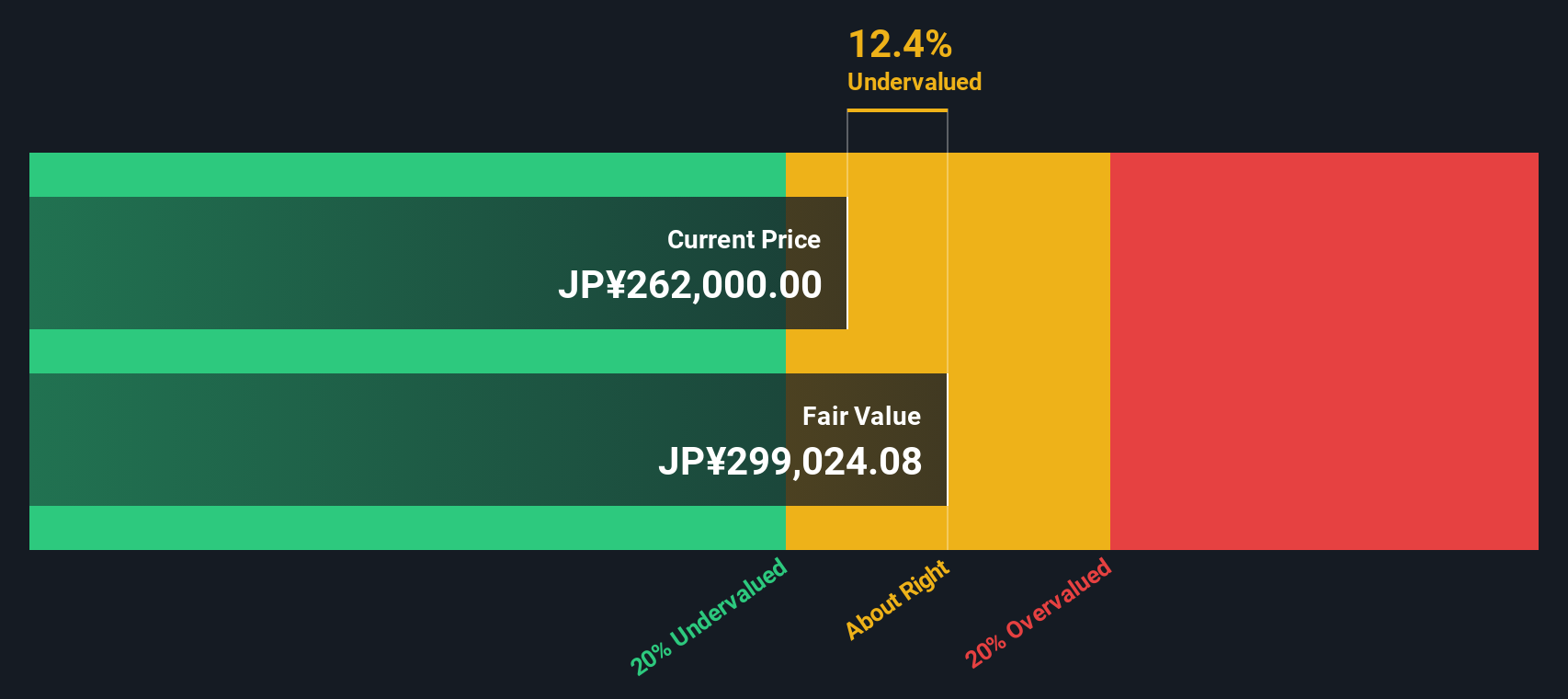

Another View: Discounted Cash Flow Signals Upside

Looking at Hoshino Resorts REIT through our DCF model, the story changes. The shares trade about 20% below this fair value estimate, which suggests there may be potential for upside. Could the SWS DCF model be highlighting value that the market currently overlooks?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Hoshino Resorts REIT for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Hoshino Resorts REIT Narrative

If you would rather draw your own conclusions or prefer to work through the numbers firsthand, you can quickly craft your own perspective and Do it your way.

A great starting point for your Hoshino Resorts REIT research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Staying ahead means acting early. Why not check out high-potential opportunities tailored to your interests? The right screener opens doors you did not know existed.

- Multiply your dividend income by targeting consistent payers and robust yields with these 16 dividend stocks with yields > 3%, which can withstand market stress.

- Fuel your portfolio’s growth prospects by zeroing in on breakthrough healthcare innovators through these 32 healthcare AI stocks, reshaping patient care and medical technology.

- Start strong in tomorrow’s tech landscape by locating cutting-edge, scalable firms among these 24 AI penny stocks that are making artificial intelligence practical and profitable.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hoshino Resorts REIT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3287

Hoshino Resorts REIT

Hoshino Resorts REIT, Inc. (hereinafter, “HRR”) invests in hotels, ryokans (Japanese-style inns) and ancillary facilities that serve at the core of the tourism industry and for which stable use is expected for the medium to long term.

Proven track record average dividend payer.

Market Insights

Community Narratives