- Japan

- /

- Real Estate

- /

- TSE:8850

Undiscovered Gems in Japan to Watch This July 2024

Reviewed by Simply Wall St

Japan's stock markets have experienced sharp weekly losses recently, with the Nikkei 225 Index falling by 6.0% and the broader TOPIX Index down by 5.6%. Despite this downturn, opportunities for growth remain, particularly in small-cap stocks that can often be overlooked. In such a volatile market environment, identifying good stocks involves looking for companies with strong fundamentals and unique competitive advantages that position them well for future growth.

Top 10 Undiscovered Gems With Strong Fundamentals In Japan

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Central Forest Group | NA | 5.16% | 12.45% | ★★★★★★ |

| Soliton Systems K.K | 0.61% | 5.36% | 20.91% | ★★★★★★ |

| Hoshi Iryo-Sanki | NA | 7.03% | 12.64% | ★★★★★★ |

| Icom | NA | 4.02% | 13.06% | ★★★★★★ |

| NJS | NA | 4.22% | 1.83% | ★★★★★★ |

| Akatsuki | 248.27% | 4.31% | 6.86% | ★★★★★☆ |

| Cresco | 8.62% | 7.79% | 9.50% | ★★★★★☆ |

| Dear LifeLtd | 93.05% | 20.12% | 18.05% | ★★★★★☆ |

| CAC Holdings | 14.97% | -0.57% | 5.02% | ★★★★☆☆ |

| GENOVA | 6.23% | 24.87% | 31.14% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Sumitomo Riko (TSE:5191)

Simply Wall St Value Rating: ★★★★★★

Overview: Sumitomo Riko Company Limited, with a market cap of ¥158.75 billion, engages in the manufacture and sale of automotive parts.

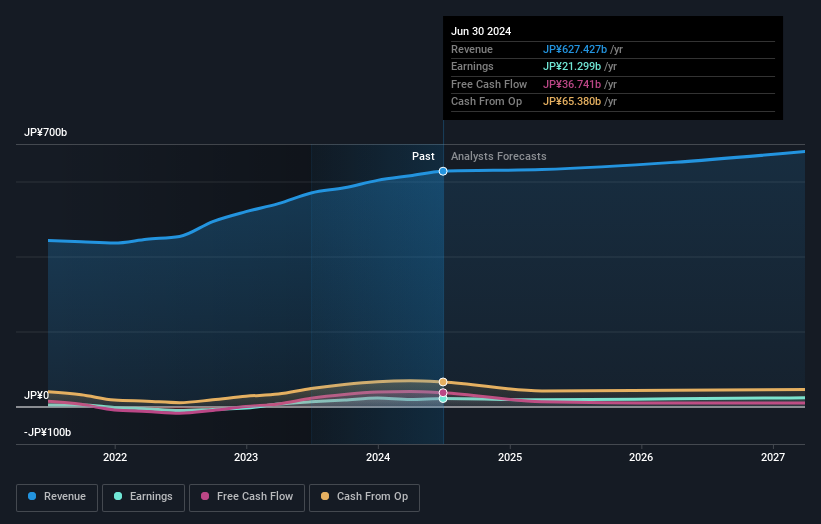

Operations: Sumitomo Riko generates revenue primarily from Automotive Supplies, contributing ¥561.79 billion, and General Industrial Supplies, adding ¥73.29 billion.

Sumitomo Riko, a notable player in the auto components sector, has shown impressive earnings growth of 178.9% over the past year, outpacing the industry average of 50.8%. The company's net debt to equity ratio stands at a satisfactory 19.7%, reflecting prudent financial management. Trading at a price-to-earnings ratio of 8.5x, it offers good value compared to the JP market average of 14.3x. With EBIT covering interest payments 23 times over and positive free cash flow, Sumitomo Riko is well-positioned for continued stability and growth in its niche market segment.

- Click here to discover the nuances of Sumitomo Riko with our detailed analytical health report.

Gain insights into Sumitomo Riko's historical performance by reviewing our past performance report.

Morita Holdings (TSE:6455)

Simply Wall St Value Rating: ★★★★★★

Overview: Morita Holdings Corporation, with a market cap of ¥84.57 billion, develops, manufactures, and sells ladder trucks, fire trucks, and specialty vehicles both in Japan and internationally through its subsidiaries.

Operations: Morita Holdings generates revenue primarily from Fire Truck sales (¥54.57 billion) and Disaster Prevention equipment (¥24.13 billion), with additional contributions from Industrial Machinery (¥6.19 billion) and Environmental Vehicles (¥11.09 billion).

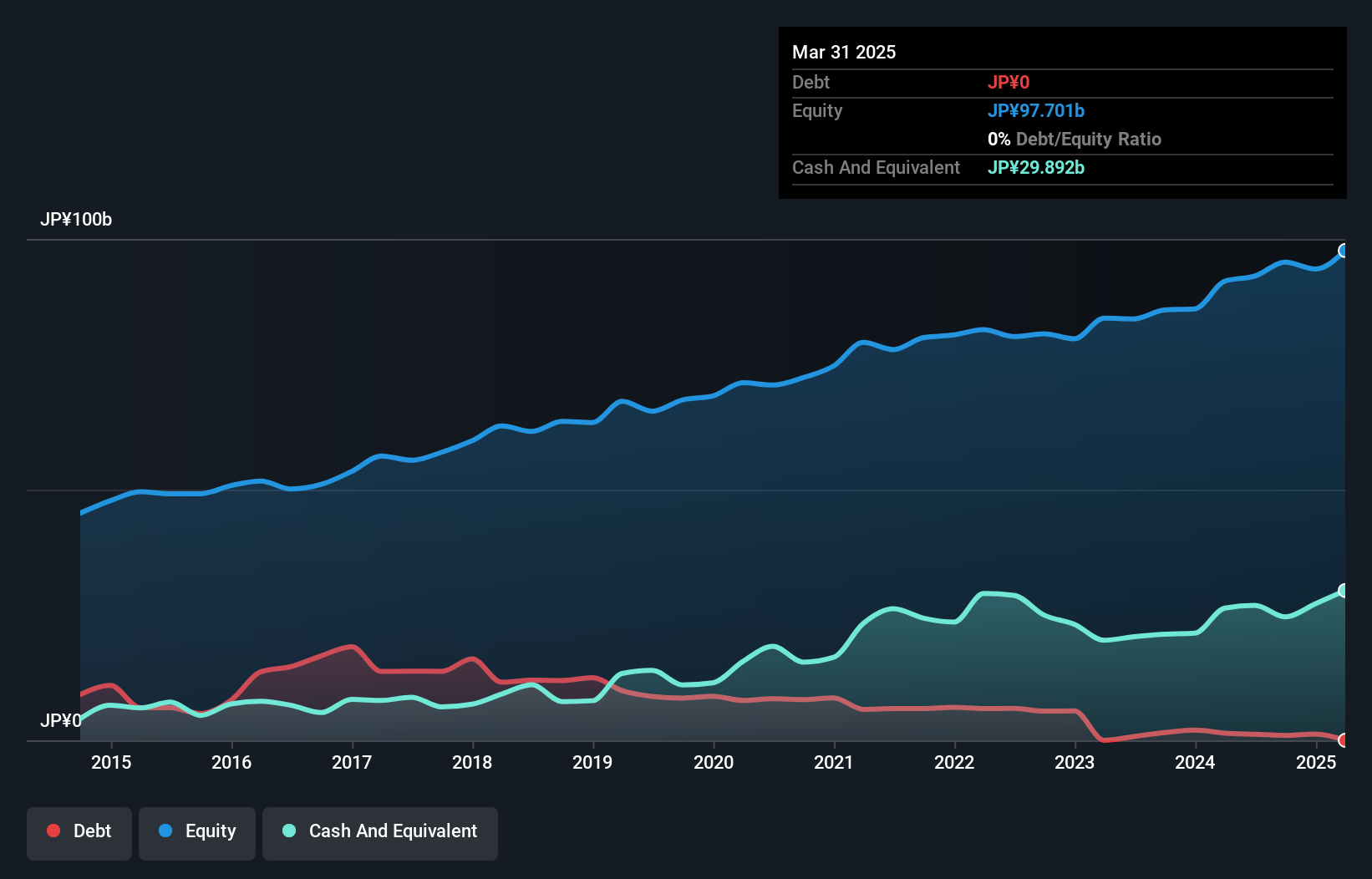

Morita Holdings, a small cap in Japan's machinery sector, has shown impressive performance with earnings growing 50.4% over the past year, outpacing the industry average of 15.7%. Its debt-to-equity ratio improved significantly from 14.6% to 1.6% over five years, indicating strong financial health. Trading at roughly half its estimated fair value and earning more interest than it pays, Morita seems undervalued with promising growth potential ahead.

- Click to explore a detailed breakdown of our findings in Morita Holdings' health report.

Gain insights into Morita Holdings' past trends and performance with our Past report.

Starts (TSE:8850)

Simply Wall St Value Rating: ★★★★★★

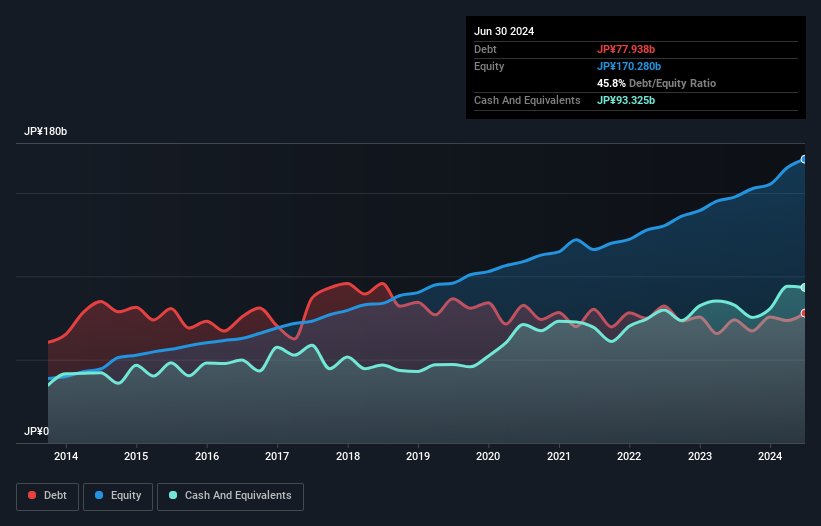

Overview: Starts Corporation Inc. operates in the construction, real estate management, and tenant recruitment sectors both in Japan and internationally, with a market cap of ¥173.10 billion.

Operations: Starts Corporation Inc. generates revenue primarily from its construction, real estate management, and tenant recruitment businesses. The company has a market cap of ¥173.10 billion.

Starts Corporation has shown consistent financial improvement, with earnings growing 8.3% annually over the past five years. The company’s debt to equity ratio decreased from 81% to 44.4%, indicating better financial health. Trading at a notable discount of 22.2% below its fair value, Starts offers good relative value compared to industry peers. Furthermore, it is free cash flow positive and profitable, ensuring no concerns about its cash runway or interest coverage issues in the near term.

- Unlock comprehensive insights into our analysis of Starts stock in this health report.

Evaluate Starts' historical performance by accessing our past performance report.

Summing It All Up

- Embark on your investment journey to our 743 Japanese Undiscovered Gems With Strong Fundamentals selection here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8850

Starts

Engages in the construction, real estate management, and tenant recruitment businesses in Japan and internationally.

Flawless balance sheet, undervalued and pays a dividend.