- Japan

- /

- Real Estate

- /

- TSE:8802

Mitsubishi Estate (TSE:8802): Valuation in Focus After Share Buyback and New Bond Listing

Reviewed by Kshitija Bhandaru

Mitsubishi Estate (TSE:8802) just wrapped up a major share buyback, repurchasing over 2% of its shares. At the same time, the company is moving to raise fresh capital through a new bond listing in Singapore. Investors are watching how these dual actions shape the company’s financial outlook.

See our latest analysis for Mitsubishi Estate.

Mitsubishi Estate’s recently completed 2% share buyback and new bond listing have set a confident tone, reinforcing its commitment to both shareholder value and financial resilience. The company’s 1-year total shareholder return is up nearly 0.5%, but long-term investors have seen steady compounding. Momentum has built slightly in recent quarters as the business adapts to changing market conditions.

If you’re keeping an eye out for what’s next in real estate, consider broadening your search and discover fast growing stocks with high insider ownership

After these strategic moves and a year of steady gains, the main question remains: Is Mitsubishi Estate trading at a discount that presents a buying opportunity, or have markets already priced in its future growth?

Price-to-Earnings of 21.4x: Is it justified?

Mitsubishi Estate shares are trading at a price-to-earnings (P/E) ratio of 21.4x, significantly higher than both its industry peers and what might be considered fair for the sector. With a last close of ¥3,421, the company is positioned at a steep premium relative to the broader Japanese real estate market.

The price-to-earnings ratio compares a company’s current share price to its per-share earnings, offering a quick sense of market expectations for its future profitability. For real estate companies like Mitsubishi Estate, a higher P/E can reflect anticipated growth, quality assets, or strong operational performance. It can also indicate over-enthusiasm or undervaluation elsewhere in the sector.

Despite recent gains in earnings and a forecast for continued, if moderate, profit growth, the company’s elevated ratio suggests the market is pricing in robust future performance. However, the P/E of 21.4x exceeds the industry average of just 11.4x and also runs above an estimated fair P/E of 20.6x. This may indicate that expectations are running ahead of fundamentals, and it is a level the market could eventually reconsider.

Explore the SWS fair ratio for Mitsubishi Estate

Result: Price-to-Earnings of 21.4x (OVERVALUED)

However, slower revenue and net income growth trends could make it difficult for Mitsubishi Estate to sustain elevated market expectations in the future.

Find out about the key risks to this Mitsubishi Estate narrative.

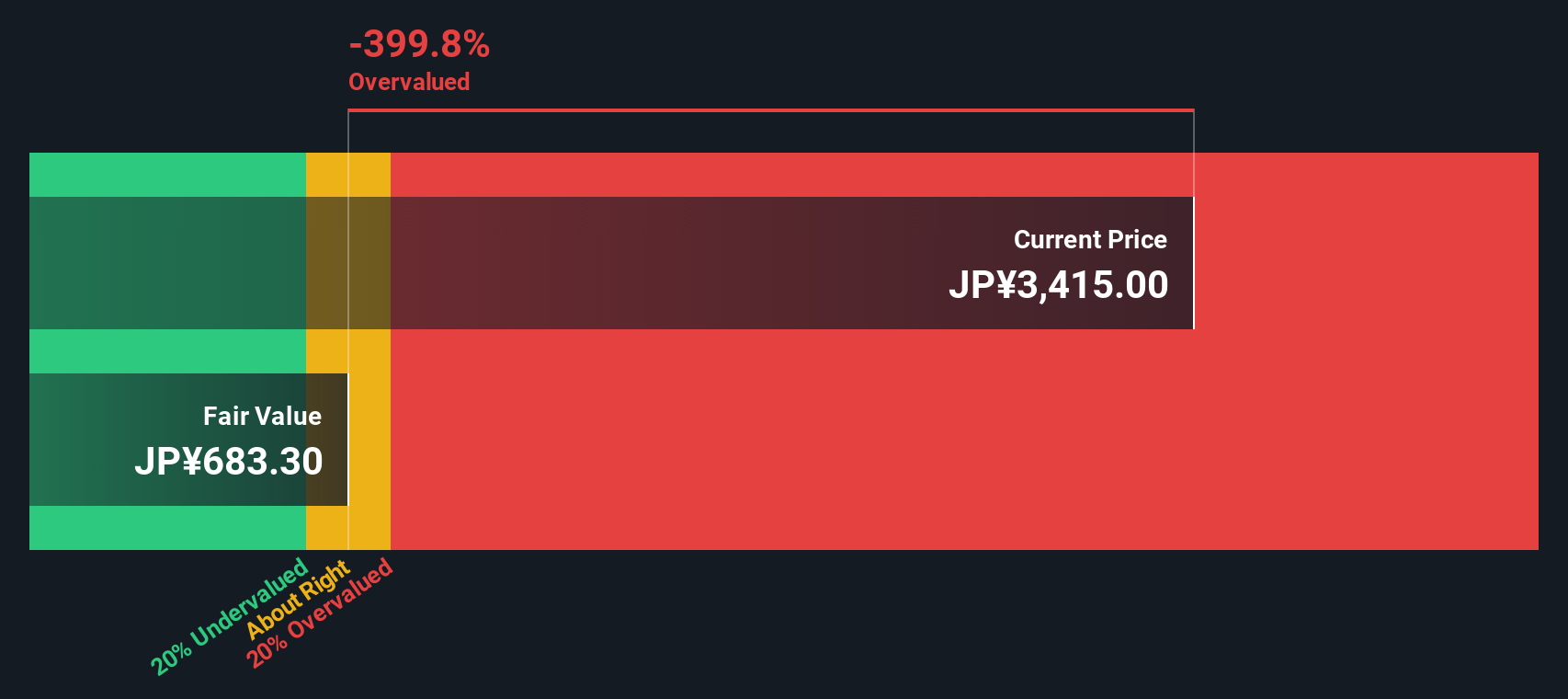

Another View: Discounted Cash Flow Model Puts Things in Perspective

Looking at Mitsubishi Estate through our DCF model gives a very different result. The current market price of ¥3,421 is well above our estimate of fair value at ¥676.48. In plain terms, this method suggests the stock could be significantly overvalued by this approach. Could the market be too optimistic, or does the DCF miss something about the long-term real estate story?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Mitsubishi Estate for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Mitsubishi Estate Narrative

Of course, if you’d rather draw your own conclusions or dig into the numbers independently, you can easily put together your own narrative in just a few minutes with Do it your way.

A great starting point for your Mitsubishi Estate research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors know that opportunities go far beyond one company. Activate your search for market-beating ideas with these powerful tools so you never miss what’s next.

- Uncover significant potential in emerging companies by checking out these 3574 penny stocks with strong financials, which feature strong financials and growth stories.

- Capture tomorrow’s breakthroughs and get ahead of the curve when you start with these 26 quantum computing stocks, highlighting innovators in quantum computing.

- Boost your returns with steady income streams by evaluating these 19 dividend stocks with yields > 3%, which offers attractive yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8802

Mitsubishi Estate

Engages in the real estate activities in Japan and internationally.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives