- Japan

- /

- Real Estate

- /

- TSE:8802

A Look at Mitsubishi Estate’s (TSE:8802) Valuation Following Share Buyback Completion and Upgraded Dividend Guidance

Reviewed by Simply Wall St

Mitsubishi Estate (TSE:8802) just wrapped up a major share buyback and rolled out higher dividend guidance. The company completed its repurchase plan and announced a boost to both near-term and future dividends.

See our latest analysis for Mitsubishi Estate.

These shareholder-focused moves have helped Mitsubishi Estate fuel positive momentum, with its stock up 50.7% year-to-date and a 56% total shareholder return over the last twelve months. Recent performance suggests growing confidence in its long-term outlook, especially after the company completed its major buyback and boosted dividends.

If you’re interested in discovering what other companies are showing strong momentum and management confidence, now is a great moment to explore fast growing stocks with high insider ownership.

With the buyback and dividends now in focus, the key question remains: is Mitsubishi Estate’s recent surge leaving room for further upside, or has the market already priced in the company’s expected growth and renewed shareholder rewards?

Price-to-Earnings of 20.2x: Is it justified?

Mitsubishi Estate’s current price-to-earnings (P/E) ratio stands at 20.2x, which puts it at a premium compared to its peers and the broader Japanese real estate industry. With a last close price of ¥3,286, investors appear to be paying up for growth and shareholder returns. Is that multiple supported by underlying fundamentals?

The price-to-earnings ratio compares a company’s share price to its earnings per share and is a widely used metric to evaluate whether a stock is fairly valued. For real estate management and development firms, the P/E gauge provides insight into how much investors expect future profits to grow versus what has already been achieved.

Right now, Mitsubishi Estate’s 20.2x multiple is not only well above the industry average of 11x, but it also surpasses the estimated fair P/E ratio of 19.7x. This signals that the market is attaching a higher value to Mitsubishi Estate’s earnings, potentially due to momentum from recent buybacks and dividend hikes. However, when compared to the fair P/E ratio set by market benchmarks, this level leaves little room for upside without further profit acceleration. If the market returns to a more conservative valuation, the stock could see its multiple move toward this fair level.

Explore the SWS fair ratio for Mitsubishi Estate

Result: Price-to-Earnings of 20.2x (OVERVALUED)

However, slowing revenue and earnings growth, or a market pullback from recent highs, could quickly challenge the current optimistic sentiment.

Find out about the key risks to this Mitsubishi Estate narrative.

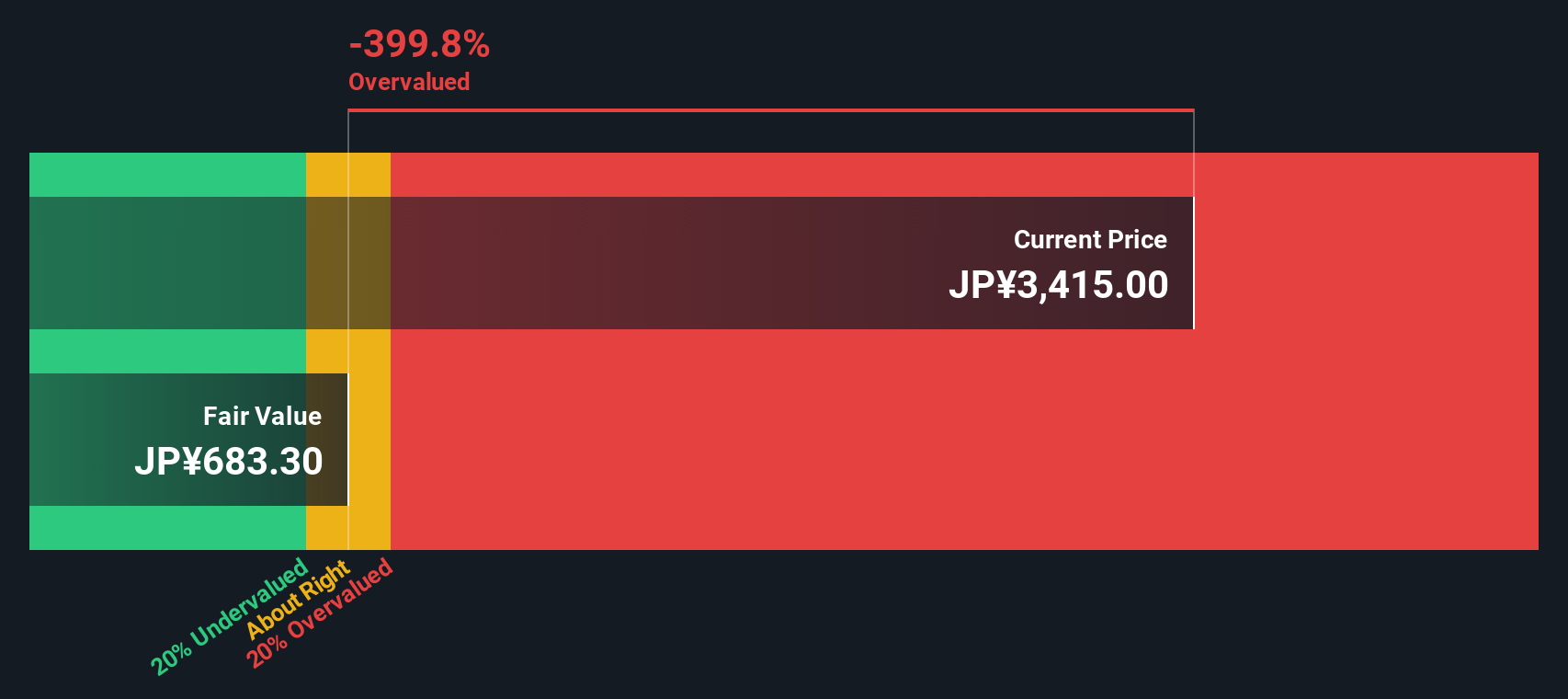

Another View: DCF Model Tells a Different Story

While the price-to-earnings ratio suggests Mitsubishi Estate may be overvalued, our DCF model offers a starker contrast. It estimates fair value at only ¥674 per share, which is far below the current price. This wide gap challenges the market’s confidence in future growth and raises the question: could investors be overestimating long-term potential?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Mitsubishi Estate for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 855 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Mitsubishi Estate Narrative

If you have your own perspective or want to examine the latest figures firsthand, you can piece together your own storyline in just a few minutes by using Do it your way.

A great starting point for your Mitsubishi Estate research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors always keep fresh ideas in play. Tease out new opportunities that could reshape your portfolio and give you an edge in today’s dynamic market.

- Unlock powerful growth potential when you check out these 855 undervalued stocks based on cash flows across various sectors. This can help ensure you never overpay for tomorrow’s winners.

- Capture reliable income streams by reviewing these 15 dividend stocks with yields > 3% with yields over 3%. This approach is ideal for building lasting wealth through steady returns.

- Position yourself on the frontier of innovation by accessing these 25 AI penny stocks that are shaping artificial intelligence and redefining the industries of tomorrow.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8802

Mitsubishi Estate

Engages in the real estate activities in Japan and internationally.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives