- Japan

- /

- Real Estate

- /

- TSE:8801

Mitsui Fudosan (TSE:8801) Is Up 6.2% After Announcing Major Buyback and Dividend Hike—Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- On November 7, 2025, Mitsui Fudosan Co., Ltd. announced a major share repurchase program of up to 60 million shares worth ¥57 billion and approved an increase in dividends for the year ending March 31, 2026, following the release of strong half-year earnings results showing higher sales and net income versus the prior year.

- These capital allocation decisions, paired with robust financial results, reflect management’s active efforts to reward shareholders and signal confidence in the company’s long-term prospects.

- We’ll explore how this new share buyback plan could reinforce the company’s focus on shareholder returns and reshape its investment narrative.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Mitsui Fudosan Investment Narrative Recap

To own Mitsui Fudosan, investors need to believe in the strength of premium Tokyo real estate and the company’s ability to balance significant development investments with ongoing shareholder returns. The recent increase in dividends and the sizeable share buyback program both support the ongoing story that management is committed to rewarding shareholders, but these actions do not materially change the key near-term catalyst, improving margins from continued demand in high-end office and residential markets, nor do they mitigate the main risk tied to elevated debt and potential interest rate increases.

Among the recent announcements, the half-year earnings update stands out: Mitsui Fudosan reported a surge in both sales and net income, with basic earnings per share rising to JPY 54.88 from JPY 31.55 the previous year. This solid financial performance is particularly relevant, as strong underlying earnings provide more room for the company to comfortably execute capital allocation decisions like the new share buyback and dividend increase, reinforcing its ability to support shareholder value while managing ongoing market risks.

But investors should be aware that, despite recent returns, elevated debt levels and changing rate conditions may alter the picture if...

Read the full narrative on Mitsui Fudosan (it's free!)

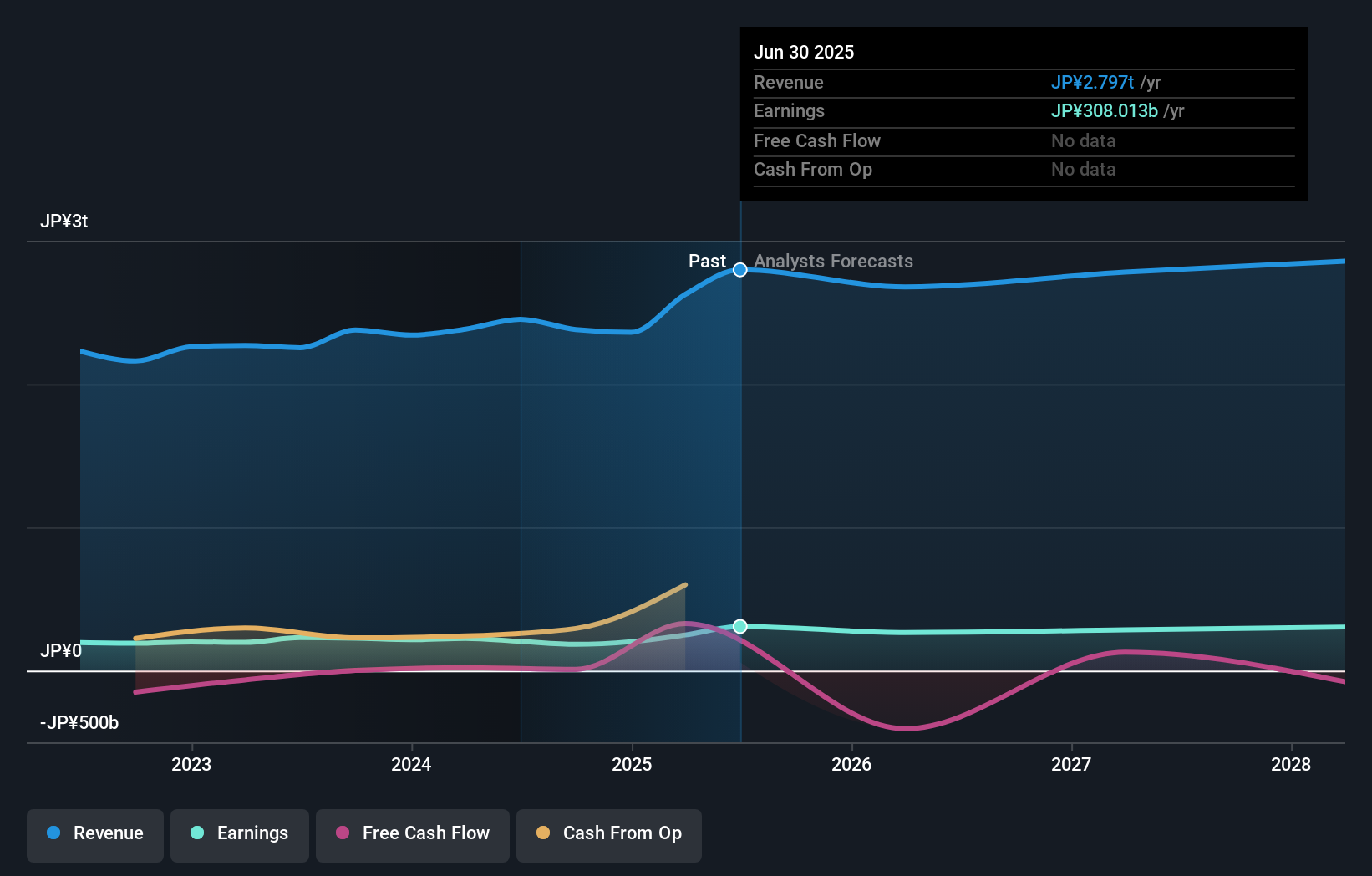

Mitsui Fudosan's narrative projects ¥2,872.2 billion in revenue and ¥304.4 billion in earnings by 2028. This requires a 0.9% annual revenue decline and a ¥3.6 billion decrease in earnings from ¥308.0 billion today.

Uncover how Mitsui Fudosan's forecasts yield a ¥1805 fair value, a 7% upside to its current price.

Exploring Other Perspectives

Only one fair value estimate from the Simply Wall St Community sits at ¥1,804 per share. While strong recent earnings have improved the company’s financial posture, heightened debt exposure means broader shifts in monetary policy could still affect Mitsui Fudosan’s outlook. Explore more views to get the full picture.

Explore another fair value estimate on Mitsui Fudosan - why the stock might be worth as much as 7% more than the current price!

Build Your Own Mitsui Fudosan Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mitsui Fudosan research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Mitsui Fudosan research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mitsui Fudosan's overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8801

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives