Eisai (TSE:4523) Valuation in Focus Following Canadian Approval for Alzheimer’s Drug and Cancer Trial Results

Reviewed by Simply Wall St

Eisai (TSE:4523) just received approval in Canada for LEQEMBI (lecanemab), its first-in-class treatment for early Alzheimer's disease. This marks a significant milestone that follows successful authorizations in the U.S., Japan, and the EU.

This regulatory progress is driven by strong Phase 3 trial results and comes as Eisai, together with Merck, also reported positive data from late-stage cancer studies. These developments highlight the company’s commitment to new therapies in neurology and oncology.

See our latest analysis for Eisai.

While Eisai’s rapid-fire news on Alzheimer’s and cancer breakthroughs has raised its profile, the 1-year total shareholder return still sits at -10.9%, reflecting long-term headwinds despite surging innovation. Momentum has been muted in recent months, though the latest product wins may renew investor optimism for the long haul.

If Eisai’s pipeline activity got you curious about other healthcare leaders with growth potential, check out the current opportunities in our Healthcare Stocks Screener: See the full list for free.

With shares still trading at a notable discount to analyst targets, is the market underestimating Eisai’s future prospects? Alternatively, has the recent wave of approvals already been factored in, presenting a real buying opportunity or not?

Most Popular Narrative: 13% Undervalued

Eisai’s most closely followed narrative sees a fair value significantly above the recent close. This sets the stage for a closer look at the drivers behind the current outlook and future expectations.

The launch and approval of the home-administered SC-AI formulation for LEQEMBI, with high physician and patient anticipation, promises to unlock substantial incremental demand through enhanced convenience, improved treatment adherence, and reduced burden on healthcare systems. This could benefit both topline revenues and margins through operational efficiencies and lower administration costs.

What’s the secret sauce behind this bullish stance? This widely followed narrative banks on a unique blend of premium pricing power, the explosive growth of one breakthrough therapy, and ambitious profit margin goals. Wondering how much revenue and earnings growth analysts are factoring in to justify this valuation? The missing pieces await in the full narrative.

Result: Fair Value of ¥5,027 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, it is important to note that global drug pricing pressure and Eisai’s reliance on just a few flagship therapies could quickly derail this optimistic outlook.

Find out about the key risks to this Eisai narrative.

Another View: What Do Market Ratios Suggest?

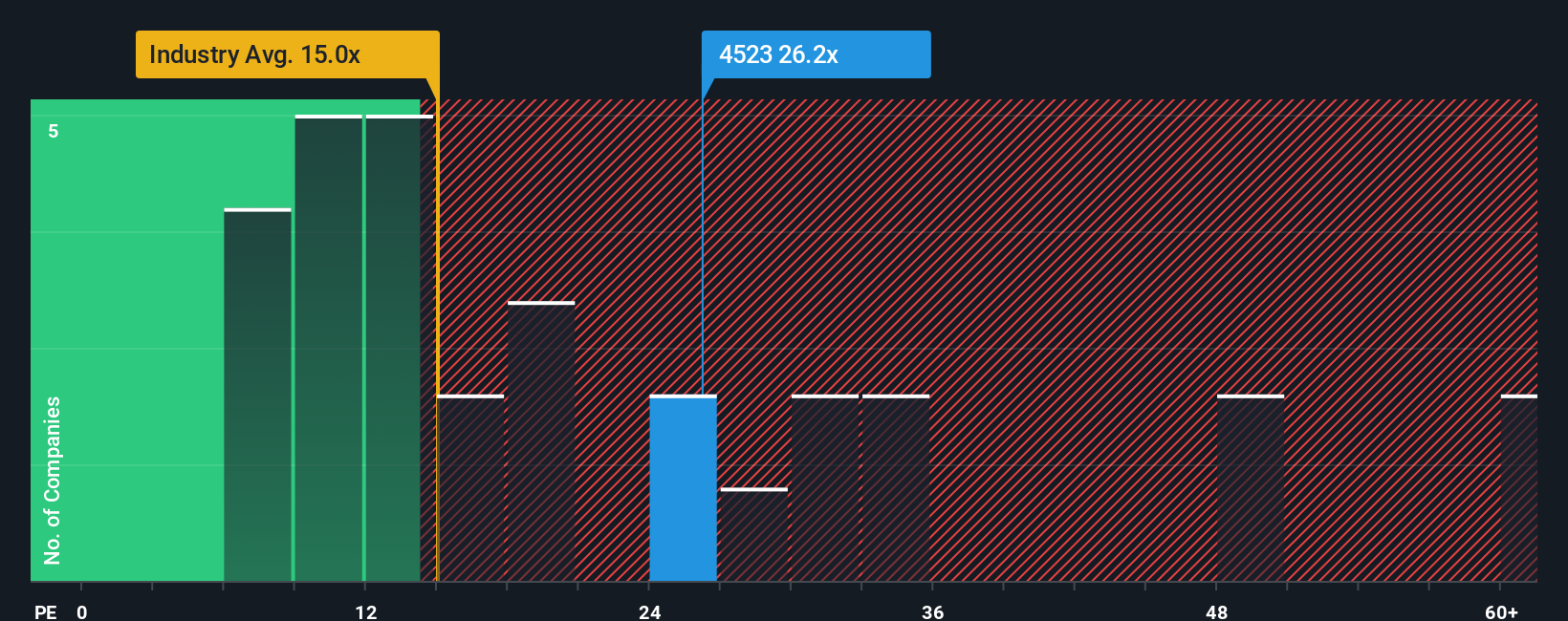

Looking at traditional market ratios provides a different lens. Eisai trades at a price-to-earnings ratio of 25x, making it notably pricier than the Japanese pharmaceuticals industry average of 13.8x and the peer average of 20.1x. Even compared to its fair ratio of 22.7x, Eisai appears somewhat expensive. Does this mismatch highlight market optimism or caution investors should heed?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Eisai Narrative

If you feel differently about Eisai’s outlook or enjoy diving into your own data-driven research, building your narrative takes just minutes: Do it your way

A great starting point for your Eisai research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Take action now and expand your opportunity set with strategies that go beyond the obvious picks. Give yourself the edge and avoid missing out on tomorrow's winners by checking out these hand-picked ideas:

- Kickstart your search for overlooked value by reviewing these 859 undervalued stocks based on cash flows that could deliver strong returns as the market catches up.

- Stay ahead of tomorrow’s tech shift, tapping into the momentum of artificial intelligence via these 25 AI penny stocks poised for major growth.

- Find steady income streams by exploring these 17 dividend stocks with yields > 3% offering reliable yields above 3% for your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eisai might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4523

Eisai

Engages in the research and development, manufacture, sale, and import and export of pharmaceuticals.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives