Will Higher Profit Guidance from North American ORGOVYX Sales Shift Sumitomo Pharma’s (TSE:4506) Narrative

Reviewed by Sasha Jovanovic

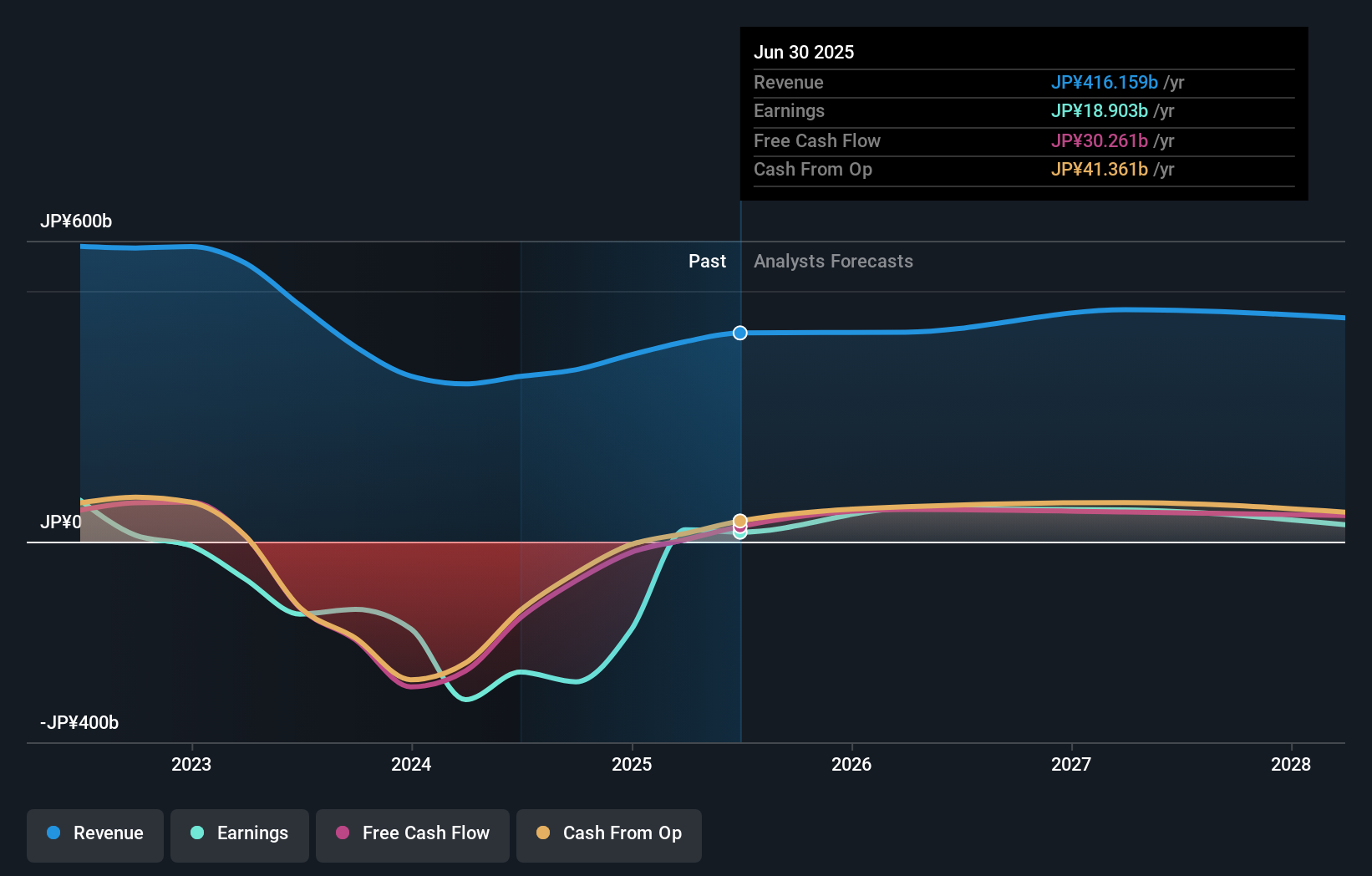

- Sumitomo Pharma recently raised its earnings guidance for both the half-year ended September 30, 2025, and the full year ending March 31, 2026, citing increased revenue projections, operating profit, and net profit, driven significantly by strong sales of ORGOVYX in North America.

- An important aspect of this announcement is the additional financial benefit achieved from a weaker yen and the reversal of deferred tax liabilities, reflecting favorable currency movements and accounting factors alongside pharmaceutical sales momentum.

- We'll explore how the upward revision in full-year profit guidance, fueled by North American growth and currency effects, impacts Sumitomo Pharma's investment story.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Sumitomo Pharma's Investment Narrative?

To be a shareholder in Sumitomo Pharma, you really need to believe in the company’s ability to sustain its turnaround through robust pharmaceutical sales, shrewd cost management, and successful overseas expansion. The recent upward revision to earnings guidance signals a material shift in the short-term catalysts, namely, continued strong demand for ORGOVYX in North America and the positive impact of currency movements on profitability. This significantly boosts near-term momentum, especially as prior projections underestimated both revenue and bottom-line potential. However, the sharply improved outlook may also raise the stakes for upcoming earnings releases, as expectations for ongoing sales strength and disciplined spending have now moved higher. Risks around earnings volatility, particularly given expense timing and lower R&D outlays in the first half, deserve close attention since any reversal or slowdown here could weigh on sentiment just as optimism peaks. In contrast, uncertainty remains around how quickly North American sales can keep offsetting cost swings and currency movements.

Sumitomo Pharma's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 2 other fair value estimates on Sumitomo Pharma - why the stock might be worth over 2x more than the current price!

Build Your Own Sumitomo Pharma Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sumitomo Pharma research is our analysis highlighting 4 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Sumitomo Pharma research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sumitomo Pharma's overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4506

Sumitomo Pharma

Engages in manufacture, purchase, and sale of pharmaceutical products for medical treatment in Japan, North America, and Asia.

Undervalued with slight risk.

Similar Companies

Market Insights

Community Narratives