Takeda (TSE:4502) Valuation Spotlight After New HYQVIA Device Launch in the U.S.

Reviewed by Simply Wall St

Takedа Pharmaceutical (TSE:4502) just made headlines with news that its newly FDA-approved HyHub and HyHub Duo devices are now available in the U.S. for HYQVIA patients over 17. This product launch aims to make infusions easier for both patients and healthcare providers, and it is opening some fresh avenues for HYQVIA’s adoption and use.

See our latest analysis for Takeda Pharmaceutical.

Takeda Pharmaceutical’s recent string of newsworthy moves, including a high-profile oncology partnership and a major presence at global industry events, has kept its name on investors’ radars. While the share price sits at ¥4,310 after a modest 1-day dip, the company’s one-year total shareholder return of 6.4% and a solid 24.6% over three years signal steady momentum. The combination of product innovation and strategic alliances continues to shape its long-term outlook.

If you’re curious about which other healthcare leaders are on the move or gaining traction, this is a good moment to explore See the full list for free.

The question for investors now is whether Takeda’s recent momentum and product innovation are already reflected in the share price, or if the stock is still undervalued, presenting a genuine buying opportunity.

Most Popular Narrative: 12.9% Undervalued

Takeda Pharmaceutical's most followed narrative estimates fair value notably higher than its current share price, suggesting meaningful upside potential if analyst projections materialize. The last close was ¥4,310, while the narrative places fair value at ¥4,949.73. This sets the stage for what drives this optimistic outlook.

The anticipated moderation and eventual stabilization of VYVANSE generic erosion after FY2025 will remove a major headwind for revenues. This would allow Takeda's core growth and launch products to drive top-line and earnings recovery going forward. Rapid progress and positive late-stage data from Takeda's innovative pipeline, especially in high-need therapeutic areas like rare diseases (orexin agonists for narcolepsy, rusfertide for polycythemia vera), set the stage for multiple high-value product launches. These developments may catalyze multi-year revenue and margin expansion.

Curious what’s behind this bullish mindset? The narrative hinges on blockbuster earnings shifts, aggressive profit margin targets, and a future PE ratio that might surprise you. Want to know which numbers really tip the scales? The details that shape this valuation are just a click away.

Result: Fair Value of ¥4,949.73 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition in key markets and tighter drug pricing reforms could quickly challenge these optimistic projections if they are not offset by new launches.

Find out about the key risks to this Takeda Pharmaceutical narrative.

Another View: Market Multiples Raise Questions

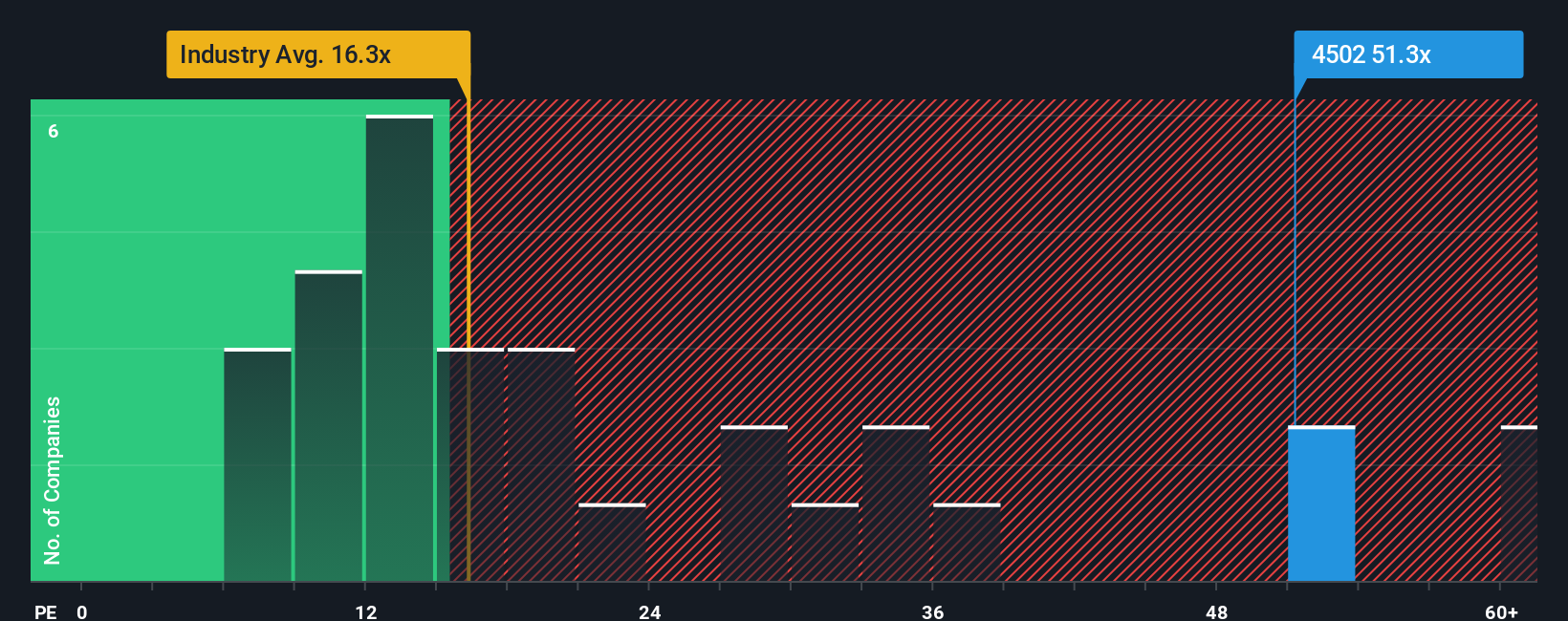

While the fair value estimate paints Takeda as undervalued, the market’s favored price-to-earnings ratio tells a more skeptical story. At 49.2x, Takeda trades far above both the industry average of 15.3x and the peer average of 24.9x, and even well ahead of the fair ratio of 29.6x. This signals the current price is factoring in significant future growth, which could be at risk if expectations are not met. How long can this growth premium last?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Takeda Pharmaceutical Narrative

If you're not sold on this perspective or want to dig into the figures yourself, you can build your own view of Takeda in just a few minutes. Do it your way

A great starting point for your Takeda Pharmaceutical research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors go where opportunity strikes first. Don’t miss your shot: put these hand-picked stock ideas on your radar and stay ahead of the market.

- Capture the potential for rapid gains by checking out these 3566 penny stocks with strong financials, which combine strong financials with under-the-radar status.

- Grow your passive income with these 19 dividend stocks with yields > 3%, featuring companies that offer yields above 3% and solid fundamentals.

- Harness the future of medicine by targeting innovation with these 34 healthcare AI stocks to see which companies are integrating AI with real-world healthcare impact.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Takeda Pharmaceutical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4502

Takeda Pharmaceutical

Engages in the research, development, manufacture, marketing, and out-licensing of pharmaceutical products in Japan and internationally.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives