Stock Analysis

- Japan

- /

- Entertainment

- /

- TSE:9697

High Growth Tech Stocks In Japan To Watch This September 2024

Reviewed by Simply Wall St

Japan's stock markets have experienced a volatile month, with the Nikkei 225 Index gaining 0.7% and the broader TOPIX Index up 1.0%, recovering from earlier sell-offs driven by renewed U.S. growth fears and yen carry trade unwinding. With this backdrop, identifying high-growth tech stocks can be crucial for investors looking to capitalize on market resilience and technological advancements in Japan’s economy.

Top 10 High Growth Tech Companies In Japan

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Hottolink | 51.80% | 61.94% | ★★★★★★ |

| Cyber Security Cloud | 20.71% | 25.73% | ★★★★★☆ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.97% | 30.50% | ★★★★★★ |

| f-code | 22.70% | 22.62% | ★★★★★☆ |

| SHIFT | 20.25% | 32.08% | ★★★★★★ |

| Kanamic NetworkLTD | 20.75% | 28.25% | ★★★★★★ |

| Bengo4.comInc | 20.76% | 46.76% | ★★★★★★ |

| ExaWizards | 22.69% | 62.99% | ★★★★★★ |

| Money Forward | 20.68% | 68.12% | ★★★★★★ |

Let's explore several standout options from the results in the screener.

Trend Micro (TSE:4704)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Trend Micro Incorporated develops and sells security-related software for computers and related services in Japan and internationally, with a market cap of ¥1.16 trillion.

Operations: Trend Micro generates revenue primarily from its security-related software and services, with the Asia Pacific region contributing ¥126.28 billion, followed by Japan at ¥84.17 billion, the Americas at ¥70.46 billion, and Europe at ¥63.59 billion.

Trend Micro's recent collaboration with GMI Cloud and its active role in the Coalition for Secure AI (COSAI) underscore its commitment to AI-driven cybersecurity innovations. Despite a 37.3% earnings drop last year, revenue is projected to grow at 6.2% annually, outpacing Japan's market average of 4.3%. Investment in R&D remains robust, with ¥39 billion spent on share buybacks this year alone, highlighting strategic financial maneuvers amid M&A rumors and stock underperformance.

- Take a closer look at Trend Micro's potential here in our health report.

Understand Trend Micro's track record by examining our Past report.

Dexerials (TSE:4980)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Dexerials Corporation manufactures and sells electronic components, bonding materials, optics materials, and other products in Japan, with a market cap of ¥370.05 billion.

Operations: Dexerials Corporation generates revenue primarily from its Optical Materials and Components segment (¥48.07 billion) and Electronic Materials and Components segment (¥51.43 billion). The company focuses on producing specialized materials for electronic and optical applications in the Japanese market.

Dexerials has demonstrated robust earnings growth, with a 26.7% increase over the past year, significantly outpacing the electronic industry’s 7.8%. The company is forecasted to grow its revenue by 5.7% annually and its earnings by 8.7%, surpassing Japan's market averages of 4.3% and 8.6%, respectively. Dexerials' focus on innovation is evident from their substantial R&D expenditure, which reached ¥15 billion last year, underscoring their commitment to advancing technology in adhesive materials and optical solutions for high-profile clients like TSMC.

- Unlock comprehensive insights into our analysis of Dexerials stock in this health report.

Examine Dexerials' past performance report to understand how it has performed in the past.

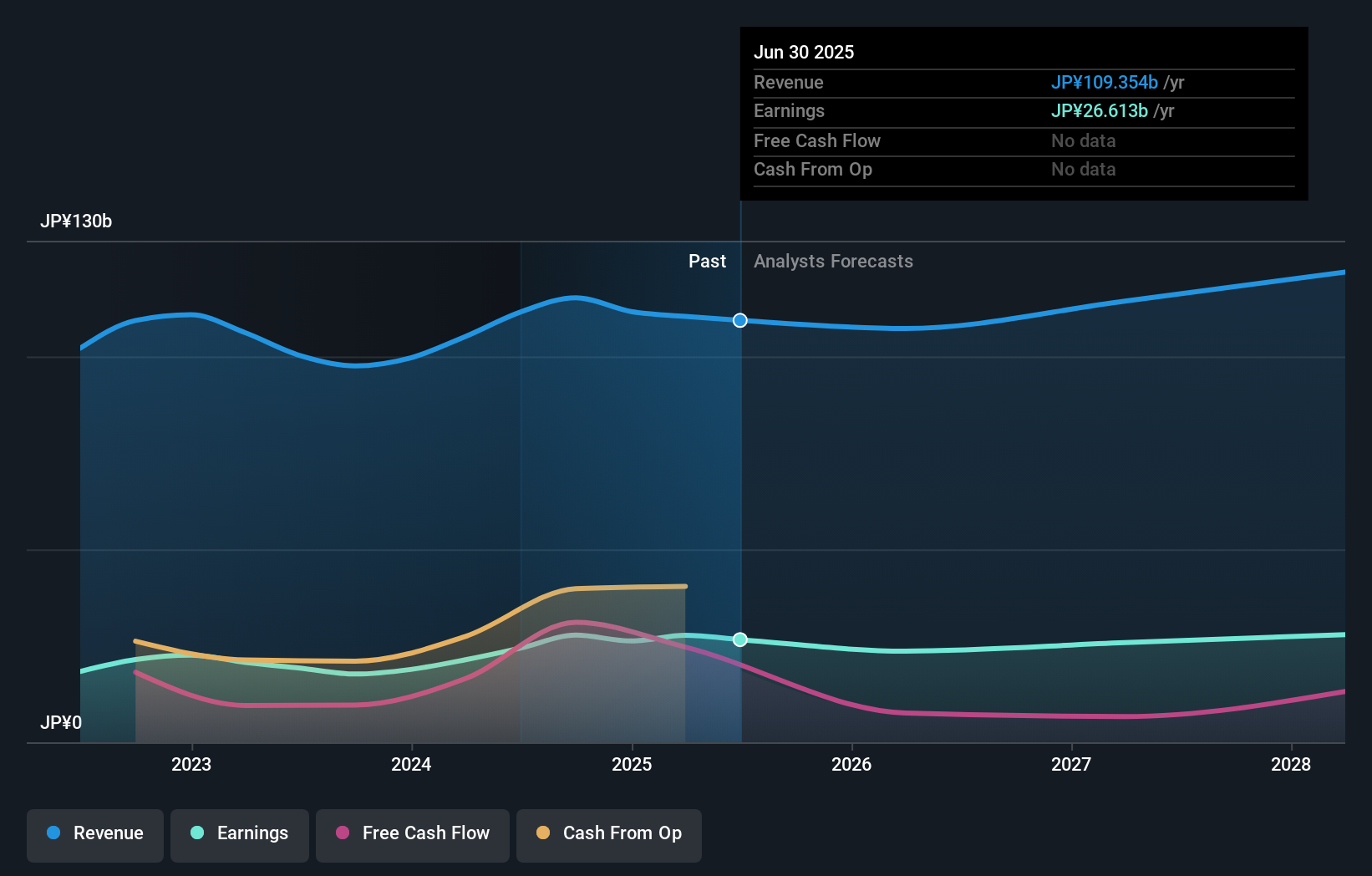

Capcom (TSE:9697)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Capcom Co., Ltd. plans, develops, manufactures, sells, and distributes home video games, online games, mobile games, and arcade games in Japan and internationally with a market cap of ¥1.34 trillion.

Operations: Capcom generates revenue primarily from Digital Content, contributing ¥103.38 billion, followed by Amusement Facilities at ¥20.09 billion and Amusement Equipment at ¥10.34 billion. The company's diverse portfolio includes home video games, online games, mobile games, and arcade games distributed both in Japan and internationally.

Capcom's earnings are projected to grow at 14.5% annually, outpacing Japan's market average of 8.6%. Despite a recent -23.3% earnings decline, its revenue is forecasted to increase by 9.5% per year, surpassing the national average of 4.3%. The company's substantial R&D expenditure underscores its commitment to innovation in gaming and digital entertainment sectors, with notable contributions from popular franchises like Resident Evil and Monster Hunter driving future growth potential.

- Dive into the specifics of Capcom here with our thorough health report.

Evaluate Capcom's historical performance by accessing our past performance report.

Where To Now?

- Click this link to deep-dive into the 129 companies within our Japanese High Growth Tech and AI Stocks screener.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9697

Capcom

Plans, develops, manufactures, sells, and distributes home video games, online games, mobile games, and arcade games in Japan and internationally.