GMO internet, Inc.'s (TSE:4784) Stock Retreats 25% But Revenues Haven't Escaped The Attention Of Investors

Unfortunately for some shareholders, the GMO internet, Inc. (TSE:4784) share price has dived 25% in the last thirty days, prolonging recent pain. Looking at the bigger picture, even after this poor month the stock is up 83% in the last year.

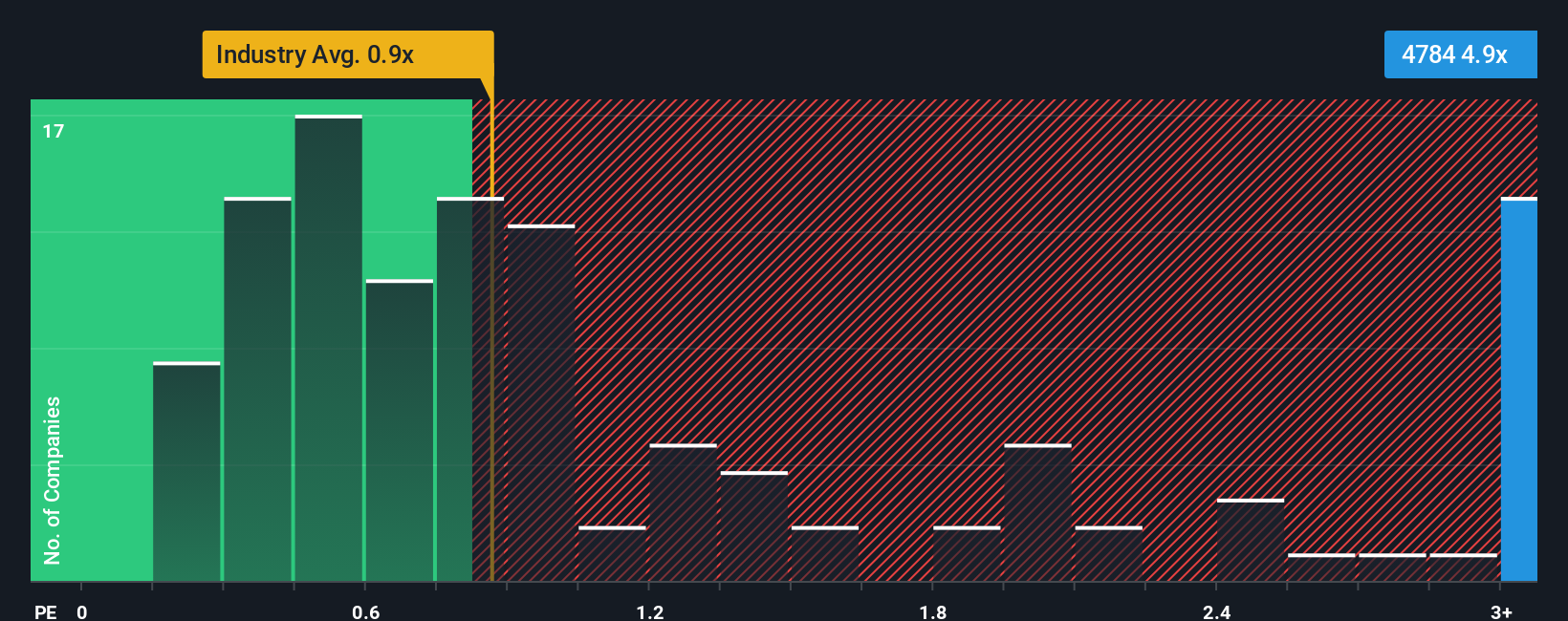

In spite of the heavy fall in price, when almost half of the companies in Japan's Media industry have price-to-sales ratios (or "P/S") below 0.9x, you may still consider GMO internet as a stock not worth researching with its 4.9x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for GMO internet

How Has GMO internet Performed Recently?

GMO internet certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on GMO internet will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For GMO internet?

GMO internet's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 238%. Pleasingly, revenue has also lifted 81% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 78% as estimated by the sole analyst watching the company. With the industry only predicted to deliver 8.2%, the company is positioned for a stronger revenue result.

In light of this, it's understandable that GMO internet's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

Even after such a strong price drop, GMO internet's P/S still exceeds the industry median significantly. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that GMO internet maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Media industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for GMO internet that you should be aware of.

If these risks are making you reconsider your opinion on GMO internet, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:4784

High growth potential with excellent balance sheet.

Market Insights

Community Narratives