- Japan

- /

- Entertainment

- /

- TSE:2329

Top Three Japanese Dividend Stocks In July 2024

Reviewed by Simply Wall St

Amidst a backdrop of surging indices, Japan's stock markets have shown remarkable strength in July 2024, with the Nikkei 225 and TOPIX indices reaching all-time highs. This robust performance sets an optimistic stage for investors considering Japanese dividend stocks, which can offer potential stability and steady income in a flourishing market environment.

Top 10 Dividend Stocks In Japan

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 3.74% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.65% | ★★★★★★ |

| Globeride (TSE:7990) | 3.89% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.54% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 5.25% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.06% | ★★★★★★ |

| Nichimo (TSE:8091) | 4.03% | ★★★★★★ |

| InabataLtd (TSE:8098) | 3.44% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.54% | ★★★★★★ |

| Innotech (TSE:9880) | 3.99% | ★★★★★★ |

Click here to see the full list of 390 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Tohokushinsha Film (TSE:2329)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Tohokushinsha Film Corporation, based in Japan, operates as a media business company with a market capitalization of approximately ¥74.43 billion.

Operations: Tohokushinsha Film Corporation generates its revenue primarily through media-related activities in Japan.

Dividend Yield: 4.7%

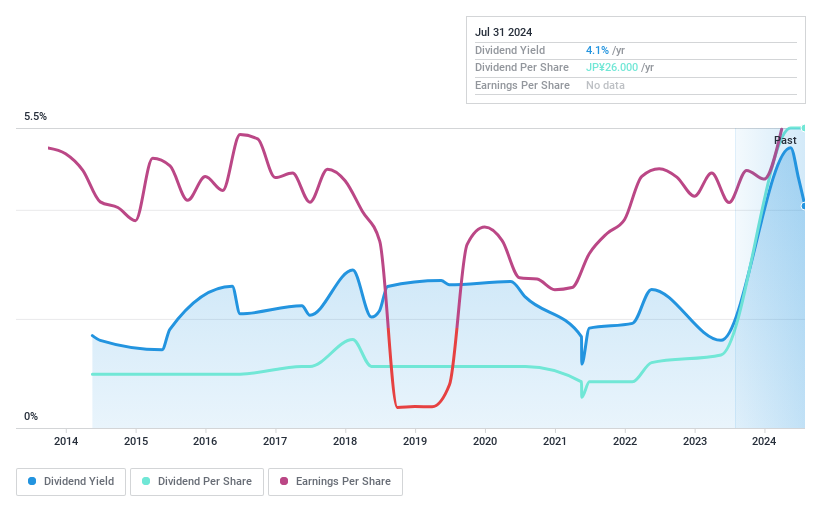

Tohokushinsha Film has exhibited a volatile dividend history over the past decade, with recent increases and subsequent decreases in its payout. Despite this, dividends are supported by a cash payout ratio of 63.4% and an earnings coverage at 87.2%, indicating reasonable sustainability from its cash flows and profits. The stock trades at a significant discount to estimated fair value, which might attract value investors despite its high share price volatility and inconsistent dividend payments. Recent corporate actions include a stock split and regular dividend payments scheduled, reflecting some level of commitment to returning value to shareholders.

- Dive into the specifics of Tohokushinsha Film here with our thorough dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Tohokushinsha Film shares in the market.

Human Holdings (TSE:2415)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Human Holdings Co., Ltd. operates in human resources, education, nursing care, and other sectors both in Japan and internationally, with a market capitalization of approximately ¥16.62 billion.

Operations: Human Holdings Co., Ltd. generates revenue from its operations in human resources, educational services, and nursing care sectors.

Dividend Yield: 4%

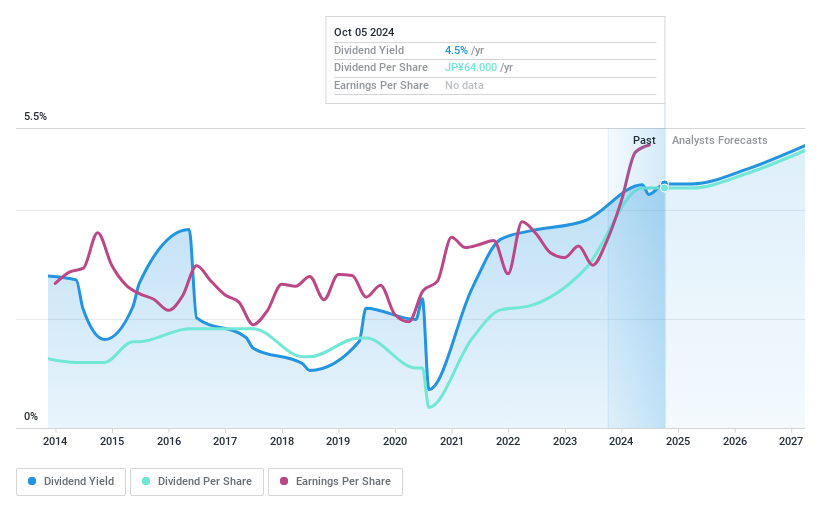

Human Holdings has increased its annual dividend to JPY 62.50 per share from JPY 27.00, with a future projection of JPY 64.00 for next year, reflecting a positive trend in shareholder returns. Despite a top-tier dividend yield of 4%, the company's dividends show low coverage by earnings and cash flows with payout ratios of 16.2% and 20.7% respectively, indicating sustainability concerns given its erratic dividend history over the past decade. However, it maintains an attractive price-to-earnings ratio at 7.7x, below the market average.

- Delve into the full analysis dividend report here for a deeper understanding of Human Holdings.

- Our comprehensive valuation report raises the possibility that Human Holdings is priced higher than what may be justified by its financials.

Tigers Polymer (TSE:4231)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Tigers Polymer Corporation specializes in manufacturing and selling rubber hoses, sheets, and molded products for various sectors including automotive, electrics, construction, housing, and industrial materials across Japan, Southeast Asia, the Americas, and China with a market cap of ¥17.87 billion.

Operations: Tigers Polymer Corporation generates revenue primarily from Japan (¥21.93 billion), the Americas (¥20.89 billion), China (¥4.84 billion), and Southeast Asia (¥4.02 billion).

Dividend Yield: 3.8%

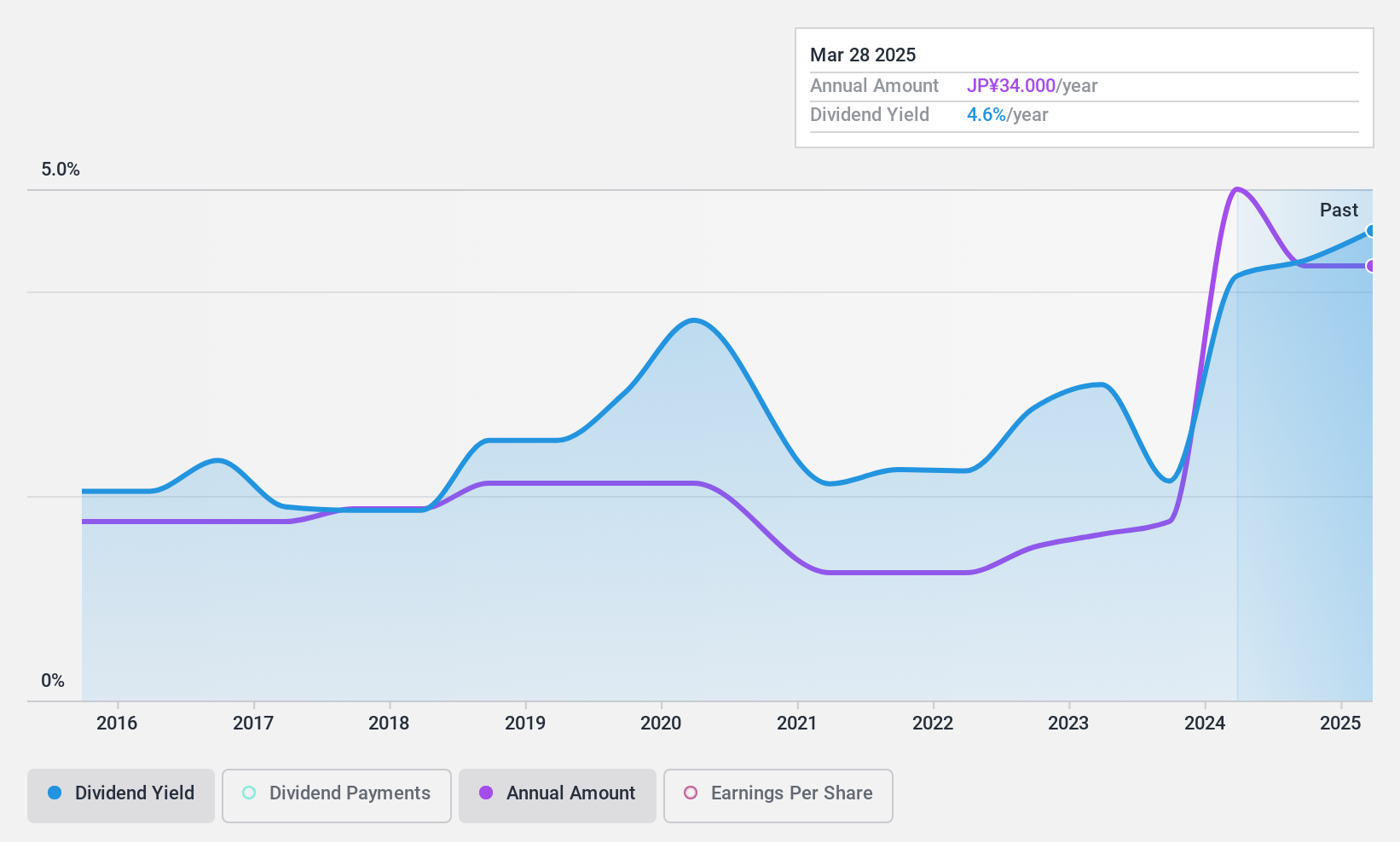

Tigers Polymer has experienced significant earnings growth, up 270% this past year, yet its dividend history is marked by instability. Despite a low price-to-earnings ratio at 5.9x—well below the Japanese market average of 14.4x—the company's dividends have been inconsistent and unreliable over the last decade. However, with a payout ratio of 31% and a cash payout ratio of 13.3%, its current dividends are well-supported by both earnings and cash flow, aligning with a competitive dividend yield of 3.79%.

- Unlock comprehensive insights into our analysis of Tigers Polymer stock in this dividend report.

- According our valuation report, there's an indication that Tigers Polymer's share price might be on the expensive side.

Seize The Opportunity

- Access the full spectrum of 390 Top Dividend Stocks by clicking on this link.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tohokushinsha Film might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2329

Flawless balance sheet with proven track record and pays a dividend.