- Japan

- /

- Metals and Mining

- /

- TSE:5857

ARE Holdings (TSE:5857): Assessing Valuation After Dividend Hikes and Upgraded Earnings Guidance

Reviewed by Simply Wall St

ARE Holdings (TSE:5857) just gave investors a double boost, announcing increases to both its interim and full-year dividends along with a higher earnings forecast for the year ending March 2026. These moves signal growing confidence in its financial outlook.

See our latest analysis for ARE Holdings.

ARE Holdings’ latest moves come on the back of impressive momentum. After a 53.7% year-to-date share price return, recent dividend hikes and upgraded forecasts add fuel to the rally. Over the last year, total shareholder return stands at 49.8%, highlighting consistent value delivered to investors while market optimism about long-term prospects continues to build.

If this surge in confidence has you wondering what else is gathering steam, broaden your search and discover fast growing stocks with high insider ownership

After this impressive run and fresh dividend boost, the big question is whether ARE Holdings’ current share price still leaves room for upside, or if the market has already factored in all this future growth. Could there still be a buying opportunity here?

Price-to-Earnings of 10.9x: Is it justified?

At a price-to-earnings (P/E) ratio of 10.9x, ARE Holdings trades below both the Japanese market average and its sector peers, pointing to apparent undervaluation versus competitors.

The P/E ratio measures how much investors are willing to pay for each yen of earnings generated by the company. For ARE Holdings, this figure is compelling, particularly given its strong recent earnings growth. It provides a snapshot of market expectations for future profitability.

When compared to the Japanese Metals and Mining industry average P/E of 12.5x and a calculated fair P/E of 14.5x, ARE Holdings appears to represent better value. The current multiple suggests the market may be underestimating the company’s growth prospects and earnings power. If investors reassess, the ratio could shift toward that higher fair P/E level.

Explore the SWS fair ratio for ARE Holdings

Result: Price-to-Earnings of 10.9x (UNDERVALUED)

However, a shortfall in earnings or slower revenue growth could limit further upside in ARE Holdings’ shares, even though the valuation is currently attractive.

Find out about the key risks to this ARE Holdings narrative.

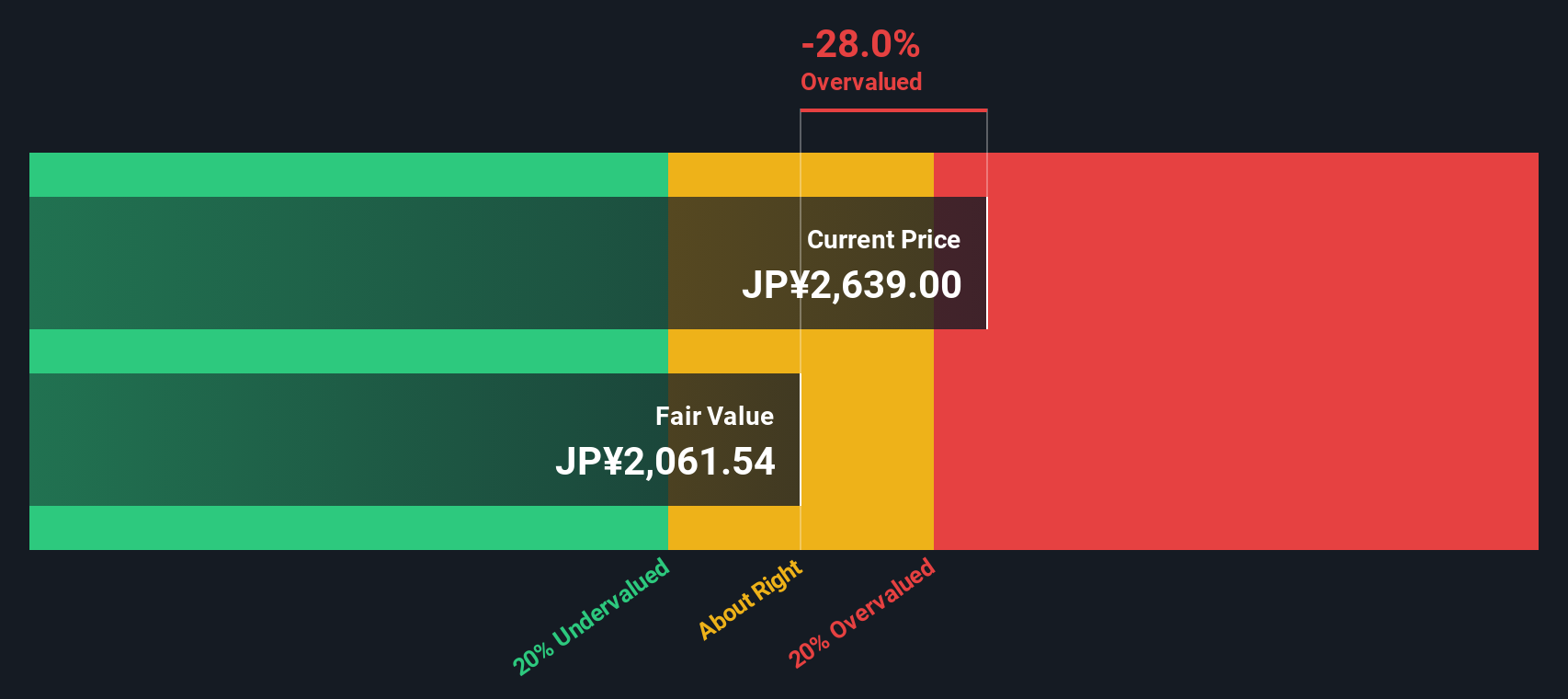

Another View: Discounted Cash Flow Suggests Shares Are Overvalued

Looking at the SWS DCF model, there is a different story. According to this approach, ARE Holdings’ current share price of ¥2,633 is trading above its estimated fair value of ¥2,065.05, suggesting the stock may actually be overvalued if you trust the DCF methodology. Is the market’s optimism outpacing the fundamentals, or could future cash flows surprise to the upside?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out ARE Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 861 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own ARE Holdings Narrative

If our perspective differs from yours, or you’d rather dive into the details yourself, it takes just a few minutes to craft your own view. So why not Do it your way

A great starting point for your ARE Holdings research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let opportunities pass you by when there are standout stocks waiting to be uncovered. These unique angles could give your portfolio an extra edge.

- Capitalize on technological disruption by targeting these 25 AI penny stocks, which are poised for rapid growth and reshaping industries with cutting-edge artificial intelligence advancements.

- Boost your income stream by seeking out these 17 dividend stocks with yields > 3%, as these offer robust yields backed by strong fundamentals and reliable payout histories.

- Unlock hidden value by focusing on these 861 undervalued stocks based on cash flows, since they have the potential for outsized returns based on attractive valuations and underappreciated earnings power.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5857

ARE Holdings

Engages in refining, manufacturing, and trading of precious metals and rare metals in Japan, Asia, and North America.

Proven track record average dividend payer.

Market Insights

Community Narratives