- Japan

- /

- Metals and Mining

- /

- TSE:5482

Aichi Steel (TSE:5482): Revisiting Valuation After Upgraded Earnings Forecast and Special Dividend Announcement

Reviewed by Simply Wall St

Aichi Steel (TSE:5482) just lifted its outlook for full-year profits, crediting stronger-than-expected results from the first half. At the same time, the company rolled out both a regular and a special dividend for shareholders.

See our latest analysis for Aichi Steel.

This brighter outlook has helped fuel Aichi Steel’s strong momentum. The share price has climbed 117% so far this year and the one-year total shareholder return is nearly 139%. Recent profit upgrades and dividend announcements have clearly energized investors and built on remarkable long-term gains.

If you’re interested in compelling opportunities with strong momentum and growth, now is a perfect time to broaden your search and discover fast growing stocks with high insider ownership

But with Aichi Steel’s profits rising and the stock already surging this year, the real question for investors is whether there's more upside ahead or if the market is already pricing in all that future growth.

Price-to-Earnings of 15.2x: Is it justified?

Aichi Steel currently trades at a price-to-earnings (P/E) ratio of 15.2x, which is significantly above both the Japanese Metals and Mining industry average of 12.5x and the average among its peers at 10.2x. This strong premium suggests that investors are paying up for the company’s earnings, which may reflect confidence in its recent turnaround and the momentum behind its profit growth.

The price-to-earnings ratio measures how much investors are willing to pay for each yen of the company’s earnings. In this case, the higher multiple indicates the market is either anticipating future earnings expansion or is pricing in the recent rapid growth as sustainable. For cyclical sectors like steel and metals, this is a noteworthy premium, particularly after a sharp run-up in share price.

When compared to both its industry and peer averages, Aichi Steel’s multiple looks elevated. While this could be justified by recent growth, it also sets a higher bar for future performance. If sector valuations return to the mean, the multiple could compress unless the company delivers on further growth expectations.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 15.2x (OVERVALUED)

However, investors should remain alert to changing sector demand and any profit margin setbacks, as these factors could quickly reverse Aichi Steel’s rapid share price gains.

Find out about the key risks to this Aichi Steel narrative.

Another View: What Does the DCF Model Say?

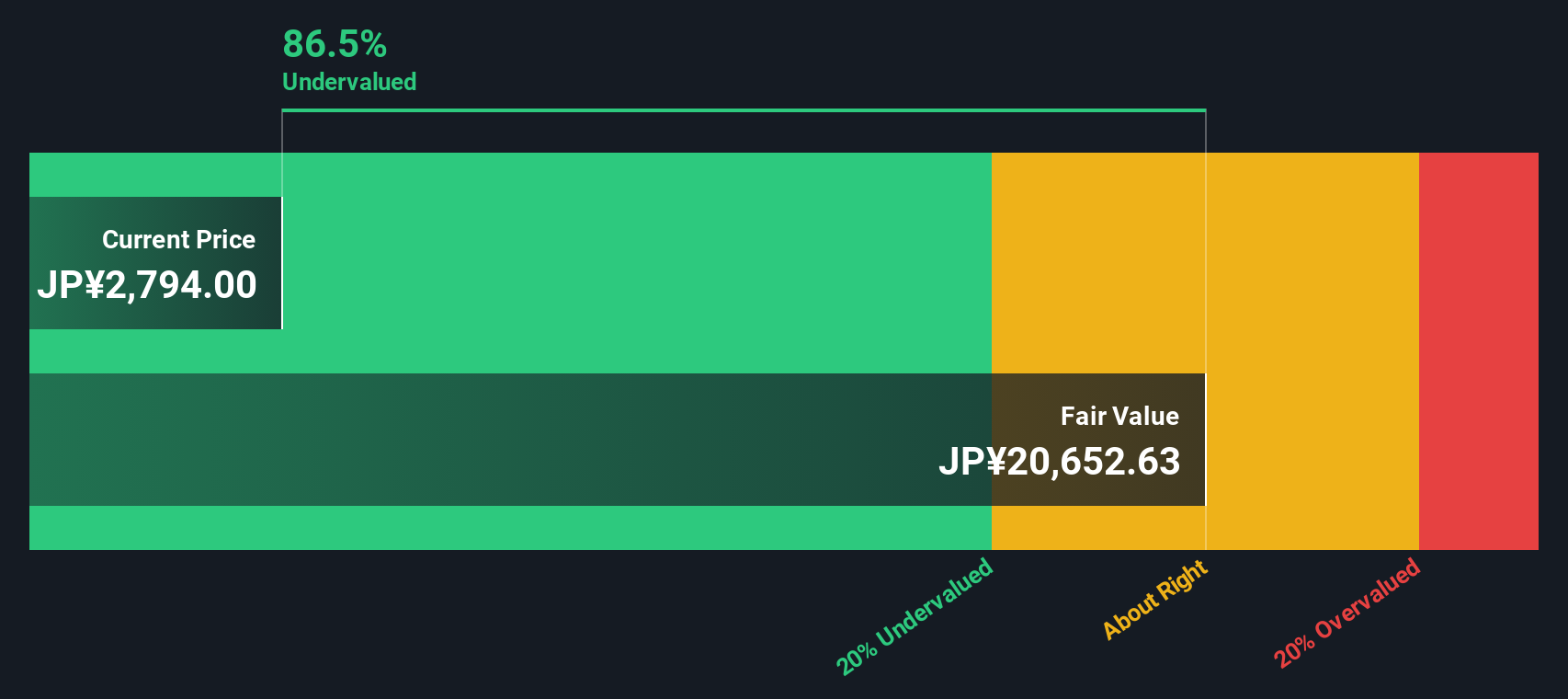

While the current price-to-earnings ratio paints Aichi Steel as overvalued compared to peers and the industry, our DCF model tells a very different story. Based on the SWS DCF model, Aichi Steel trades at a staggering 86.5% below its calculated fair value, suggesting significant undervaluation.

Look into how the SWS DCF model arrives at its fair value.

With two valuation measures offering such contrasting signals, which one holds the real clues for investors considering what comes next?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Aichi Steel for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Aichi Steel Narrative

If you see things differently or want to take a hands-on approach with the numbers, you can quickly piece together your own perspective. Do it your way

A great starting point for your Aichi Steel research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart moves come from seeing every angle, and the next big opportunity might be right in front of you. Don’t let fresh momentum stocks and market shifts pass you by.

- Uncover fast-growing sectors shaping healthcare’s future by jumping into these 32 healthcare AI stocks for companies at the crossroads of medicine and AI.

- Tap into reliable dividend income streams and see what sets these leaders apart using these 16 dividend stocks with yields > 3% for yields over 3%.

- Get ahead of market trends and ride the crypto wave with these 82 cryptocurrency and blockchain stocks as these companies make moves in digital assets and blockchain innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5482

Aichi Steel

Manufactures and sells steel materials, forged products, electronic functional materials and components, and magnetic products in Japan, the United States, Thailand, China, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives