- Japan

- /

- Metals and Mining

- /

- TSE:5471

Will Daido Steel’s (TSE:5471) Dividend Review Reshape Its Capital Allocation Story?

Reviewed by Sasha Jovanovic

- Daido Steel has scheduled a board meeting for October 30, 2025, to review possible changes to its shareholder return policy, decide on distribution of the dividend surplus, and revise its dividend forecast.

- This type of agenda often signals management is reconsidering capital allocation priorities, a topic that can influence shareholder expectations and company valuation assessments.

- We will assess how the potential shift in Daido Steel’s dividend approach could shape its investment narrative moving forward.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Daido Steel's Investment Narrative?

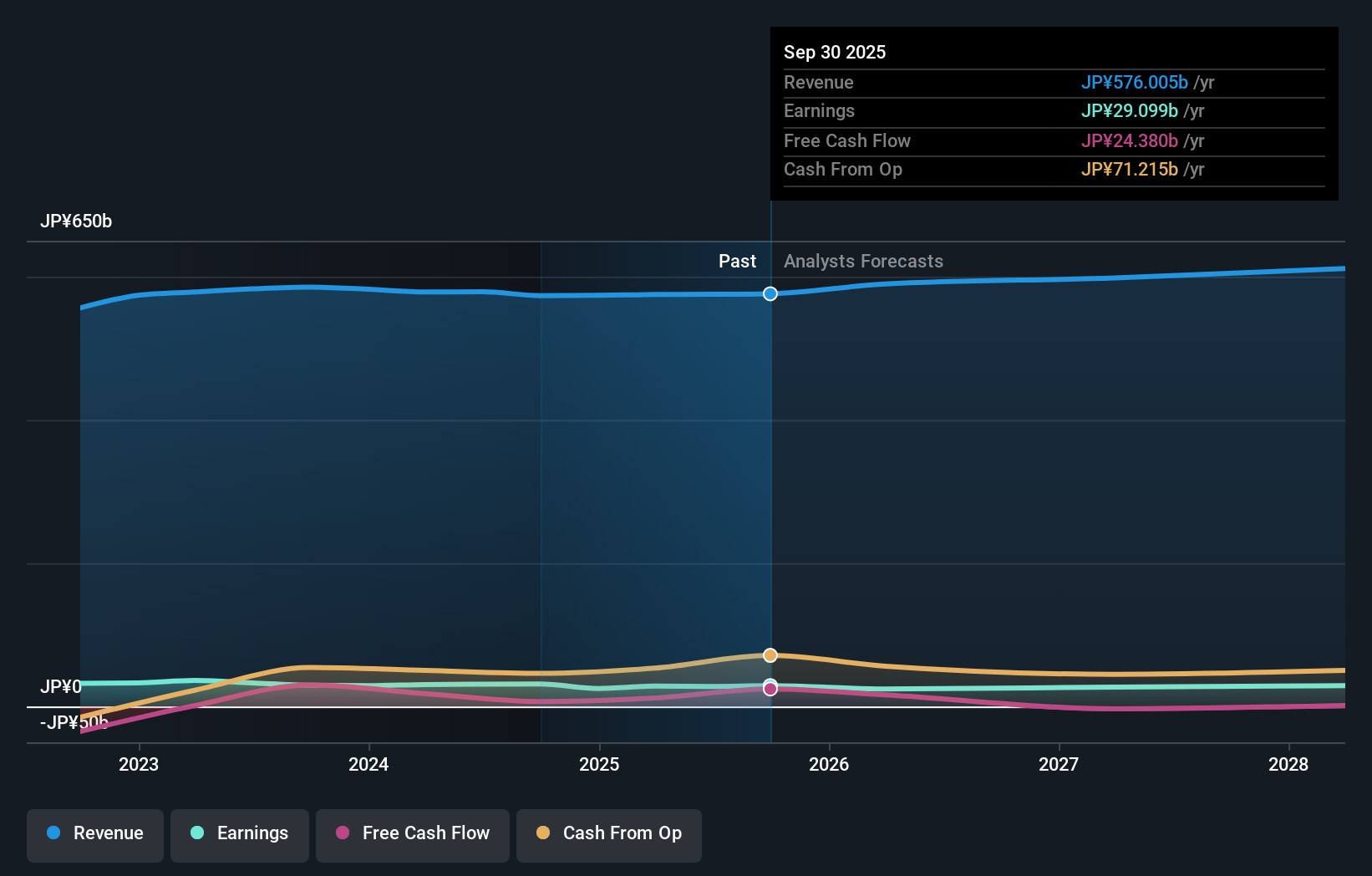

For anyone considering Daido Steel, the big picture is all about stable performance and disciplined value. As a shareholder, you'd need to be comfortable with steady but modest revenue and earnings growth, plus a management team that actively revises capital return strategies. The recent announcement about a board meeting to review dividend policy and forecasts adds a new layer to near-term catalysts. Previously, risks centered on dividend sustainability and lower returns on equity, with catalysts including share buybacks and perceived undervaluation compared to peers. With this board agenda, dividend policy uncertainty could become more important in the short term and may influence the share price and income predictability going forward. If the board opts for a more conservative approach, it could temper enthusiasm, while a more shareholder-friendly stance might be a catalyst in itself.

But don’t ignore the growing questions around dividend stability, they could soon matter more than ever.

Daido Steel's shares are on the way up, but they could be overextended by 38%. Uncover the fair value now.Exploring Other Perspectives

Explore another fair value estimate on Daido Steel - why the stock might be worth 28% less than the current price!

Build Your Own Daido Steel Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Daido Steel research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Daido Steel research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Daido Steel's overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5471

Daido Steel

Engages in the manufacture and sale of steel products in Japan and internationally.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives