- Japan

- /

- Metals and Mining

- /

- TSE:5444

Yamato Kogyo (TSE:5444) Valuation in Focus After Earnings Upgrade and Major Share Buyback

Reviewed by Simply Wall St

Yamato Kogyo (TSE:5444) just completed a substantial share buyback and announced higher earnings guidance for the year. The company cited stronger sales in Japan and less foreign exchange drag than initially feared.

See our latest analysis for Yamato Kogyo.

Yamato Kogyo’s combination of upgraded earnings guidance and a sizeable share buyback has fueled optimism around its business strength and capital discipline. The stock’s year-to-date share price return sits at a strong 26.95%, while its 1-year total shareholder return of 21.47% highlights that both recent capital policies and core business momentum are generating meaningful value for investors over time.

If this kind of forward momentum catches your interest, now is an ideal time to broaden your horizons and discover fast growing stocks with high insider ownership

With such robust earnings upgrades and a completed buyback in play, investors are left to wonder if Yamato Kogyo’s current share price offers real value or if future growth is already fully accounted for.

Price-to-Earnings of 25.4x: Is it justified?

Yamato Kogyo’s shares currently trade at a price-to-earnings (P/E) ratio of 25.4x, making them look pricey compared to both the peer group and what would be considered a fair valuation.

The P/E ratio measures what investors are willing to pay for a company’s earnings. For manufacturers such as Yamato Kogyo, it is a go-to metric for quickly comparing valuation against competitors and sector benchmarks. A higher than average P/E can mean that the market expects future growth or superior profitability, but it can also highlight over-optimism if fundamentals do not support it.

In Yamato Kogyo’s case, the 25.4x P/E surpasses both the peer average of 10.6x and the industry average of 12.5x. It also stands well above the estimated fair P/E of 17.9x, signaling the market is incorporating significant optimism into the price.

Explore the SWS fair ratio for Yamato Kogyo

Result: Price-to-Earnings of 25.4x (OVERVALUED)

However, slower revenue growth and a much higher P/E than peers could expose Yamato Kogyo’s shares to sharp corrections if confidence shifts.

Find out about the key risks to this Yamato Kogyo narrative.

Another View: What Does the SWS DCF Model Say?

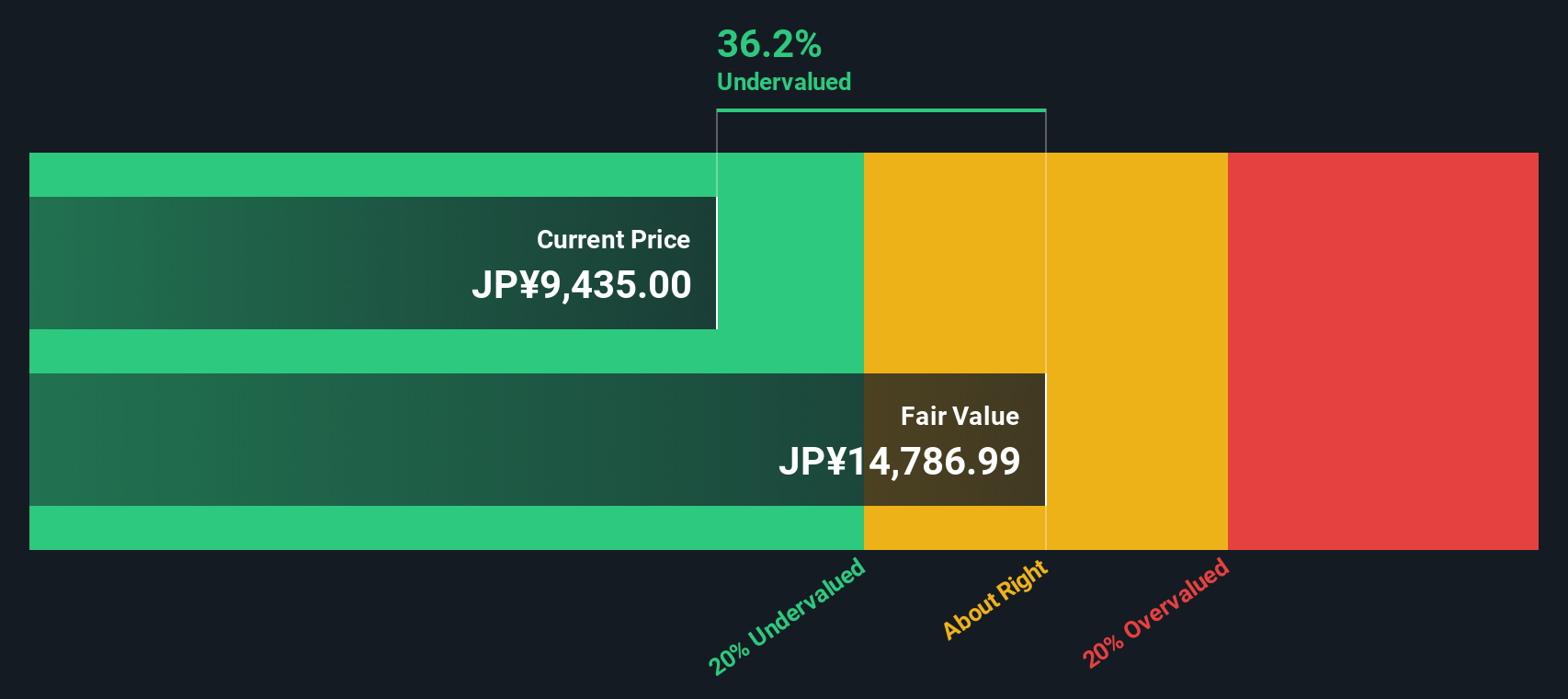

While the P/E ratio suggests Yamato Kogyo looks expensive versus peers and the sector, our SWS DCF model takes a different perspective. By focusing on the company’s projected future cash flows, the DCF model actually points to shares trading at a substantial 36.3% discount to fair value. This suggests possible undervaluation. Does the market see something the numbers do not?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Yamato Kogyo for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Yamato Kogyo Narrative

If you have a different take on Yamato Kogyo’s outlook or want to dig into the data yourself, you can craft a personalized view in under three minutes. Do it your way

A great starting point for your Yamato Kogyo research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Compelling Stocks?

Not acting now could mean missing out on high-potential opportunities that fit your goals. Take charge and uncover ideas perfectly matched to your strategy.

- Unlock standout returns by tracking these 870 undervalued stocks based on cash flows, which are trading beneath their fair value and could present strong upside ahead of the herd.

- Tap into future tech trends by targeting these 24 AI penny stocks, as these are reshaping industries with advanced artificial intelligence.

- Secure your portfolio and enjoy income growth with these 16 dividend stocks with yields > 3%, delivering reliable yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5444

Yamato Kogyo

Through its subsidiaries, engages in the manufacture and sale of steel products in Japan and internationally.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives