Stock Analysis

- Japan

- /

- Metals and Mining

- /

- TSE:5440

Exploring Kyoei Steel And Two Additional Leading Dividend Stocks

Reviewed by Kshitija Bhandaru

Amid escalating geopolitical tensions and a challenging interest rate environment, Japan's stock markets have recently faced significant headwinds, with the Nikkei 225 and TOPIX indices experiencing notable declines. In such times, investors often turn to reliable dividend stocks as a potential source of stable returns.

Top 10 Dividend Stocks In Japan

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 3.69% | ★★★★★★ |

| Nippon Air conditioning Services (TSE:4658) | 3.35% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.04% | ★★★★★★ |

| HITO-Communications HoldingsInc (TSE:4433) | 3.30% | ★★★★★★ |

| Innotech (TSE:9880) | 3.91% | ★★★★★★ |

| Asia Air Survey (TSE:9233) | 3.43% | ★★★★★★ |

| Star Micronics (TSE:7718) | 3.34% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.34% | ★★★★★★ |

| Toyo Kanetsu K.K (TSE:6369) | 3.35% | ★★★★★★ |

| Nichimo (TSE:8091) | 4.05% | ★★★★★★ |

Click here to see the full list of 303 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

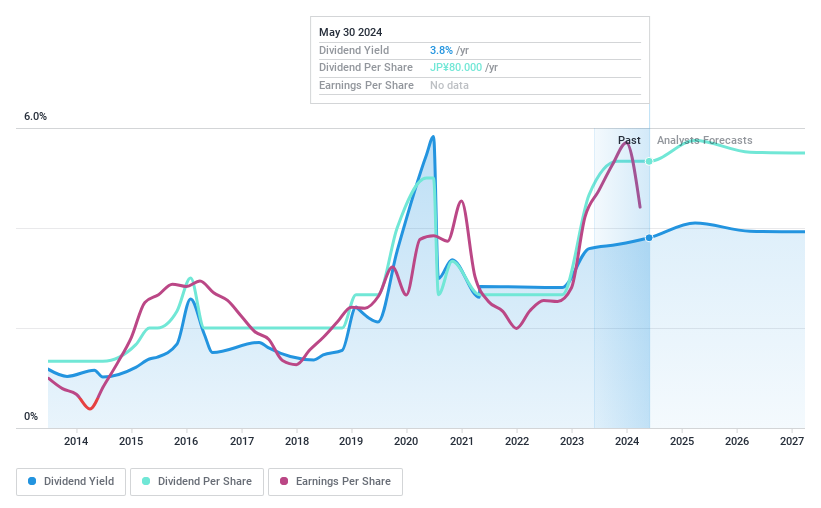

Kyoei Steel (TSE:5440)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Kyoei Steel Ltd. operates in the manufacture, processing, and sale of billets and steel products across Japan, Vietnam, North America, and other international markets with a market capitalization of approximately ¥111 billion.

Operations: Kyoei Steel Ltd. generates its revenue primarily through the production and sale of billets and steel products across various key regions including Japan, Vietnam, North America, and other global markets.

Dividend Yield: 3.1%

Kyoei Steel's dividends appear sustainable with a low payout ratio of 17.6% and cash payout ratio at 15.5%, indicating strong coverage by both earnings and cash flows. Despite trading 18.8% below estimated fair value, offering potential upside, the dividend track record is unstable, showing volatility over the past decade. Additionally, while dividends have increased over this period, the current yield of 3.13% is slightly below the top quartile in Japan's market at 3.29%.

- Click here to discover the nuances of Kyoei Steel with our detailed analytical dividend report.

- The valuation report we've compiled suggests that Kyoei Steel's current price could be quite moderate.

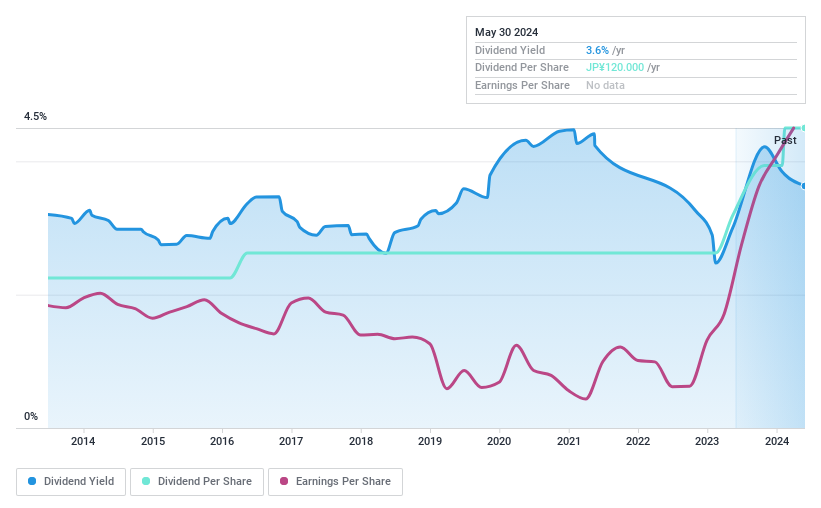

Mars Group Holdings (TSE:6419)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Mars Group Holdings Corporation operates in the amusement, automatic recognition system, and hotel and restaurant sectors primarily in Japan, with a market capitalization of approximately ¥56.58 billion.

Operations: Mars Group Holdings Corporation generates its revenues from three primary sectors: amusement, automatic recognition systems, and hotel and restaurant services.

Dividend Yield: 3.7%

Mars Group Holdings maintains a stable dividend, with a 10-year history of consistent payouts and growth, supported by a solid earnings coverage (Payout Ratio: 21%) and cash flow (Cash Payout Ratio: 65.2%). The stock offers an attractive yield of 3.73%, positioning it above the top quartile average in Japan at 3.29%. Despite this, shareholders experienced dilution last year, which could impact future payouts. Currently, the stock is valued at 12.2% below its fair value estimate, suggesting potential for appreciation.

- Click to explore a detailed breakdown of our findings in Mars Group Holdings' dividend report.

- The analysis detailed in our Mars Group Holdings valuation report hints at an deflated share price compared to its estimated value.

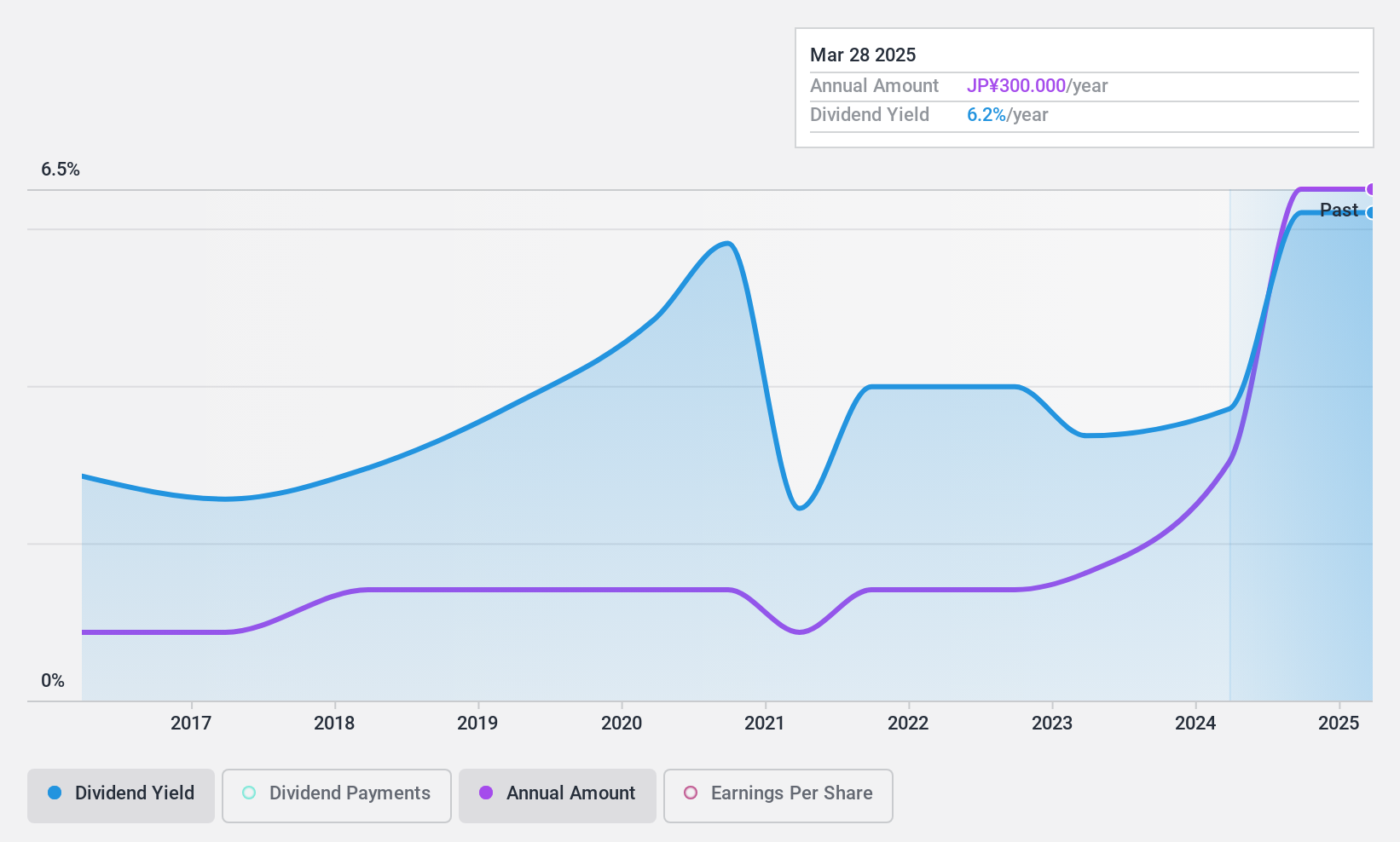

Araya Industrial (TSE:7305)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Araya Industrial Co., Ltd. is a company that manufactures and sells steel products both in Japan and internationally, with a market cap of approximately ¥20.98 billion.

Operations: Araya Industrial Co., Ltd. generates revenue through the manufacture and sale of steel products across domestic and international markets.

Dividend Yield: 3.7%

Araya Industrial has shown a growth in dividend payments over the past decade, though its track record reveals some volatility with drops exceeding 20% annually. The dividends are well-supported by both earnings and cash flows, with a low payout ratio of 12% and a cash payout ratio of 35.1%. Despite trading below its fair value by 13.3%, concerns persist due to lower profit margins this year compared to last (4.6% vs 6.7%).

- Click here and access our complete dividend analysis report to understand the dynamics of Araya Industrial.

- In light of our recent valuation report, it seems possible that Araya Industrial is trading beyond its estimated value.

Turning Ideas Into Actions

- Explore the 303 names from our Top Dividend Stocks screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Kyoei Steel is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5440

Kyoei Steel

Kyoei Steel Ltd. engages in the manufacture, processing, and sale of billets and steel products in Japan, Vietnam, North America, and internationally.

Excellent balance sheet established dividend payer.